Executive Summary

In this report, we analyse what is happening to television news. We map recent changes in traditional television viewing, the rise of online video, and a range of examples of how different organisations are working with new forms of television-like news developed for a digital environment.

We show how recent years have seen significant declines in traditional television viewing in technologically developed markets, and a rapid rise in online video viewing driven by video-sharing sites, video-on-demand services, and the integration of video into social media sites. Television is still an important medium, and will remain so for years to come, but it will not be the dominant force it was in the second half of the twentieth century.

Television viewing in countries like the UK and the US have declined by 3 to 4% per year on average since 2012. These declines are directly comparable to the declines in print newspaper circulation in the 2000s and if compounded over ten years will result in an overall decline in viewing of 25 to 30%. The average audience of many television news programmes is by now older than the average audience of many print newspapers.

The decline in viewing among younger people is far more pronounced both for television viewing in general and for television news specifically, meaning that the loyalty and habits of older viewers prop up overall viewing figures and risk obscuring the fact that television news is rapidly losing touch with much of the population.

There are no reasons to believe that a generation that has grown up with and enjoys digital, on-demand, social, and mobile video viewing across a range of connected devices will come to prefer live, linear, scheduled programming tied to a single device just because they grow older. This raises wider questions about how sustainable the broad public interest role broadcast news has played in many countries over the last 60 years is.

Television news is still a widely used and important source of news, and will remain so for many older people for years to come, but if television news providers do not react to the decline in traditional television viewing and the rise of online video – in particular on-demand, distributed, and mobile viewing – they risk irrelevance. The full implications of the changes we identify here will not be felt immediately, as current viewers will continue to watch for years to come. But the challenge needs to be recognised now and acted on if television news providers want to reinvent themselves and find an audience that increasingly prefers digital media to television, and increasingly embraces on-demand, distributed, and mobile video distributed online.

Many different kinds of news organisations, including legacy broadcasters, print legacy media, and a range of digital pure players, are experimenting with different kinds of television-like and online video news to reach audiences, especially younger people. We review some of what they are trying to do below and show how a limited number of new players, most notably video-on-demand providers like Netflix and Amazon Prime, and platforms like Facebook and YouTube, are currently leading the move towards a video-enabled internet and that, while there are impressive experiments with long-form, in-depth content, shorter clips, and various modes of distribution, no one seems to have found the right recipe for online video news or IPTV news. None of the platforms and on-demand services that dominate online video focus on news.

The fact that no one has found the right recipe for doing online video news in this rapidly changing environment takes nothing away from the urgency of adapting to it. Television as a platform may well be about to face disruption on a scale comparable to what printed newspapers have experienced over the last decade. Television news providers face this transition with many strengths, including well-known brands, creative talent, and deep archives of quality content, but they also risk being constrained by their legacy organisation and culture.

Television news providers who wish to reach younger audiences, adapt to this changing environment, and remain relevant will therefore need to continue to invest in innovation and experimentation, and can learn much from established insights into organisational traits that enable innovation in digital news.

Introduction: A Golden Age of Television, but not of Television News

We live in a golden age of television, but not of television news.

Television entertainment has embraced the rise of digital media, and the best programming seems to thrive in a world where on-demand, socially distributed, and mobile video viewing is more and more important. For younger people, beyond-the-box video accounts for half of all viewing in technologically advanced markets like the UK and the US (Meeker 2015). 1 Television news, meanwhile, reaches a shrinking number of older viewers whose media habits are increasingly different from the population at large, and especially from the media habits of those who have grown up with digital media.

Technological developments and audience preferences have driven a growth in viewing ‘beyond the box’ and a long-term decline in television news viewing. While major television channels are still pulling in large audiences, these audiences are eroding and ageing while a range of new entrants seek to pick up younger audiences who continue to turn away from traditional television news and embrace digital media.

What Is Happening to Television News?

This development is a major challenge for television journalism. It challenges the role television news has played over the last half century in many countries as the most used, most valued, and most widely shared source of news (see e.g. Barnett 2011, Cushion 2011). It challenges the business models underwriting commercial television news. It also challenges the ability of public service television news to deliver on its mission, as well as its long-term political and popular legitimacy.

The full implications of the decline of traditional television viewing and the rise of online video will not be felt immediately, as current viewers will continue to watch for years to come. But the challenge needs to be recognised now and acted on if television news providers want to reinvent themselves and find an audience that increasingly prefers on-demand, distributed, and mobile video (see the back of the report for a list of terms). Television news as we know it, from evening bulletins to 24-hour news channels, increasingly serves the past, not the future, and television news producers have to experiment with new formats and forms of distribution if they wish to remain relevant.

Traditional television viewing is still strong, but no longer as stable as it once was. 2015 may turn out to have been for the television industry what 2005 was for the newspaper industry, a year when the pace of change accelerated. While we should not overestimate the immediate short-term impact, it is clear that the longer-term effect over a five-to-ten-year horizon will be dramatic. This concerns television generally, but also television news specifically. As traditional television viewing overall erodes, television news will benefit less from lead-in programming and will see its own audience shrink faster, and television news providers will have to develop new offers and new strategies.

The Erosion of Traditional Television and Growth of Online Video Challenge Television News Providers

The change among younger people is already particularly pronounced. In many of the most technologically advanced markets, traditional television viewing has begun to erode, and online video consumption is increasing. The rise of the video-enabled internet puts television and digital media in much more direct competition. As connectivity, devices, and file compression formats improve, this competition will become more intense. And the development will continue as older viewers with pre-digital media habits are gradually replaced with younger generations who have grown up with digital media, and as online video offerings develop in terms of content, convenience, and integration into people’s communities and daily conversations.

The question is who will benefit from this development – legacy broadcasters, other legacy media, new online video start-ups, video-on-demand services, or third-party platform providers like Facebook and YouTube – and what role specifically will news find in this changing environment? Given the accelerating shift away from television and towards an environment where traditional television remains important, but digital media grow ever more important, it is clear that the future of television news is about much more than television. It is at least as much about whether and how television news providers benefit from the rise of on-demand, distributed, and mobile video viewing on digital platforms. And will television news broadcasters continue to play the core role in informing a broad base of society that they have played for much of the last half century? Television news will continue to reach millions of people for years to come via evening bulletins and 24-hour news channels. But to remain relevant and reach a younger audience, television news providers also have to embrace a whole new range of digital platforms and experiment with on-demand, distributed, and mobile video news.

Overview of the Report

In this report, we analyse what is happening to television news. Our main focus is on what is happening in technologically developed markets like the UK and the US, but we also examine trends elsewhere. First, we map recent changes in traditional television viewing. Second, we consider the rise of online video. Third, we examine examples of how different organisations are working with new forms of television-like news developed for a digital environment. We go into some detail in providing an overview of how television more broadly is changing and online video growing because these two trends help define the environment in which television news providers operate. We focus on new experiments with television-like and video news online in the third part of the report because we are interested in innovative approaches to adapting to a new environment rather than the incremental evolution of traditional formats.

We show how a limited number of new players, most notably video-on-demand providers like Netflix and Amazon Prime and platforms like Facebook and YouTube, are currently leading the move towards a video-enabled internet and that, while there are impressive experiments with both long-form in-depth content, shorter clips, and various modes of distribution, no one seems to have found the right recipe for online video news or IPTV news.

What is clear is that the right recipes are unlikely to be the same recipes that worked for news bulletins or 24-hour news channels and that news organisations need to break with much of the broadcast legacy and continue to experiment with both editorial products and distribution strategies to make online video news work. Television news is changing as traditional formats evolve, with evening news bulletins seeking ways to add value though much of their audience already know the major headlines, and 24-hour news channels seeking ways of balancing their desire to break news in an accelerated cycle with the challenge of getting complicated stories right in real time. But television news is also changing in a wider sense as people increasingly move away from these traditional formats and incorporate new kinds of online video news in their media repertoires.

If television news providers do not adapt to these changes, they risk irrelevance.

The Erosion of Traditional Television Viewing

Despite the rise of digital media, traditional television viewing held up well for the last twenty years. Measured as viewing of live, linear, scheduled programming, overall television consumption remained stable – and in some cases grew – throughout the 1990s and 2000s, even as digital technologies disrupted other media industries and as desktop internet and later the mobile web came to account for a larger and larger share of overall media use.

In recent years, however, time spent watching television has started to erode, in some countries dramatically so. Digital media use is increasingly not simply supplementing, but also supplanting, television viewing. Second screens are becoming first screens. By now, desktop and mobile internet use account for over half of all time spent using media in some technologically advanced markets, more time than television (Meeker 2015). 2 (And the percentage of households in the UK that have a television set has declined for the first time ever. 3 Similar trends are seen in other technologically advanced markets like the Nordic countries. (In countries with a significantly older population, like Germany, overall viewing figures have been more stable, but younger people are still moving away from television and towards digital media.)

These declines are directly comparable to the declines in print newspaper circulation in the 2000s. Compounded over ten years, annual declines of 3 to 4% will result in an overall decline of 25 to 30%. This would be a more severe drop than the decline in print newspaper circulation in the UK or US from 2000 to 2009 – in both cases about 20%. Audience share – the percentage of people viewing who are viewing a particular programme – may hold up for some channels and programmes, but the total audience that this is a share of is eroding, ageing, and spending less time watching television. In recent years, the average age of the BBC1 audience has grown by more than one year every year, from 52 in 2009 to 59 in 2014.

Television News Viewing

Even looking solely at traditional television, news, especially catch-all evening news bulletins, continues to suffer from the underlying and decades-long move away from a few dominant channels and towards a more fragmented multichannel environment (Prior 2007). 4 In the UK, overall television news viewing has declined from 2011 onwards broadly at the same pace as total television viewing. 5 Generational differences are pronounced. By 2014, the average number of hours of television news watched in the course of the year was down to 108 for all adults. For people aged 16–24, the number was 25 hours. The figures for younger viewers have declined every year since 2010, while those for viewers over 55 have remained more stable. The loyalty and habits of older viewers prop up overall viewing figures and risk obscuring the fact that television news is rapidly losing touch with younger people.

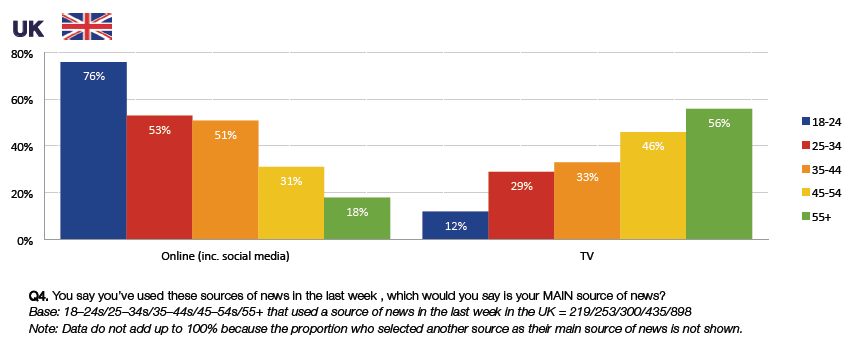

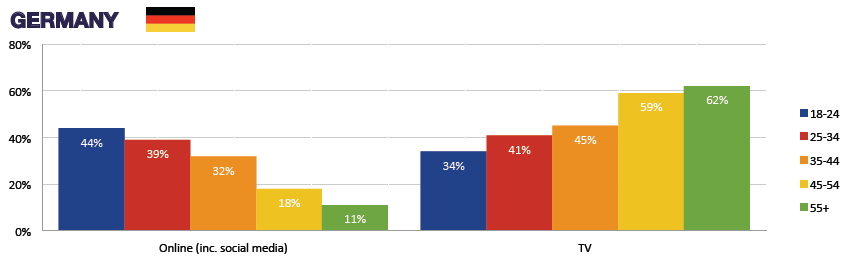

Overall viewership of some television news programmes is now declining about as fast as the readership of print newspapers. Some programmes have held up relatively well, but many have not. ITV Evening News in the UK drew about 3.4 million viewers on weekday evenings in 2010 and was down to about 2 million by late 2015. RTL Aktuell in Germany is down from about 4 million to about 3.3 million in the same period, and TF1 20 heures in France from 6.7 million to about 6 million. The remaining audience is also, like print readers, increasingly older than the population at large. In 2015, the median age for viewers of Fox News in the US was 67, MSNBC, 63, and CNN, 61. 6 By comparison, the average reader of the print edition of the New York Times was 60. 7 In the UK, the average reader of the print edition of the Daily Mail is younger than the average BBC1 viewer. 8 In the US, viewing time is down 29% over the same period for 18–24 year olds. 9 In 2015, Nielsen estimated that younger Americans (those under 34) spent almost as much time watching video across TV-connected devices, personal computers, tablets, and phones as they did watching traditional television. 10 While it is still the case that young people watch significantly less television than the population on average, although they tend to start watching more as they age and settle down, internal research from one broadcaster in the UK that we have seen suggests that not only do young people today watch far less television than people the same age in the past, but the increase in television viewing as they age is also far less pronounced. 11 (The distribution in France and the US is very similar.) Even in countries like France and Germany, where television is the most important source of news for the population overall, online is far more important for younger people. In the UK and the US, online is the most important source of news for every age group under 44 (Newman et al 2015).

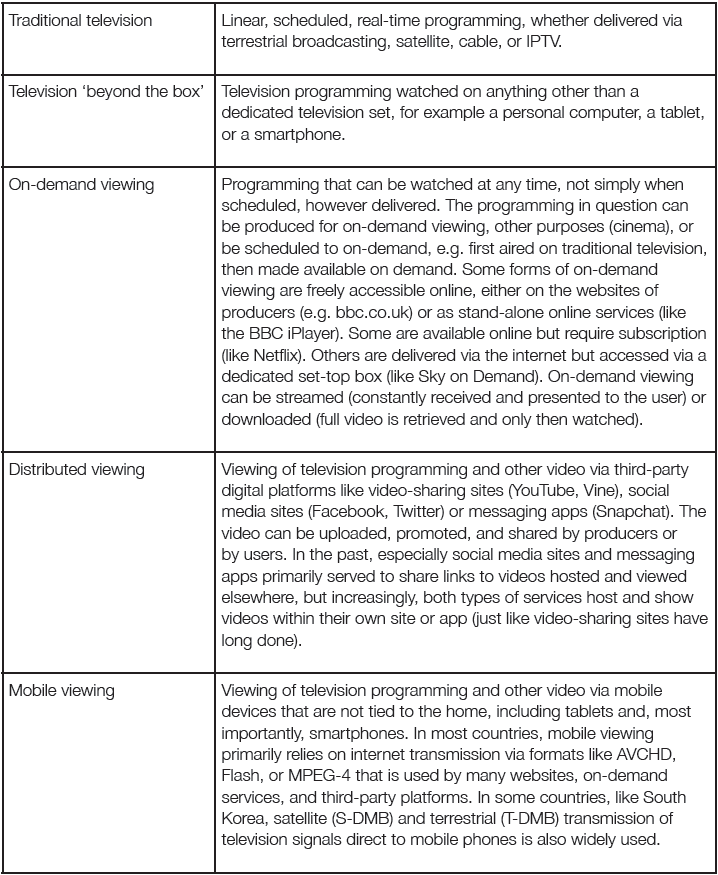

Figure 1.2. Proportion within each age group who said each source was their main source of news (UK)

Figure 1.2. Proportion within each age group who said each source was their main source of news (UK)

Figure 1.3. Proportion within each age group who said each source was their main source of news (Germany)

Figure 1.3. Proportion within each age group who said each source was their main source of news (Germany)

There are thus no reasons to believe that a generation that has grown up with and enjoys digital, on-demand, social, and mobile video viewing across a range of connected devices will come to prefer live, linear, scheduled programming tied to a single device just because they grow older. A combination of two powerful factors point to a long-term move from traditional television towards digital media, including various forms of online video. First, the continued technological development of better devices, connections, and file compression formats. Second, the generational replacement of older, pre-digital generations with younger generations who have grown up with digital media and prefer them.

The Rise of Online Video

In parallel with the erosion in the overall television audience, viewing time, and in some cases the number of television households, recent years have seen massive growth in ‘television beyond the box’ and online video, enabled by better connectivity, devices, and file compression formats. Video is increasingly integral to much of the internet across both websites and apps, and across destination content sites, social media, and messaging apps, leading some to suggest that ‘the future of the internet is TV’. 12 In the United States, in 2015, 65% of television viewers reported also using Netflix, 34% Amazon Prime, and 16% Hulu. 13

Distributed viewing, viewing of video from many different brands and content creators (including user-generated content) on video-sharing platforms, social media sites, and via messaging apps, grew particularly rapidly in 2015. YouTube is the single most important example of this, and it reported more than 8 billion daily video views. But social media and messaging apps moved aggressively into video distribution in the course of 2015 and increasingly prioritise video. Facebook has evolved from posting links to showing clips, to hosting clips, and now to auto-play of videos, and by the autumn of 2015 reported more than 8 billion video views per day – up from 4 billion earlier in the year. The messaging app Snapchat reported 6 billion daily views by the end of 2015. 14

Mobile viewing, especially people watching videos on their smartphones, is also growing rapidly. Small screens, often used vertically and in silent mode and thus offering a very different interface and user experience from a large horizontal television screen with the sound on, account for a larger and larger share of video-enabled devices and time spent viewing. And it is not only that mobile is increasingly central to video. Video is also increasingly central to mobile. In 2015, Cisco estimated that mobile video grew to account for more than half of all mobile data traffic. 15 What is noteworthy about this is not the figure in itself – video consumes a lot of data compared to text or images – but how quickly mobile video data traffic has grown in recent years, with annual growth rates of over 60%. Mobile video is expected to account for over 75% of all mobile data traffic by 2020. 16 With better (4G) connections and cheaper data, video will also be more appealing to users.

Television beyond the Box

The rise of on-demand, distributed, and mobile viewing points towards an environment in which video is used very differently. Linear scheduled television continues to be an important part of this digital environment, but only one part, and is no longer the dominant platform it was for much of the twentieth century. Online, content discovery is not about prime-time scheduling or position on the electronic programme guide, but about brand awareness, search, and recommendations – including social recommendations and algorithmically generated ‘you-may-also-like’ recommendations.

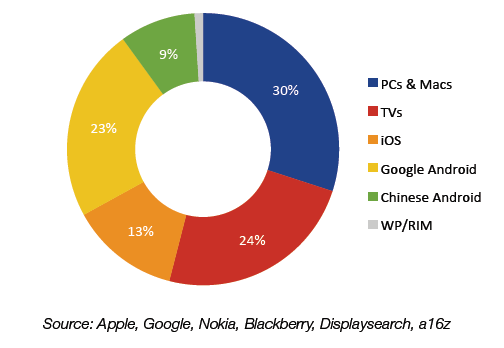

Already, mobile devices account for the largest share of video-enabled devices globally (46% according to one estimate; see Figure 2.1, adopted from Evans (2015)). People do not necessarily watch much video on these devices (yet), and may never watch as much video on any one of these many other screens as they do on a television set with a good screen, good sound, and a central place in the home – but the proliferation of video-enabled devices suggests where new opportunities lie in the future.

Figure 2.1. Global install base of video players (2014)

Figure 2.1. Global install base of video players (2014)

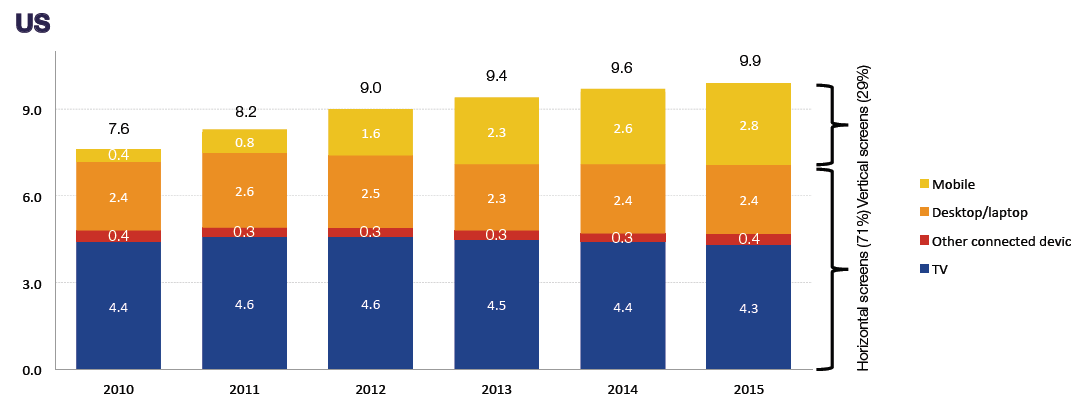

And this is not only about potential and about the future. Since 2013, some estimate, digital devices have accounted for more than half of all time spent on screens in the US. Mobile screens alone grew from a 5% share in 2010 to a 28% share of all screen time in 2015. (See Figure 2.2, adopted from Meeker (2015).) This is a transformative change in just five years.

Figure 2.2. Hours per day spent on screens by orientation (US)

Figure 2.2. Hours per day spent on screens by orientation (US)

There is still considerable growth potential for digital video, unlike traditional television viewing, which is expected to continue to erode for the reasons discussed above. In relation to both devices, connectivity and content quality deterring some, Ofcom estimates that only about two thirds of those in the UK who own personal computers and smartphones regularly use them for video at this stage. 17 But in the future, as devices, connectivity, and file compression improves, we expect more and more people to get video-enabled digital devices, and more and more people to in fact use them to watch video.

Broadcasters Are Unlikely To Be the most Important Players in Online Video

The most important players in this new online video environment are not legacy broadcasters, but newer video-on-demand providers like Netflix and Amazon Prime and platforms like YouTube and Facebook. In France, for example, Mediametrie estimates that France Télévisions videos were streamed 19 million times online in September 2015 and TF1 videos 42 million times. By comparison, the French video platform DailyMotion was estimated to have seen 50 million views in France that month, Facebook 325 million, and YouTube 1 billion. 18 (Some of these videos originate with broadcasters, but exactly how many is unclear, and in any case broadcasters have less control over where and how their content is consumed in this more distributed environment.)

Whereas legacy players often have strong brands, in-house creative talent, and audience loyalties and habits built over decades (especially in terms of offline media use), a few dominant new players, all of them coming out of the United States, are building an advantage in terms of ability to invest, in terms of technology talent and in terms of data about their audiences. They are developing superior technologies both at the back end and at the interface with users and they are building global scale in a way no legacy media organisation has been able to do. Netflix, Amazon, Facebook, and Google all operate in more countries than even the biggest international broadcasters. They are not invincible – several of them have made multiple attempts to break into the large and lucrative television market, for some with only limited success. But even when they fail, they are not giving up, and they will continue to experiment and invest in video.

In contrast to traditional media organisations with newsrooms, distribution strategies, and cost structures built around older media and serving older audiences, the newer players are fully committed to digital media. Some have grown to become very large players in a short period of time. Netflix has announced that the company plans to invest $6 billion in content in 2016, more than almost any other player, including major legacy broadcasters like the BBC or ITV, CBS or PBS, ARD or RTL, France Télévisions or TF1. One estimate put Amazon Prime investments in content at $2.5 billion for 2015 – again, more than all but the biggest broadcasters. 19 Overall, the video-on-demand and online video advertising businesses are still much, much smaller than the pay television and television advertising businesses. But the traditional television industry is expected to stagnate as people turn their attention elsewhere, and online video will be one of the beneficiaries of this development. 20

The Business of Online Video and its Implications for Television News

The decline of traditional linear scheduled television relative to on-demand, distributed, and mobile viewing will eventually impact the resources invested in television news. Television news today is funded by money coming from advertising, subscription to pay television, and, in most high-income democracies, significant funds invested in public service broadcasting. In the United States, the television industry in 2014 was about 40% advertising and about 60% subscription, with less than 1% public funding. In European countries like the UK, France, and Germany, public funding is far more significant – about 27% of total television revenues in France and the UK, and 46% in Germany – with a broadly similar split between advertising and subscription. 21 (And the BBC licence fee in the UK is £145.50 a year, more than $200.)

Private broadcasters in many countries have already cut their investment in news. 22 Public service broadcasters faced with budgetary pressures are doing the same – like the BBC in the UK. Where investment in news provision was once a formal or informal condition for obtaining a licence to broadcast (a private provision of public service in return for access to scarce spectrum), this is less and less relevant in a digital environment.

Meanwhile, the dominant new players are delivering significant growth, and in the case of Netflix and Amazon, investing heavily in original content. But none of the dominant online video players – whether content-based like Netflix and Amazon Prime or platforms like YouTube and Facebook – are making investments in news. (When a journalist freely interpreted a statement from Netflix CEO Reed Hastings and headlined an article ‘Netflix Sets Sights on News Programming’, the company’s communications office immediately and very publicly clarified that Netflix was not attempting to get into the ‘reporting and live news business’.) 23

Television News in a Changing Media Environment

Traditional television formats, including evening bulletins and 24-hour news channels, still serve large audiences, but television news providers face an ageing and eroding audience on traditional platforms, an increasingly digital media environment offering more and more forms of online video, and a whole range of new competitors vying for people’s time and attention.

In this section, we focus on the development of television-like, often primarily video-based, forms of news online, rather than on how traditional television formats are evolving to find their niche in an increasingly digital media environment. We discuss them apart from developments in traditional television formats in part because the recent history of innovation in digital journalism shows how dangerous and stifling it can be to always discuss new initiatives through the lens of inherited professional and technical standards without first examining them on their own terms (e.g. Boczkowski 2004, Küng 2015).

Many different kinds of news organisations are experimenting with different kinds of online video news to reach audiences, especially younger people, in this changing environment.

Major players include:

Legacy broadcasters both private (CNN, ITV, RTL, TF1, etc.) and public (PSB, BBC, ARD/ZDF, France Télévisions, etc.) seeking to complement their traditional television offerings. With a few exceptions like the BBC and Fox News, their online reach is generally much more limited than their offline reach (Newman et al 2015).

Legacy media with a print background seeking to develop video as part of their digital strategy, including brands as different as The New York Times, Vice, and The Daily Telegraph, as well as brands like Die Welt and Spiegel in Germany – both of which have incorporated more traditional television elements (N24 and Spiegel TV).

Digital pure players, including both established players like BuzzFeed and the Huffington Post as well as newer start-ups like NowThis and WatchUp built primarily around video, who often have focused primarily on building an audience for distributed viewing via platforms like Facebook and YouTube.

Everyone is still experimenting, and the clearest take-away from these experiments in online video news so far is that there is no one recipe, and no one has it. Further, with such a significant shift in consumer patterns and technology, some failures are inevitable and even essential for successful innovation. As yet, there is no major success for on-demand TV news along the lines of Netflix for drama, no news-related YouTube stars to compete with PewDiePie, and few news brands among the most viewed videos on social media and messaging apps – although many organisations are trying to move into these spaces.

Two of the earliest ambitious attempts to offer online video news, Reuters TV and Huffington Post Live, illustrate how hard it is. Reuters TV has completely changed strategy within two years – from selling access and its app to giving it away for free across many platforms and allowing other publishers to use their content. Similarly, Huffington Post Live has, after major investments in an online streaming news channels, discontinued its live stream and moved towards a much greater emphasis on distributed viewing across social media platforms. Neither of these initiatives worked out as originally intended, but both organisations deserve credit for investing in new approaches to online video news, and have learned from their experiences and adapted accordingly. The right model is not always clear and no one model will work for all of the different providers or in all of the different contexts.

Incumbent Legacy Media and Insurgent Start-Ups Face Different Challenges

Online, the challenge for incumbents is to adapt their formats and production process to new platforms and patterns of consumption; the challenge for insurgents is to create sufficient distinct, compelling content and build their brand in a crowded, fast-changing market. As, for example, Vice attempts to move from online video into TV channels it faces a formidable challenge in stepping up from a few hundred hours of available content to a sufficient inventory to sustain linear broadcasting. In contrast, legacy broadcasters moving into online video have thousands of hours of content, but it is all shot in horizontal formats and produced to be viewed on a big, horizontal, HD screen with the sound on in the comfort of one’s own home – not to be watched on a small, vertical smartphone screen with the sound off and the viewer ‘on the go’.

Both legacy broadcasters and newspapers have for years produced some online video, but most of it so far has been either ‘shovelware’, originally produced for other purposes, then simply cut up and posted on the website/app or very low production value ‘talking-head’ videos of journalists talking to camera in a simple studio in the newsroom, often repeating points made in already published articles. These approaches have led some to dismiss online video news as ‘Same Sh*t, Different Screens’. 24 It is clear that news providers have to move beyond these genres to allow online video news to find its own voice.

Current experiments have moved in two very different directions when compared with the classic two-minute television news clip bundled up in a 30-minute bulletin. A lot of experimentation has focused on short, sharable, immediately compelling videos produced for social media and video-sharing platforms (for example BuzzFeed), while others (like Vice) have prioritised longer-form, rich, sometimes interactive video content and hope to draw people to their websites or apps with especially compelling content. Both legacy organisations and pure players face the challenge of reaching people in a more distributed environment where brand awareness, search, and recommendations are central to discovery.

Distributed Content

Third-party platforms are currently driving reach in online video. Traffic at scale is focused on ‘one-stop-shop’ sites like YouTube and Facebook and messaging apps like Snapchat rather than on attempts to draw users back to a home site. For publishers like AJ+, BuzzFeed, and NowThis News, this is a way of offering content without dragging users away from the platform they choose to be on. These approaches offer an opportunity to reach the significant number of people who use these platforms every day, but also risks losing a direct relationship with the audience and poses challenges around monetisation, and there are unresolved questions about what kind of user data platforms are prepared to share with publishers.

Many different news providers, including legacy broadcasters and digital start-ups, have embraced this idea and pursue distributed video strategies. AJ+, Al Jazeera’s online news and current events channel, is one prominent example, and various BuzzFeed verticals and the video-oriented start-up NowThis News are other examples. All three feature among what the

analytics company Tubular Labs report are the top ten most viewed ‘creators’ across YouTube, Facebook, Vine, and Instagram – alongside Justin Bieber, The Ellen Show, and World Wresting Entertainment Inc..

AJ+ is focused on distributed content, building audiences directly on Facebook and other platforms. It is short, sharable and made so that it can be viewed with the sound off. ‘Volume-agnostic’ video is seen as essential for the mobile, social market. On Facebook, where it has 2.8 million likes, AJ+ reported 2.2 billion video views in 2015 – around half of those were 30-second views. Similarly, BuzzFeed operates several verticals with a strong distributed video profile, including Tasty, BuzzFeed Video and BuzzFeed Food. At the end of 2015, BuzzFeed was estimated to generate more than 2 billion video views across multiple social media and video-sharing platforms every month. 25 Its strategy is not focused on distribution via its own website, but on distribution via third-party platforms. NowThis News, another brand built around distributed viewing, also reported dramatic growth, going from 1 million views in 2014, to 50 million early in 2015, to 200 million by the summer and 600 million a month by the end of the year. 26 Like other digital start-ups, it has adopted a distributed media strategy, attributing its success to ‘platform appropriate’ video and data-driven decision making.

AJ+, BuzzFeed, and NowThis News are not alone in pursuing a distributed strategy around short, sharable videos. The BBC’s various efforts across YouTube, Facebook, Instagram, and Vine, including dedicated teams like BBC Trending, are examples from a prominent European public service broadcaster. Major American television news brands also have significant reach via social media and video-sharing platforms. Tubular Labs estimate that CNN generated 214 million views in January 2016 and Fox News about 172 million. [https://tubularlabs.com/yt/cnn, https://tubularlabs.com/creator/eGNJb2A3UX/Fox-News ] (BBC News, by comparison, had 87 million. 27) In all three cases, their distributed reach was overwhelmingly driven by Facebook. CNN’s ‘Great Big Story’ initiative is an example of how some legacy broadcasters have embraced distributed viewing, and one clear take-away is that socially distributed videos have to be different not only from television clips, but also from website content. 28

Long Form

But short and sharable is not the only way to go. A range of other players including brands as different as Vice and The New York Times have prioritised longer-form, rich, sometimes interactive video content in an attempt to stand out in a very competitive marketplace for attention.

Vice began as a Canadian print magazine but has built a formidable online brand across different genres and demonstrated that there is a young audience for long-form video online with its documentaries. Its success is attributed to its tone, relevance to its target audience, and its understanding of how its material is viewed.

News organisations like The New York Times and Sky News have experimented with virtual reality, allowing users to have a rich, immersive experience of a major news event or location through their smartphone. As yet it is a minority service – but producers believe it will quickly develop into a mainstream application.

Similarly, some broadcasters seek to exploit their long-form experience and strength. The UK’s Channel 4 offered a video-rich, interactive analysis of the European migrant crisis on a bespoke site, twobillionmiles.com, building on the interactive precedents of The New York Times’ ‘Snow Fall’ and The Guardian’s ‘Firestorm’. These interactive, video-rich experiences offer depth and a compelling user experience. Even though they do not attract mass audiences, they may help some brands carve out an identity as a distinct destination website for key users.

It is not just the format, but the type of content that is offered which has to change. There is a market for the latest breaking events, for the highly visual, and also for in-depth specialist topics. But the middle ground of the basic television news package finds little traction online. One reason for this is that video and packaging in the style of rolling broadcast news is harder to manage online or on mobile than providing text updates on a fast-moving story. If all one wants is headlines, headlines delivered in text and images is faster and more convenient for the user. The longer-form video packages that work therefore have to add value – by being emotionally compelling, providing background, novelty, and an explanation or an angle – and should normally be something which will still be appreciated 24 hours later and beyond. Differentiation is all.

Live Streaming News

Those attempting to build an audience for live streaming have had a mixed experience. Big live events, particularly sports events like the Olympics, have seen significant audience spikes for broadcasters like the BBC and NBC, as have major breaking-news events like the Paris terror attacks – but so far there has been little audience for general day-to-day streamed news programming.

Some media organisations are working to develop online video offerings built around streams. The BBC is developing its own mobile ‘Newstream’ – aggregated content and live video, structured to offer either immediacy or depth, which some speculate may replace its UK news channel. 29 CBS News runs a 24/7 online live stream running content from the news division and affiliates. News agencies too have recognised the demand for content around live events. The Associated Press (AP) works in partnership with Livestream.com to bring major news events live to customers that is formatted for TV, mobile, or online. So far, little data is available on how these live news streams are performing.

Apps like Facebook LiveStream, Twitter’s Periscope and Meerkat, offering live streaming as opportunities to witness events, have built an audience around live events and events like the Paris terror attacks. Much of the content is offered by the public or ‘citizen journalists’ rather than professional news teams. [40. https://www.journalism.co.uk/news/mobile-journalism-has-great-potential-but-where-are-the-journalists-/s2/a594525/ And from the point of view of news organisations, there are not only editorial challenges involved in making use of these new tools, but also questions around what kind of business private news providers can build around them.

Mobile Video News

All this reinforces the notion that the current battleground is mobile. As data from the Reuters Institute’s Digital News Report indicate, the growth in mobile use for news across many markets continues to accelerate (Newman et al 2015). Mobile needs to be seen as a disruptive technology in its own right, one that affects every stage of news – from newsgathering to production, distribution, and consumption. Mobile is a medium with its own dynamic, expectations, demands, and opportunities. What organisations, seeking to adapt to the demands of mobile, must recognise is that going ‘mobile first’ does not just mean introducing a responsive design website or app, or about rearranging desks in the newsroom. It is much more fundamental than that. Storytelling has to change – it has to be short, visual, timely, and hyper-relevant. Production routines and content management systems have to evolve to include new formats as more and more video viewing is moving from landscape to portrait and from large screens with sound to small, muted, screens.

But above all, news organisations have to figure out what editorial value is on a mobile screen. How do you serve people on small personal screens? How do you differentiate in a world of abundant digital content? Technological change has always had a major impact on journalism and media organisations – in the past through the rise of the printing press, radio, cameras, and the web. Mobile is now doing the same.

Ways Forward For Television News

For half a century, traditional television news has been the most widely used, most important, and most shared source of news in most countries. That is not going to change overnight, and television remains an important part of people’s media use and an important source of news for many. But audiences – especially younger audiences – are increasingly moving away from traditional television and towards digital platforms.

Television news providers have yet to find their place in this changing environment. If they do not, they risk irrelevance. And losing touch with the audience will undermine the journalistic mission of television news, as well as the commercial business models and public service justifications for funding it. The move to a ‘post-broadcast democracy’ heralded by the rise of cable and satellite multichannel television in the 1990s and 2000s may now point towards a ‘post-television democracy’ as digital media are on track to overtake television as the most important sources of news.

The erosion of traditional television and the rise of online video present legacy television news providers with a range of challenges and opportunities.

Challenges, because adapting to a dynamic environment requires constant change, and change is always difficult. And organisations that used to occupy a very privileged position in a low-choice environment suddenly find themselves caught between very large platforms and many new players all providing online video in a high-choice environment. (The situation that legacy broadcasters face online today is thus in some ways quite similar to that faced by newspapers in the early 2000s.)

Opportunities, because a video-enabled internet with better devices, connections, and file compression formats provides television news providers with a whole range of new ways of reaching and serving audiences, and because they benefit from having strong brands, creative talent, and deep archives of quality content that they can use in new ways in a new environment.

The Need for Experimentation

As we have shown, no one has defined how to do online video news. We see many interesting experiments, both those focused on leveraging distribution of short, sharable videos via large platforms and those focused on producing stand-out, rich, longer-form video and virtual reality content to draw people to their own website or app. But it is not yet clear that any of these examples represent best practices for others to imitate. A better understanding of what adds value for audiences, what new kinds of journalism can enrich their lives, is needed.

What is clear is that as devices, connections, and file compression improve and as older generations with a preference for traditional television are replaced by younger generations who use digital media far more than they use television, television news providers will increasingly need to think about what their role is in a changing environment. They can – and many probably should – continue to serve an ageing audience on traditional platforms. But how do they reach younger audiences? The cases we have discussed here have not necessarily hit upon the best way to do that, but what they have shown is a willingness to embrace new opportunities and to experiment with how best to seize them.

The need for experimentation is for us the most important conclusion from this review of what is happening to television news. We know traditional television is important but eroding. We know online video is growing rapidly and will continue to become more important as digital media become ever more important. And we know that finding the right way forward between these trends will require constant adaptation and a willingness to change, to try things out, to fail, and to learn from failure without losing sight of the underlying urgent need to change. Not setting aside significant resources for experimenting with new formats and forms of distribution is effectively a decision to not prepare for the digital future. The fact that no one knows precisely how to react effectively to the developments we have discussed here does not reduce the urgency of reacting to them. This is a significant challenge for traditional broadcasters whose culture does not usually support an iterative ‘launch, learn, re-launch’ approach to new projects and for public service media that face a greater degree of political scrutiny of new initiatives.

So far, many legacy broadcasters have tended to approach the rise of online video in the same reactive, defensive, and pragmatic way most newspapers approached the rise of the internet in the 1990s and 2000s (see e.g. Boczkowski 2004). Given the incentives to serve existing users, the challenging business of digital media, and the uncertainties involved in trying to navigate a rapidly changing environment, this is understandable. But it is also very dangerous. An incremental approach is not necessarily the right approach to a revolutionary situation. If you change more slowly than the environment in which you operate, you fall behind.

Successful Experimentation?

How can television news providers move ahead? In her research on innovators in digital news, Lucy Küng (2015) has identified seven features innovative digital news organisations have in common: (1) a clear sense of purpose, (2) unequivocal strategic focus, (3) strong leadership, (4) a pro-digital culture, (5) deep integration of digital technology talent and editorial talent, (6) digital operations with a high degree of autonomy from legacy operations, and (7) an early start relative to their competitors. (Interestingly, Küng notes that an early start is less about first-mover advantage than about developing an organisation that embraces adaptation and innovation and that is accustomed to learning from experimentation, including frequent failures.) All of these features enable continuous adaptation to a constantly changing environment.

Very few traditional television news providers have all these features in place, or even a majority of them. Many of them are still unsure about what their purpose is in an increasingly digital media environment, what to focus on, and how to integrate digital talent into news production (Sehl et al 2016). A significant number of the people who work in this field still regard digital media with a mix of scepticism, fear, and incomprehension rather than see them as a set of challenges to be confronted and opportunities to be seized.

Television news providers need to overcome these barriers to be able to deal with change, including the continued erosion of traditional television viewing and the continuing rise of online video and digital media. The wider television industry needs to overcome them to face its biggest battle, which is yet to come. It will involve a fight for attention, for brand visibility, for control of content, and for access to the data that help one understand the audience and unlocks commercial opportunities. Above all, it will be a fight to offer differentiated content in the most convenient way as consumers embrace new technologies and develop new habits and expectations. Television still captures more of people’s attention than even the biggest digital players – in January 2016, Facebook reported that its 1 billion monthly global users now watch a total of 100 million hours of video every day, and Netflix reported that its 75 million global subscribers stream on average about 116 million hours of video every day. [41. http://techcrunch.com/2016/01/27/facebook-grows/, https://variety.com/2016/digital/news/netflix-hits-75-million-streaming-subscribers-stock-jumps-1201683114/ By comparison, the US population alone watches more than 1,000 million hours of television every day. It is clear that the dominant digital players – Google TV, Apple TV, and Amazon TV, among others – all see this as an opportunity, as do video-on-demand services like Netflix, video-sharing sites like YouTube, and social media sites like Facebook, as well as a range of smaller start-ups. But none has yet conquered the online video market, and for most, news is peripheral to their vision.

This is perhaps the biggest challenge for television news – how to reinvent its core social and political mission in a new environment and find ways of resourcing it. The question should not be what will replace traditional television news. Nothing will. The question has to be how can we move beyond television news as we know it?

List of terms

References

Barnett, S. 2011. The Rise and Fall of Television Journalism: Just Wires and Lights in a Box? London: Bloomsbury Academic.

Boczkowski, P. J. 2004. Digitizing the News: Innovation in Online Newspapers. Inside Technology. Cambridge, Mass: MIT Press.

Cushion, S. 2011. Television Journalism. Sage.

Cushion, S., Sambrook, R. (eds). Forthcoming, 2016. The Future of 24-Hour News: New Directions, New Challenges. London: Peter Lang

Evans, B. 2015. ‘Mobile Is Eating the World’, https://www.ben-evans.com/benedictevans/2015/6/19/presentation-mobile-is-eating-the-world.

Küng, L. 2015. Innovators in Digital News. RISJ Challenges. London: Tauris.

Lotz, A. D. 2014. The Television Will Be Revolutionized, second edition. New York: NYU Press.

Meeker, M. 2015. ‘Internet Trends 2015’, https://web.archive.org/web/20160331180221/http://www.kpcb.com/internet-trends.

Napoli, P. M. 2011. Audience Evolution: New Technologies and the Transformation of Media Audiences. New York: Columbia University Press.

Newman, N., Levy, D. A. L., Nielsen, R. K. 2015. Reuters Institute Digital News Report 2015. Oxford: Reuters Institute for the Study of Journalism. https://www.digitalnewsreport.org/.

Prior, M. 2007. Post-Broadcast Democracy: How Media Choice Increases Inequality in Political Involvement and Polarizes Elections. New York: Cambridge University Press.

Sehl, A., Cornia, A., Nielsen, R. K. 2016. ‘Public Service News and Digital Media’. Oxford: Reuters Institute for the Study of Journalism.

Westlund, O., Weibull, L. 2013. ‘Generation, Life Course and News Media Use in Sweden 1986–2011’, Northern Lights: Film & Media Studies Yearbook 11 (1): 147–73. doi:10.1386/nl.11.1.147_1

- https://www.ofcom.org.uk/__data/assets/pdf_file/0022/20668/cmr_uk_2015.pdf

Premium drama series like Game of Thrones and House of Cards win critical acclaim and draw global audiences of engaged fans across different platforms and screens. The most popular talent shows, reality programmes, and major sports events continue to be must-see appointment viewing for millions of people of all ages, whether they watch on an old-fashioned television set or stream them via any number of connected devices – smart TVs, smartphones, tablets, personal computers, set-top boxes, gaming consoles, etc. (Lotz 2014).

It is less clear that television news has found its place in an increasingly digital media environment, even as online video – on-demand, mobile, and social video more than the live, linear, scheduled programming associated with traditional television – becomes more and more popular.

Younger people especially seem increasingly indifferent to television news, although they embrace many forms of online video. In the United States, Twitch, the Amazon-owned website for watching online streams of video games, has a prime-time audience that rivals major cable news channels like MSNBC and CNN, and it attracts many more younger viewers. [2. http://www.nytimes.com/interactive/2014/08/26/technology/charting-the-rise-of-twitch.html?_r=1 ↩

- https://www.ofcom.org.uk/__data/assets/pdf_file/0022/20668/cmr_uk_2015.pdf

In the UK, the average number of minutes of television viewing for the population as a whole declined from a high of 241 minutes per day in 2012 to 216 minutes per day in 2015, a 10% decline in just three years. [4. http://stakeholders.ofcom.org.uk/binaries/consultations/psb-review-3/statement/PSB_Review_3_Data_Annex.pdf, page 14. ↩

- http://web.archive.org/web/20151215202715/http://www.themediabriefing.com:80/article/television-in-trouble-some-fresh-perspectives-on-the-migration-of-audiences) The decline in viewing time for US adults was about 15% in the same period. [6. http://www.nielsen.com/us/en/insights/reports/2015/the-total-audience-report-q3-2015.html (from Q3 2012 to Q3 2015). ↩

- http://stakeholders.ofcom.org.uk/binaries/research/cmr/cmr15/icmr15/icmr_2015.pdf ↩

- http://stakeholders.ofcom.org.uk/binaries/research/tv-research/news/2015/News_consumption_in_the_UK_2015_report.pdf ↩

- http://www.nytimes.com/2015/12/31/business/media/fox-news-holds-its-lead-in-a-year-of-growth-for-cable-news.html?_r=0 ↩

- http://www.nytimes.com/2015/03/22/public-editor/the-curious-and-vital-power-of-print.html ↩

- http://downloads.bbc.co.uk/bbctrust/assets/files/pdf/regulatory_framework/service_licences/service_reviews/television_services/television_services.pdf, http://web.archive.org/web/20170610132456/https://www.themediabriefing.com/article/youth-audiences-newspaper-old-demographics-advertising

In the US, the UK, and France, television news bulletins in particular are of declining importance as a source of news, especially for younger viewers, but also the population as a whole. In Germany, which has an older population overall, television is holding up better, but the difference between younger and older people is as pronounced in Germany as it is elsewhere. (See Figure 1.1)

Figure 1.1. Proportion of under- and over-45s who accessed TV news programmes or bulletins (US, UK, Germany, France)

Figure 1.1. Proportion of under- and over-45s who accessed TV news programmes or bulletins (US, UK, Germany, France)Young People and Television News

The erosion in time spent watching traditional television and the growth in on-demand, distributed, and mobile viewing across various forms of online video is significantly more pronounced when it comes to younger people. In the UK, traditional television viewing among those aged 16–24 was down from 157 minutes per day in 2012 to 124 by 2015. This is a 21% decline. [12. http://stakeholders.ofcom.org.uk/binaries/research/cross-media/Ofcom_factsheets_for_Oxford_Media_Convention_2015.pdf ↩

- http://www.marketingcharts.com/television/are-young-people-watching-less-tv-24817/ ↩

- https://www.nielsen.com/us/en/insights/report/2015/the-total-audience-report-q3-2015/

Young people’s media habits have always differed from those of older people, but people’s lifelong media habits also tend to reflect the media environment they have grown up in (see e.g. Westlund and Weibull (2013)). Younger people have always watched less television news than older adults. But the difference is growing because generational differences between digital and pre-digital generations are growing. The average time spent viewing television news for all UK adults is down 9% since 2010, and for those between the ages of 16 and 24 it is down 25%. [15. http://stakeholders.ofcom.org.uk/binaries/research/tv-research/news/2015/News_consumption_in_the_UK_2015_report.pdf ↩

- See also https://www.ofcom.org.uk/__data/assets/pdf_file/0024/68910/cmr_2015_annex_changes_in_tv_viewing_habits.pdf

For young people in high-income countries, the media environment they are growing up in is overwhelmingly digital, also when it comes to news, as documented in the Reuters Institute Digital News Report 2015 (Newman et al 2015). Figures 1.2 and 1.3 (below) present the data for the percentage of people identifying online and television respectively as their main source of news, broken down by age, for the UK and for Germany. [17. All data available at digitalnewsreport.org. The Digital News Report is a survey of online news users and thus tends to underrepresent the habits of older people and those who are offline. ↩

- https://www.theawl.com/2015/02/the-next-internet-is-tv/

The most important features are the rise of (1) video-on-demand services like Netflix and Amazon Prime, (2) distributed viewing across a range of platforms from the dominant video-sharing site YouTube (owned by Google/Alphabet), over social media like Facebook (which has made major moves to integrate more video into its services), to messaging apps like Snapchat, and (3) mobile viewing, especially on smartphones. While broadband and mobile infrastructures still do not offer the universality, reliability, and low cost to the consumer of digital terrestrial television, and cannot currently effectively serve an entire population streaming high-definition video at the same time as television can, hardware, software, and connectivity are rapidly improving and offering better and better online video and IPTV experiences.

Precise, consistent, and comparable data on how exactly these trends are evolving are hard to come by. Established measurement systems are highly platform specific (broadcast ratings, audited circulation, unique users) and do not allow for like-for-like comparison across media. Even when the metrics are the same – like time spent – how they are measured varies. Furthermore, measurements are at least in part tied to the interests of media companies (Napoli 2011). Crudely put, broadcasters benefit from metrics suggesting broadcasting is thriving (and tend to emphasise data that suggest television remains stable), just as technology companies benefit from metrics that suggest digital media are becoming more important (and tend to highlight data suggesting new media are growing rapidly).

With these caveats in mind, we believe that three things are clear that are directly relevant for television news and its role in society.

First, while television remains important, it no longer occupies the dominant position it held in the second half of the twentieth century, as digital devices and platforms are becoming increasingly central to how people use media.

Second, video is an increasingly important part of the overall digital media environment, enabled by improved devices, bandwidth, and compression formats and primarily taking the form of more on-demand, distributed, and mobile viewing (rather than streaming of scheduled IPTV, for example).

Third, while television content, and video more generally, is doing well in this environment, television news has benefited far less from the rise of online video than entertainment and various forms of user-generated and social content has.

Some of the best television drama, talent shows, and sports programming seem to thrive online, and celebrities in new (PewDiePie, Smosh) and old (Adele, Justin Bieber) forms have used online video to build their digital presence. It is much less clear that television news producers – in spite of experimentation – have found ways of using online video to effectively connect with a wider audience online. Even broadcasters like the BBC or CNN, that have considerable reach online, still serve people with more text and images than video.

On-Demand, Distributed, and Mobile Viewing

The current developments in online video concern the rise of video on demand, distributed viewing, and mobile viewing. Together, these trends present users with very different, and in many ways more attractive, forms of online video than what was available just a few years ago.

Video-on-demand, people accessing video content at a time and on a device of their own choosing via stand-alone services like Netflix, Amazon Prime, or Hulu, or via those associated with established private or public broadcasters, like Sky+ or the BBC iPlayer, is growing rapidly. By 2014, an estimated 32% of all drama television watched in the UK was time shifted (programmes recorded on a digital video recorder or catch-up viewing via video-on-demand services). The same goes for 14% of entertainment programming and 8% of sports – but just 2% of news. [19. http://stakeholders.ofcom.org.uk/binaries/consultations/psb-review-3/statement/PSB_Review_3_Data_Annex.pdf, page 41. ↩

- https://www.investors.com/comcast-time-warner-cable-verizon-fios-face-cord-cutting-trend/?ven=djcp&src=aurlabo ↩

- Different platforms measure views differently, often in ways broadly aligned with advertising definitions of a ‘view’ as at least 50% of the content in-view for at least two consecutive seconds – such measures are clearly not directly comparable to how viewership is measured for traditional television. ↩

- http://www.cisco.com/c/en/us/solutions/collateral/service-provider/visual-networking-index-vni/mobile-white-paper-c11-520862.html ↩

- http://www.cisco.com/c/en/us/solutions/collateral/service-provider/visual-networking-index-vni/mobile-white-paper-c11-520862.html ↩

- http://stakeholders.ofcom.org.uk/market-data-research/market-data/communications-market-reports/cmr15/ ↩

- http://www.mediametrie.fr/internet/communiques/telecharger.php?f=af4732711661056eadbf798ba191272a ↩

- http://www.wsj.com/articles/overheard-amazons-prime-numbers-1413137520 ↩

- https://www2.deloitte.com/content/dam/Deloitte/global/Documents/Technology-Media-Telecommunications/gx-tmt-prediction-us-tv-television-market.pdf; see also Meeker (2015). ↩

- https://www.ofcom.org.uk/__data/assets/pdf_file/0020/31268/icmr_2015.pdf

With eroding television viewing forecast for all demographics, especially pronounced for younger demographics, advertising revenues are projected to stagnate and eventually decline (Meeker 2015). Subscription revenues are already faced with pressures from ‘cord-cutters’ opting out of pay television packages in favour of free terrestrial TV sometimes combined with video-on-demand, and a new generation of ‘cord-nevers’ who settle down without ever taking up pay television packages. In the United States, a Netflix subscription costs $7.99 per month, a Hulu subscription starts at $7.99 per month, and Amazon Prime costs $99 per year. The average cable TV subscription, by comparison, costs about $99 per month. [29. http://www.cnbc.com/2015/12/30/can-cable-compete-with-streaming-tv-in-2016.html ↩

- http://www.journalism.org/2015/04/29/state-of-the-news-media-2015/ ↩

- https://variety.com/2015/digital/news/netflix-expresses-interest-in-expanding-into-news-programming-1201618182/

Streaming services like Netflix and Amazon Prime are built around a combination of unique stand-out programming and deep archives of older material, a model that has little room for news, is rarely truly unique, and has a very short shelf life. Platforms like YouTube and Facebook are happy to host news – and increasingly collaborate with news providers – but their business is built around bundling of services and content and advertising sold against their huge, global audiences, not investments in original content. [32. YouTube is making some investments in original programming for its premium pay offer YouTube Red, where a $10/month subscription gives access to advertising-free videos, original content from various high-profile YouTube contributors, and a bundle of other Google services including Google Play Music. So far, there has been no investment in news. ↩

- http://allthingsd.com/20131204/same-sht-different-screen-the-disruption-myth-and-digital-tv/ ↩

- https://tubularlabs.com/rank/december-2015/cross-platform/ ↩

- https://tubularlabs.com/rank/december-2015/cross-platform/ ↩

- https://tubularlabs.com/creator/zaBdgtCrUg/BBC-News ↩

- https://www.fastcompany.com/3051812/cnn-launches-great-big-story-its-answer-to-vice-and-buzzfeed ↩

- http://bbcnewslabs.co.uk/projects/atomised-news/ ↩