1. Introduction

More than 15 years after the term was first coined, podcasting has become one of the hottest topics in media. Our Reuters Institute Digital News Report shows that podcasting is now a worldwide phenomenon, with 36% of those surveyed accessing a podcast each month and around 15% using a news podcast. Edison Research estimates that around 90m people listen to podcasts each month in the United States – a number that has doubled since 2015.1 In the United Kingdom podcast usage is up 40% in the last year,2 driven by a younger – plugged in – generation looking for information, entertainment, and distraction. At the same time advertisers are shifting significant budgets into podcasting, while private and public financiers are supporting a range of start-ups in Europe and North America (e.g. Luminary, Himalaya, Podimo, Sybel). Apple has been synonymous with podcasting for many years, but now other big tech companies are investing in the medium. Spotify is commissioning and paying for original podcasts while Google has made them visible in search results at the same time as developing its own podcast service for Android phones.

Publisher interest has grown following the success of The Daily from the New York Times, which has built an audience of 2m daily listens along with substantial annual revenues. Dozens of daily news podcasts have launched over the last 18 months.

There has been much written about podcasts in general and the drivers around growth, but there has been less focus on news podcasts and the creative and commercial opportunities for publishers. Nor has there been much attempt to understand differences between domestic markets, especially outside the English-speaking world. This research sets out to redress that balance by answering the following questions.

- What types of news podcasts are being produced, who is producing them, and how does that differ across countries?

- How big is the daily news podcast category in particular? Why are publishers investing?

- What are wider publisher content and monetisation strategies?

- What role are platforms and other intermediaries playing in discovery and monetisation?

- What are the future prospects for publishers in this space?

We have categorised the top news podcasts in five countries (the United Kingdom, the United States, Australia, France, and Sweden) and linked this with wider industry data on consumption and demographics. We also interviewed around 30 leading publishers (including the Washington Post, Slate, BBC, the Guardian, ABC, The Australian, Les Echos, Radio France, Swedish Radio, Dagens Nyheter), platforms such as Spotify, Google, and Acast, independent producers such as Stitcher, advertising executives, and podcast experts too.

Key Findings

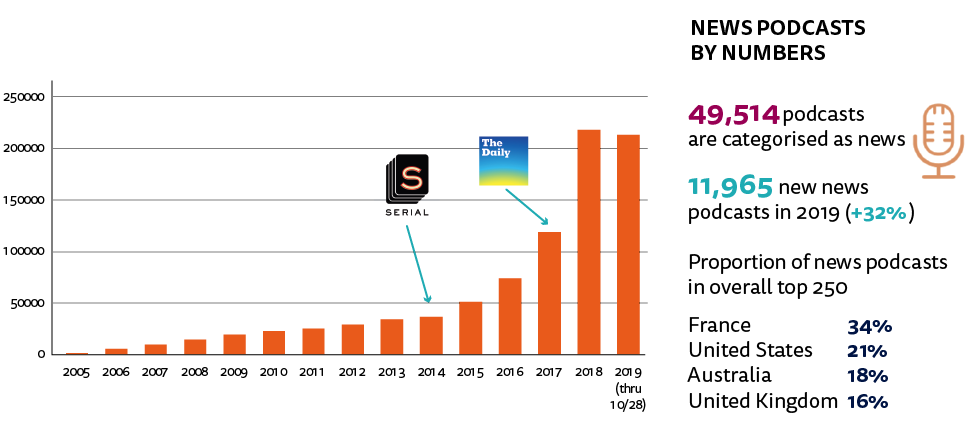

News podcasts make up a small proportion (6%) of the 770,000 existing podcasts, as categorised by Apple, but the general appeal and stickiness of news content means that the category punches well above its weight in terms of consumption. News makes up around a fifth (21%) of the most popular episodes in the United States Apple charts. It is a similar picture in other countries, with a third (34%) of the top podcast episodes in France categorised as news, and just under a fifth in Sweden (18%), Australia (18%), and the United Kingdom (16%).

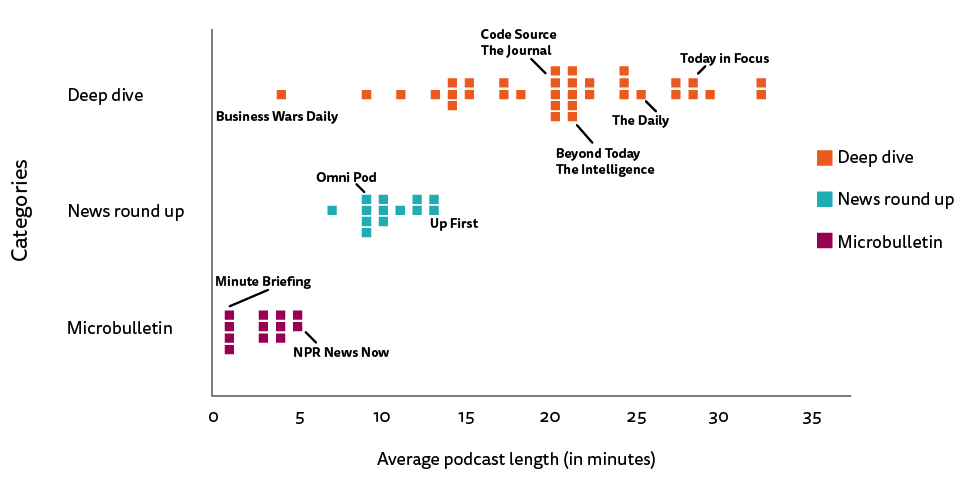

The category itself is also growing rapidly. The number of new news podcasts globally rose by almost 12,000 between January and October 2019 – an increase of around a third (32%) according to data provided by Chartable. Talk and interview shows are the most popular sub-genre within news, along with one-off narrative series, but daily news has become an increasingly important focus. We have identified almost 60 native daily news podcasts across our five countries (see full list in Appendix B) with the majority of these shows having launched in the last 18 months. Some of the most popular daily news podcasts in the United States – such as The Daily from the New York Times – are attracting audiences of millions, while others are struggling in an increasingly competitive market. Elsewhere audiences are more modest but are showing consistent growth. We have identified three sub-categories of daily news podcasts:

- Micro-bulletins, with a length of between 1 and 5 minutes.

- News round-ups, with a length of between 6 and 15 minutes.

- Deep-dives, with a length of 20 minutes or more.

Our research shows that many publishers from print or digital-born backgrounds have focused on single-subject deep-dives that play to their strengths in analysis and explanation. Print journalists have enthusiastically embraced these new forms of storytelling, finding them a natural add-on to existing workflows. By contrast, many broadcasters have focused on producing micro-bulletins and redistributing existing radio programmes as podcasts. Where they have commissioned digital-born or native podcasts, these have often been aimed at younger and more diverse audiences that they are finding hard to reach through linear channels.

Some commercial publishers are already deriving significant revenue from podcasts, especially in the United States. More than half of Slate’s total revenue now comes from podcasts. NPR is expecting to earn $55m from podcasting next year, overtaking radio in terms of sponsorship income. But outside the English-speaking world and in smaller markets, monetisation is far more challenging, with lower consumption and much lower interest from advertisers. But short-term revenue is often not the only motivation. Publishers see podcasts as a good way to build brand awareness and loyalty, which some hope may eventually transfer into subscriptions or donations.

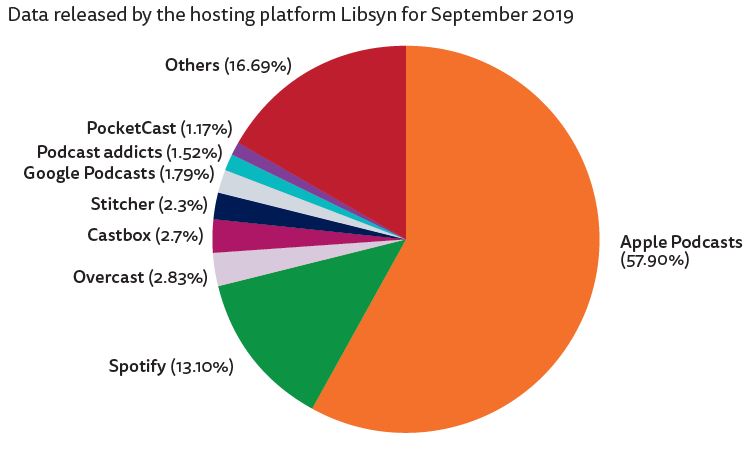

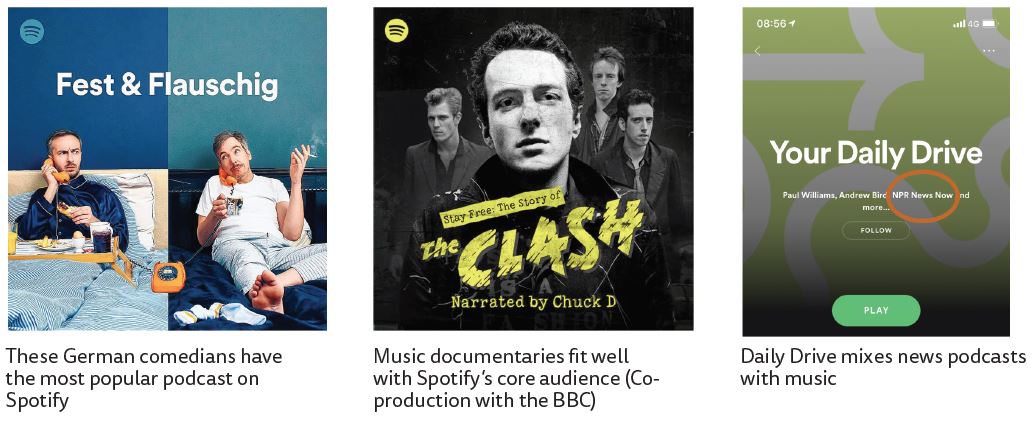

New platforms are shaking up the podcast market, bringing new ideas and extra investment. Apple still accounts for the majority of podcast use but Spotify has doubled its market share in the last year.3 A number of paid content providers are commissioning original content, using Netflix-type models, and offering significant sums for the production of exclusive content. This is opening up new opportunities for publishers around comedy, sport, lifestyle, and high-quality narrative series.

But the growing influence of tech companies and other intermediaries is also bringing familiar challenges. Many publishers fear they could be helping platforms build profitable businesses on the back of their content. Others worry that they could lose their direct relationship with audiences, including first-party data, as platforms take the credit for content. Public broadcasters, in particular, are trying to develop their own destinations for audio content and a number have started to publish first in their own platforms or are withholding content altogether from third parties.

Most publishers and experts feel there is still significant room for growth, with new voice-driven interfaces making it easier to access on-demand audio in the home and on the move. But the scale of the opportunity remains unclear, with revenue still relatively modest and increasing competition from platforms and independent producers. Podcasting is attracting younger audiences but these are predominantly from the better educated ‘latte-drinking’ classes. Reaching mainstream audiences will require a broader range of content and audio formats, better interfaces, and improved distribution. These changes are likely to take some time.

2. Methodology and Definitions

The aim of the analysis was to map the news podcast sector across different countries. In order to do so, we collected data from the Apple Podcasts charts in five countries (the United States, the United Kingdom, Australia, France, and Sweden). Our methodology only explored content that was tagged as News & Politics by publishers themselves in July 20194 and focused on the top (trending) 200 podcasts in each country. This allowed us to capture a wide range of well-used content from daily news to documentary in a consistent way. However, it will have missed out some specialist content, such as sport, comedy, and lifestyle areas, as well as less popular content.

We further categorised each podcast to identify sub-genres (daily news, narrative serialised podcast, chat/interview, etc.) along with producers (broadcasters, print and digital-born publishers, independent podcast companies, etc.). We used the Apple charts because these metadata have become the industry standard and the majority of listening still happens via the Apple podcasts app. These charts, which are not fully transparent, and are loosely based on the number of subscriptions to a particular podcast feed, helped us to identify podcasts that are worth categorising in each country. Apple is only one source of podcasts, and other services (e.g. Spotify) may show different results.

Understanding podcast consumption is more challenging so we have used a variety of sources. We have used survey data (Edison Infinite Dial and Digital News Report) to help put podcasts into a wider context as well as provide robust data on demographics. The Apple Podcasts Episode charts, based on recent usage around specific shows, help provide a picture of relative consumption – even if actual numbers are not publicly available. To help fill in these gaps, we have in some cases used consumption data provided directly by individual publishers, or we have referenced aggregated publisher data from Podtrac in the United States and Poddindex in Sweden.

We chose the United States, the UK, and Australia because they have been quick to embrace podcasting, with fast developing monetisation and professional podcast services. By contrast, France has been slower to adopt podcasts but has a vibrant and emerging independent sector and is an example of a large non-English-speaking country. Sweden is the home of Spotify and another country with a high level of podcast consumption. We interviewed leading publishers in all five countries, along with platforms, other intermediaries, and industry experts. We also included three interviews from Denmark, a small European market which is showing innovation in business models and through a recently launched paid podcast platform, Podimo. A full list of interviewees is included in Appendix A of this report.

What is a Podcast Anyway?

In the Digital News Report, we define a podcast as an episodic series of digital audio files, which you can download, subscribe to, or listen to. Technically the programme or show itself sits inside a feed, which can be accessed via an app (sometimes known as a podcatcher) such as Apple Podcasts, Google Podcasts, Stitcher, or Podcast Addicts – or via a publisher app or website, such as BBC Sounds or SR Play from Swedish Radio, or the New York Times, which has recently incorporated a podcast feature in its app. But in the last few years podcasts have also become available via music services such as Spotify and Pandora, via voice platforms such as Amazon’s Alexa and the Google Assistant, and via Google search itself. As audio becomes more integrated into mainstream consumer experiences across the internet, these early technical definitions are becoming less meaningful. Individual shows are increasingly being surfaced across the web often without the need to subscribe to a feed or use a specialist app. Given this, it is perhaps more useful to consider the other characteristics of a podcast, in terms of content or form, that make it different from a traditional radio programme.

A number of previous studies have noted that podcast listening is a more active process, with listeners typically listening intently from the start, whereas radio is often consumed distractedly as a flow of information.5 This allows shows to be constructed in a more demanding way, often using immersive and narrative storytelling techniques borrowed from movies and television drama. ‘It is often more filmic,’ says Kellie Riordan, manager at ABC Audio Studios. ‘Radio tends to be topic driven whereas podcasts – even if they’re news podcasts – build in storytelling, and plot points, and casting, and character, and scene building.’ Marguerite Howell, co-editor of The Intelligence at The Economist says it is not just about the way shows are constructed, it is also about tone: ‘It’s much more intimate, where sometimes with the radio it’s as if you’re being assaulted.’

But it is not just the production techniques. The context is also different, with 90% of podcast listening happening alone, largely using headphones attached to a smartphone, whereas radio listening is often a shared experience.6 This tends to push creators towards a more intimate experience where the relationship with the host is critical. ‘People are choosing to listen to that particular host either daily or weekly and make that part of their habit,’ according to Susie Warhurst, SVP of Content at Acast. ‘You are incredibly engaged with the content.’

Others point to the democratic nature of podcasts – the way that low barriers to entry encourage diverse viewpoints. Podcasts open up the possibility of super-serving an almost infinite number of passions and niches. In that sense they are different from radio programmes which, in terms of the spoken word, have tended to serve a more general audience within a particular broadcast distribution area.

Attempts to neatly define and categorise podcasts are often problematic, as this study shows. A significant proportion of popular podcasts originated as radio programmes but can now be enjoyed in a new context. We also find broadcasters adapting and reversioning content as well as commissioning podcast-first content that finds itself back on the radio. In this report we will use the terms native podcast and catch-up radio, because it helps us understand the production and supply of content. However, these differences are not clear cut and audiences themselves rarely make these distinctions.

|

Term |

Definition |

Examples |

|

Podcast |

A podcast is an episodic series of digital audio files, which you can download, subscribe to, or listen to via a range of technologies (RSS feed, podcasting apps) |

771,000 examples catalogued by Apple

|

|

Native Podcast

|

An audio programme produced and designed as an on-demand programme/show, without being bound to the radio or TV broadcasting schedule.

|

The Daily (New York Times), The Teachers Pet (The Australian), P3 Dystopia (Swedish Radio) |

|

Catch-up Radio

|

A time-shifted, on-demand programme formerly broadcast on radio (or even TV)

|

Morning Edition (NPR), AM (ABC), In Our Time (BBC), Le Téléphone Sonne (France Inter) |

3. Comparing the Production of News Podcasts across Five Countries

This chapter looks at the different types of content that are being produced. It looks first at the news in the wider context of podcasting before looking at typologies of news content. Finally, it examines the different producers of news content and links these to the typologies.

The Importance of News in the Wider Podcast Ecosystem

Taking native and catch-up radio podcasts together, we find 771,000 podcasts in the Apple directory as of November 2019, but the news category makes up a relatively small proportion of these – 6% or about 50,000 podcasts. And yet we find that news makes up more than a fifth (21%) of the top 250 places in the Apple episode charts: ‘These episode charts are reflective of consumption, not just recent subscriptions. So clearly news pods punch above their weight,’ says Dave Zohrob, CEO of Chartable, which tracks changes in the podcast ecosystem.

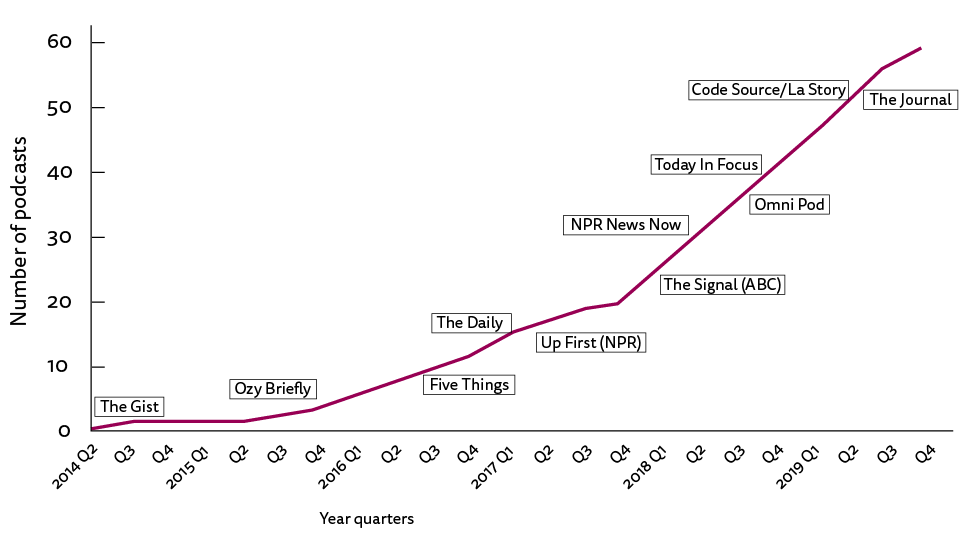

Across all genres, the number of new podcasts is growing at a rate of more than 200,000 a year, though this rate has started to slow a little (see the next chart). Many of these are produced by hobbyists and individuals, but this growth is also increasingly driven by higher-quality professional content with significant investment from broadcasters and digital-born publishers, as well as those with a background in print. There have been almost 12,000 new news podcasts so far this year, representing an increase of around a third (32%) in the last year.

News podcasts 2005–2019

Source: Chartable

While some publishers have been creating and distributing podcasts for 10 or 15 years, it was the blockbuster success of Serial (2014), an investigative journalism podcast developed as a ‘spin off’ from the American public radio show This American Life, that kicked off this current wave of excitement. The show’s first two series notched up 340m downloads,7 sparking a new genre of true crime investigations including break-out hits S-Town and more recently The Teacher’s Pet in Australia. Noting renewed interest in podcasts, the New York Times started to develop a daily news show to showcase its journalism in an audio format. Borrowing techniques from American public radio, the show launched in early 2017, becoming a surprise hit, in part because of the podcast’s ‘conversational and intimate’ tone.8 In turn this has led to the development of a new genre of narrative news podcasts that take a deep-dive into one or more stories.

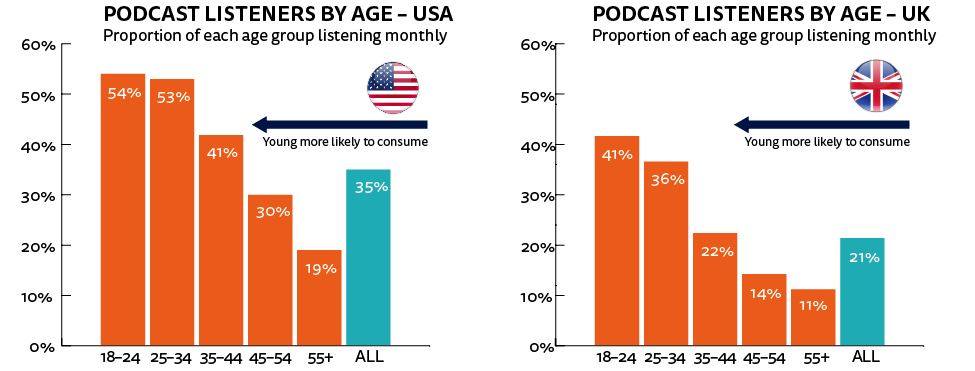

In the United States listening patterns have already started to change dramatically: ‘Strategically we know that we would be completely foolish if we weren’t committing ourselves to pushing aggressively into the on-demand space,’ says Chris Turpin, Vice President for Editorial Innovation and Special Projects at National Public Radio (NPR), who notes that the podcast audience is much younger than the broadcast audience (see next chart).

Source: Digital News Report 2019: Q11 A podcast is an episodic series of digital audio files, which you can download, subscribe or listen to. Which of the following types of podcast have you listened to in the last month? Base: All markets – UK= 2023, US=2012

But for other publishers, audio represents another significant disruption to traditional models. ‘You can see consumer habits changing to include audio more in daily routines,’ says Chris Duncan, Managing Director of The Times and Sunday Times. ‘It feels like a positive opportunity but also it’s a threat for attention – so it’s a place that we have to be.’

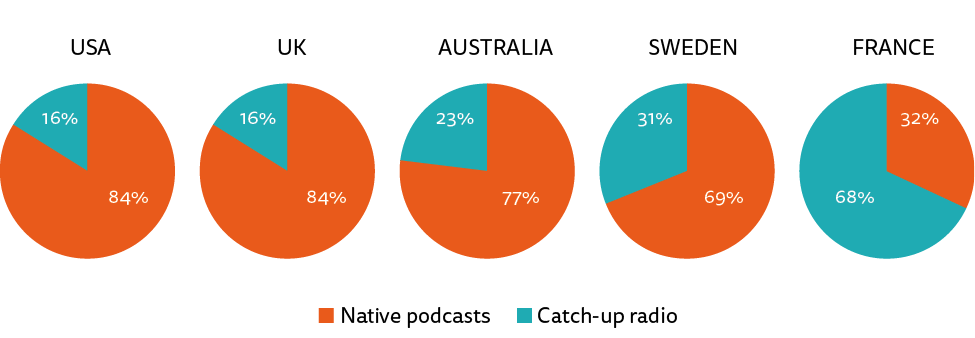

Native vs Catch-Up Radio

The next chart shows the proportion of trending news podcasts that are native (digital-born), as opposed to catch-up radio content, across our five countries.

Percentage of top 200 news podcasts that are native vs catch-up in five markets

Source: Apple Podcasts charts top 200 News & Politics, 16 July 2019 (Domestic only, n = 200 in each market)

Source: Apple Podcasts charts top 200 News & Politics, 16 July 2019 (Domestic only, n = 200 in each market)

It is striking that in the United States, the United Kingdom, Australia, and Sweden ‘native’ podcasts are more prevalent than podcasts originating as radio programmes. In these countries more than two-thirds of the top 200 podcasts are made first for this medium, showing both how media companies have invested in this area and also how this has been matched by consumer interest.

In France the situation is different, with the majority of trending podcasts (68%) being catch-up radio programmes from mainstream radio stations such as the Radio France group (France Culture, France Inter, and France Info), RTL, and Europe 1. This shows the different levels of maturity of podcasting in France, where catch-up radio still dominates and where there has been a relative lack of investment from other publishers.

Further analysis shows that the most popular shows in France tend to be on-demand versions of debate and current affairs programmes (e.g. Le 7–9 from France Inter and RTL Soir from RTL) as well as short segments from broadcast, such as the three-minute Géopolitique morning section from Pierre Haski (France Inter). In the United States we find just 16% of the trending podcasts are catch-up, but these include audio versions of popular cable television programmes, such as The Rachel Maddow Show (MSNBC), and highlights from The Daily Show (Comedy Central). In the UK, commercial broadcasters like LBC (James O’Brien, Nigel Farage) and Talk Radio compete with the BBC with offcuts and recuts of popular shows.

Catch-up radio is often a good starting point for news podcasts, but over time we see high-quality native podcasts competing strongly with broadcast content – often resonating more with consumers.

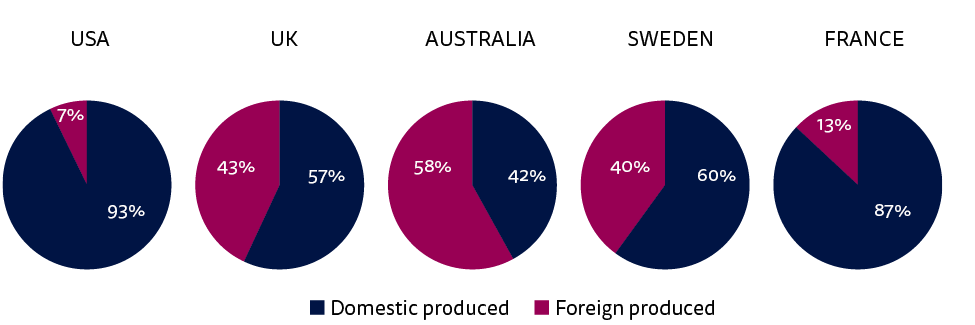

Domestic vs Foreign Podcasts: US and UK Podcasts have International Reach

Our chart explores the extent to which people are accessing podcasts from outside their home country. Once again, we see significant differences across our markets.

Percentage of top 200 news podcasts that are domestic vs foreign in five markets

Source: Apple Podcasts charts top 200 News & Politics, 16 July 2019 (n= 200 for each country)

Source: Apple Podcasts charts top 200 News & Politics, 16 July 2019 (n= 200 for each country)

The dominance of the US podcasting industry, especially the production of high-quality narrative podcasts, is reflected in the significant pink wedges that we see in the pie charts from the UK, Australia, and Sweden. More than half (58%) of the podcasts in the Australian charts are produced internationally, with US shows such as White Lies (NPR), and Cold (KSL and Wondery) leading the charge – along with those from the UK. This research suggests that podcasts can – to some extent at least – break down national boundaries around audio content. Seven programmes are represented in the top 200 places in all of the countries studied. These include The Daily, Can He Do That?, and The Argument from the US, the Global News podcast from the BBC, The Intelligence by The Economist, and the true crime podcast Uncover from the Canadian public broadcaster CBC.

Over time, one might expect the proportion of US podcasts in the top 200 to reduce as domestic podcast scenes become stronger, with higher quality content. On the other hand, smaller countries with high levels of fluency in English, like Sweden, are likely to continue to look outwards for relevant content.

By contrast, in the United States and France, the podcast scene is dominated by local producers, albeit for very different reasons. In the United States only 13 of the top 200 shows (7%) are non-domestic, with half of those being British. Strong domestic competition makes it extremely hard to break into this American market. In France almost nine in ten (87%) of our trending podcasts were locally produced, with language clearly a factor.

Different Types of Popular News Podcasts across Countries

We have identified five types of news podcasts, which were categorised using the following criteria.

|

Type |

Description |

Examples |

|

Daily News/current affairs |

This is either a) a NATIVE and DAILY podcast focusing on NEWS AND CURRENT AFFAIRS or b) a daily radio (or TV) show repackaged as podcast. |

Post Reports (Washington Post), La Story (Les Echos), Ekot (Sveriges Radio) |

|

Talk/Interview unscripted |

A TALK / DEBATE / CONVERSATION show. Can be native or catch-up. Mostly these are weekly and non-scripted. |

Political Gabfest (Slate), The Nigel Farage Show (LBC), The Professor and The Hack (10 Speaks) |

|

Narrative series – single topic |

NATIVE podcast with a SEASONAL / IRREGULAR frequency. A podcast in series focused on one story / investigation / true crime narrative. |

Serial, The Assassination (BBC), The Teacher’s Pet (the Australian), Injustices (Louie Média) |

|

Other documentary – many topics |

DOCUMENTARY strand released at a REGULAR frequency (weekly, monthly, etc.). It reports on a wide range of topics. Can be native or catch-up. |

P3 Dystopia (SR), Code Switch (NPR), Slow Burn (Slate), Une lettre d’Amérique (RTL) |

|

Audio long read |

NATIVE podcast. A read of newspaper/magazine feature. Can be regular or seasonal / irregular. |

Guardian Long Read (Guardian) Les éditos de la rédaction (Les Echos) |

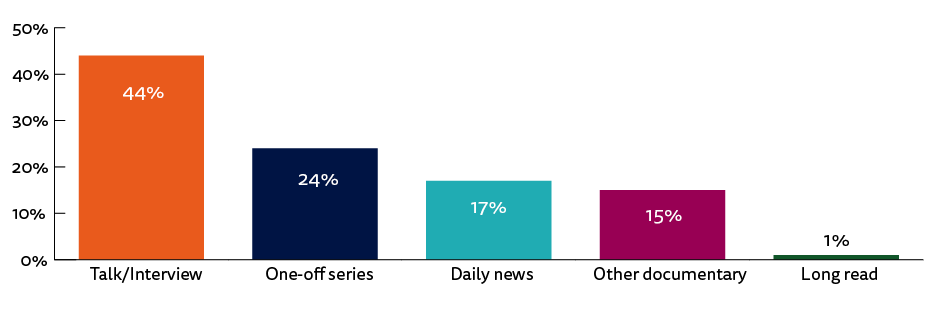

Percentage of different types of popular news podcasts

AGGREGATED TOTALS FROM THE UK, THE US, AUSTRALIA, SWEDEN, AND FRANCE

Source: Apple Podcasts charts top 200 News & Politics, 16 July 2019 (n= 1000; 200 from each country)

Source: Apple Podcasts charts top 200 News & Politics, 16 July 2019 (n= 1000; 200 from each country)

Our research shows that talk and interview formats were most common across all five countries, accounting for more than four in ten (44%) news podcasts across all five countries. These are shows like the Political Gabfest from Slate, which was one of the pioneers of this format. Talk radio hosts such as James O’Brien in the UK have also found success by reversioning their broadcast shows as podcasts.

The one-off narrative series is another popular format (24%), with true crime hits coming from the US, as well as Australia and the UK. The Teacher’s Pet was a true crime podcast from the Australian that was downloaded more than 30 million times. The Assassination from the BBC was an award-winning investigation into the death of Pakistani politician Benazir Bhutto.

Daily news podcasts made up 17% of the total, and this category includes catch-up morning radio shows, as well as native podcasts including short-form bulletins like NPR News Now, and deep-dives like Today in Focus from the Guardian and Aftonbladet Daily. We explore this category in much more detail in Chapter 4.

Who are the Main Producers of News Podcasts across Countries?

Next we identified the main producers of both catch-up radio and native podcasts.

|

Type |

Description |

Examples |

|

Broadcaster |

From a TV or radio background. High level of radio shows reversioned as podcasts. Some are commissioning native podcasts |

NPR, BBC, ABC, SR, Radio France |

|

Print / Digital Media |

From either a) a newspaper/magazine background or a digital-born publication |

Washington Post, the Guardian, Le Parisien, Slate, Vox |

|

Podcasting company |

A studio producing original programmes designed to be podcast |

Gimlet Media, District Productive, Louie Média, 10 Speaks, Audioboom |

|

Independent |

An individual or a group of individuals producing one single podcast show. Often self-funded or via donation platforms like Patreon. |

The Bellingcat Podcast, Reasons to be Cheerful with Ed Miliband and Geoff Lloyd |

|

Other |

A range of diverse actors, from universities to institutes to political parties. Mostly non-commercial |

Reuters Institute

|

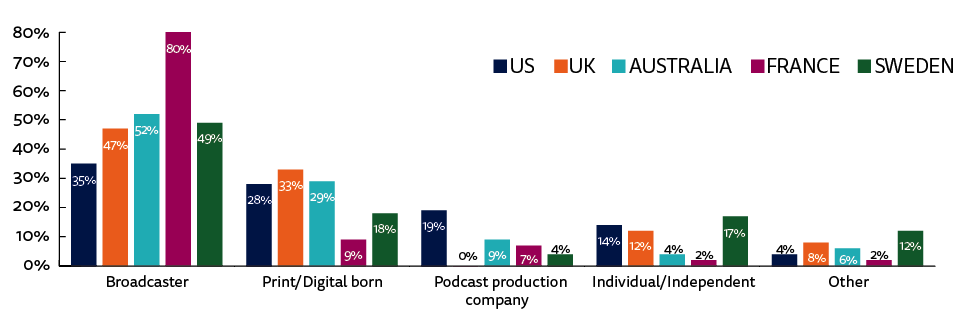

It is noteworthy that broadcasters are consistently the biggest producers of domestic podcasts in each country – mainly because of the amount of radio catch-up material they are able to provide. This is particularly the case in France, where 138 out of the top 200 are taken directly from the broadcast schedule. Around 80% of the top domestic podcasts are produced by French radio stations Radio France, RTL, and Europe 1, but only around 5% of these are native. French publishers from a print or digital background are now starting to invest, with legacy media such as Le Monde, Le Parisien, and Les Echos launching a new range of podcasts over the past few months. Independent podcasting companies tend to focus on non-news areas such as video games and gender issues.

By contrast the US podcast scene is more evenly split, with publishers from a print or digital-born background (28%) producing almost as many popular podcasts as broadcasters (35%).

Top producers of domestic news podcasts by country

Percentage of each type

Source: Apple Podcasts charts top 200 News & Politics, 16 July 2019 (US=186. UK=114, Australia=84, Sweden=119, France=174)

Another striking feature of the podcasting scene in the United States is the strength of podcast production companies such as Gimlet, Stitcher, and Wondery. These studios produce 26 of the top trending domestic news shows in the United States (19%) and their shows are widely consumed around the world. Wondery recently held the top chart position in seven countries around the world with its blockbuster true crime series Dr Death, the story of a two-year-killing spree committed by spinal surgeon Christopher Duntsch. The show has been translated into a number of languages and is destined for a TV spin-off.

In many cases podcast studios are creating content in partnership with media brands. Stitcher produces Today Explained with Vox Media and Wondery collaborated with the Boston Globe on Gladiator, an investigative series about the secret life of the American footballer Aaron Hernandez.

In many cases podcast studios are creating content in partnership with media brands. Stitcher produces Today Explained with Vox Media and Wondery collaborated with the Boston Globe on Gladiator, an investigative series about the secret life of the American footballer Aaron Hernandez.

Elsewhere the independent sector is far more nascent. In France, Louie Média has produced a number of successful narrative podcasts, including Injustices, a series about sexual harassment within French journalism. In Australia there are a handful of independent producers working closely with media companies while the television company Ten has recently set up a native podcast studio called 10 Speaks. It has created a talk show called The Professor and the Hack and a true crime hit Where’s William Tyrrell? By comparison, in the UK there was no domestic podcast production in the top 200, though a number of independent production companies do create hit shows on behalf of the BBC so this figure may be slightly misleading.

Overall, independent podcasting companies account for less than one tenth of all the popular domestic news podcasts listed in the five countries studied. This could be because it is hard to compete with traditional media companies in news – so the focus is often on documentary, lifestyle, sport, or creating content for brands. It will be interesting to see if countries outside the US can support more independent studios as the market grows – or if big US companies will move in.

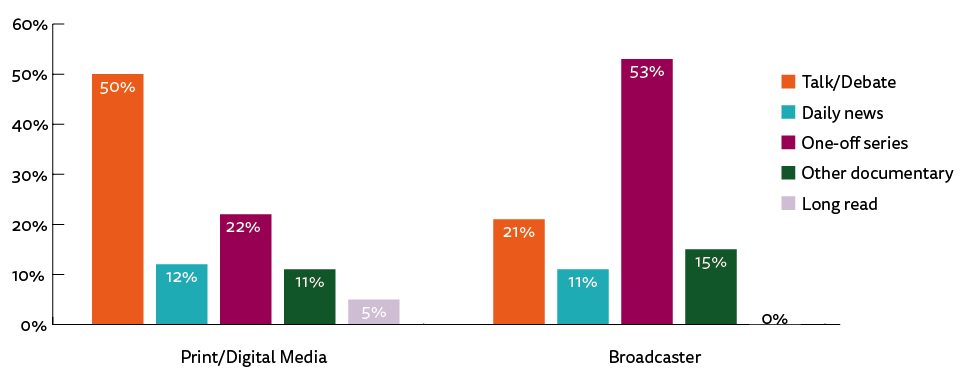

Print and Digital-Born Companies See Opportunities for Disruption

Although broadcasters are the largest podcast producers in all five countries studied, print and digital media companies produce more of the trending native podcasts overall, according to our analysis. Print and digital publishers have focused more on talk and interview formats that are relatively cheap to produce as well as deep-dive daily news podcasts. Both of these formats allow them to reuse existing journalistic talent, showcasing the expertise of their newsrooms.

Percentage of native and domestic news podcasts in each category

Print/Digital-born vs Broadcaster

Source: Apple Podcasts charts top 200 News & Politics, 16 July 2019

Base: Native and domestic podcasts aggregated total across countries, n=247

In total, half of the trending native podcasts (50%) produced by print and digital media companies are classic talk/debate shows. A number of the most successful are personality-led shows such as the Ezra Klein show (Vox), Giles Coren Has No Idea (The Times), or Intercepted With Jeremy Scahill (The Intercept). Others are branded with the name of the outlet, such as FT Politics, The Spectator Podcast, The Economist Asks, and Politics And More.

By contrast radio broadcasters have looked to leverage their skills in documentaries and audio production in creating more one-off series. All the main broadcasters of the countries studied have invested in serialised podcasts. These include Death In Ice Valley – a true crime podcast produced by the BBC and Norway’s NRK – and Russia If You’re Listening, a landmark series from ABC (Australia) about the Mueller report.

Overall, one-off series represent just over half (53%) of the total of native broadcaster podcasts listed in the trending charts. Broadcaster-produced native talk and debate shows tend to be either closely focused on one specific topic (e.g. Brexitcast by the BBC), or try to bring the listener ‘behind the headlines’, e.g. Sky News Australia 2600 Talks podcast, or Political Thinking With Nick Robinson (BBC). Not surprisingly, the long-read format is only created by print publications.

4. Deep-Dive into Daily News Podcasts

In this chapter we will take a deeper look at the native daily news podcast segment. We have identified almost 60 of these in the five countries studied. The vast majority have launched in the last 18 months.

The evolution of news podcasts

THE US, THE UK, AUSTRALIA, FRANCE, SWEDEN ONLY

Source: RISJ research (The full list of daily news podcasts is included in Appendix B to this report.)

The 59 native daily news podcasts identified divide into three broad sections:

- Micro-bulletins – short news bulletins of just a few minutes that aim to provide a quick summary of the day’s news. These are often aimed at voice devices such as the Amazon Alexa and Google Home. Examples include BBC Minute and NPR News Now.

- News round-ups – these are longer podcasts that have the aim of briefing people at particular points in the day with a short update. Examples include the FT News Briefing.

- Deep-dive analysis – these typically take one story for deeper analysis. Examples include The Daily from the New York Times.

In the following chart we have mapped the length of these podcasts against these different types in order to highlight three length clusters. Micro-bulletins have an average length of around three minutes, news round-ups are around 10 minutes, and the deep-dives tend to be around 20 minutes or longer.

Daily news podcasts: length by category

Average length calculated from the last 15 episodes from September 2019

Source: RISJ analysis

Deep Dive Podcasts

In terms of popularity, it tends to be the longer deep dives that are the biggest hit with consumers – at least in the UK and the US. The Podtrac ranking for September 2019 shows The Daily as the most popular podcast in the United States, with NPR’s Up First, which is a news round-up, at number four. By contrast, news round-ups do best in Sweden, with Ekot and Omni Pod achieving top listening figures according to Poddindex.

Popular native daily news podcasts in five countries

|

United States |

United Kingdom |

France |

Australia |

Sweden |

|

The Daily – New York Times Up First – NPR Today Explained – Vox *News Now – NPR Post Reports – Washington Post Start Here – ABC News Skimm This – The Skimm What Next – Slate The Journal – Wall Street Journal

|

Today in Focus –Guardian Beyond Today – BBC The Intelligence – Economist FT News Briefing The Leader – Evening Standard

|

La Story – Les Echos Code Source – Le Parisen Programme B – Binge Audio

|

The Signal – ABC News 7am – Schwartz Media The Quicky – Mamamia Squiz today – Squiz

|

*Ekot – Swedish RadioOmni Pod – Schibsted Aftonbladet Daily – Schibsted Di Morgonkoll – Dagens Industri

|

* These are not strictly native as they are radio bulletins updated many times a day. They are included because they have been adapted and branded for on demand and made available as podcasts

Daily news podcasts are not just delivering reach, they are also bringing deeper engagement. Private data from publishers show that listeners come back several times a week and listen to the majority of each show – completion rates tend to be between 60% and 90%. This suggests engagement times of more than an hour per podcast user per week, which compares extremely favourably to a few minutes a week for the average website visitor.9 ‘We are thrilled to have 25 minutes a day with people that we didn’t have before,’ says Erik Borenstein, Director of Audio at the New York Times. ‘We really think of The Daily as the new Front Page.’

Many of our interviewees referenced The Daily as an inspiration for starting their news podcast, and it is not surprising that formats and length of deep-dive podcasts that we uncovered in this research are relatively uniform (see examples below). The group in France which owns the business paper Les Echos and popular daily Le Parisien looked at The Daily when looking to create first-mover advantage in France. Both publications worked with recently acquired start-up Binge Audio to develop their daily news podcasts and quickly settled on the format of one big story, as presenter of La Story Pierrick Fay recalls: ‘It’s the format that works in the United States. For two months, I listened to what was being done, as we designed our new show.’ Le Parisien cancelled its audio briefing for Amazon Alexa devices to make room for a deep-dive podcast: ‘The number one goal was to tell a few stories differently, with a podcast daily news that lasts about twenty minutes,’ says Editorial Deputy Director Pierre Chausse.

Others have defined themselves almost as an alternative to The Daily. ‘We saw the afternoon space as an opportunity because a lot of shows were consolidated around the morning,’ says Jessica Stahl, Head of Audio at the Washington Post, which launched more than a year after the Times with a proposition that was aimed at evening commuters. The Post has also tried to differentiate itself with a format of three stories each day, showing off the variety of its journalism as well as its depth.

The Economist also settled on a three-story format for The Intelligence, with the aim of showcasing the global spread of its correspondents and building awareness for its brand in the United States. It hits the market at 6am Eastern Time but, because the show is produced in London, the time-difference allows the team to add more newsy elements at the top of the podcast. The Wall Street Journal operates one 15-minute single-item investigation called The Journal produced with Gimlet.

News Round-Ups and Micro-Bulletins

In the United States, the most successful news round-up show is Up First from National Public Radio. This 12-minute show is actually a hybrid, with the original interviews airing on NPR soon after 5am. These are then recut with the same host and given more of a podcast feel. NPR’s Chris Turpin says this is an effective way to reach a new audience without breaking the bank: ‘The same material is reaching an audience that is on average at least 20 years younger than our broadcasting audience with the same hosts.’ NPR says that the audience for Up First is still much smaller than the morning radio audience but runs into millions and is up 50% in the last year.

The Financial Times has also gone for a news round-up approach aimed at the business community in the US. The FT News Briefing typically runs to 9 or 10 minutes and covers three or four news stories and then one analytical item in greater depth. It is the FT’s fastest-growing podcast, surpassing a million monthly listens in August 2019: ‘It’s not a behind the scenes, deeper dive,’ says Renée Kaplan, Head of Audience and New Content Strategies at the FT, who says the aim is not to compete head to head with the other big players. ‘It is a business and markets focused news update that is really meant to equip you to start your day.’

We also find a number of micro-bulletins, such as NPR’s News Now, which is the recut radio bulletin updated every hour. The Washington Post has been operating the Daily 202 Big Idea podcast alongside its morning newsletter for some time, while the BBC Minute packs five stories and two presenters into a frantic 60-second native podcast updated several times each day. These micro-bulletins are all available as podcasts but are also aimed at voice platforms.

How Many People Does it Take to Make a Daily News Podcast?

Creating a deep-dive daily news podcast is a significant investment – certainly when compared with low-cost weekly chat/interview shows that many publishers had previously favoured. The New York Times employs around 15 dedicated people on The Daily – amongst a wider audio team of around 30 – though it has access to a total journalistic team of hundreds. The Guardian employs ten for Today in Focus, and The Economist eight. At the other end of the scale, Schwartz Media in Australia, Le Parisien, and Les Echos in France all produce their daily podcasts with four or five – a more typical number for smaller publications starting out. The skillset tends to include one or two hosts, an executive producer, one or two producers, and a sound engineer/sound designer.

Today in Focus executive producer Nicole Jackson says that robust staffing levels at the Guardian have helped to avoid burn out and ensure that the show has a constant stream of high-quality stories. ‘Every producer is at a different stage on their story. Someone’s finishing, someone’s making calls, someone’s in the middle of an edit, and it allows you to really hone those stories. If we had a smaller team, you would only be able to work on that day’s and maybe the following day’s and it just wouldn’t be as good’.

One underestimated element of a news podcast is the sound design. The Guardian’s Axel Kacoutié is a critical member of the team, whose work inspires such devotion that a group of listeners have named a quiz team after him. ‘When we plan out the interviews, we think about them in terms of chapters and that pacing is really important when we hand over the piece [with notes] to Axel.’ Nicole Jackson says that using music to create the right mood is a critical part of the production process: ‘What’s so brilliant about Axel is he will take those notes and always give you something that feels surprising, original and fresh.’

A key factor for many teams producing daily news podcasts has been the wider cooperation of the newsroom. While other digital developments have often been resisted, the podcast has been universally welcomed: ‘A lot of our journalists just like it,’ explains Christian Bennett, Head of Global Audio and Video at the Guardian. ‘People like talking about their stories and finding new ways of doing that. It’s a place of storytellers.’

The Podcast Host Helps Create an Intimate Atmosphere

Another key element of a successful podcast is the personality of the host. The Daily’s Michael Barbaro is a former political reporter whose slow, deliberate style provided a natural fit for The Daily, where he coached other reporters in narrative audio techniques such as setting a scene and sustaining a dramatic arc. ‘I had to learn to ask questions differently. The questions are what propel the whole interview,’ he recently told an interviewer.10

The difference between radio and podcasting hosting was a regular theme in our interviews. ‘Not all great TV and radio broadcasters make great podcasters,’ says John Shields, editor of the BBC’s daily narrative podcast Beyond Today, which targets younger consumers. With fewer pressures of time and a more demanding audience, he says that part of his job has been getting hosts in a different frame of mind: ‘We talk about “making the tea” – getting them to slow down, relax, and linger on the details.’

Schwartz Media brought in the experience of Elizabeth Kulas, who had been working with native podcaster Gimlet Studios in the United States and had previously won a Peabody award with NPR’s Planet Money. ‘We saw her as a perfect host for our show and also coming from the school of podcasting that we were inspired by,’ says CEO Rebecca Costello. Le Parisien also looked to bring in an experienced host from outside, Jules Lavie from Radio France, while Les Echos was able to call on the talents of Pierrick Fay, a former broadcaster who already worked in the newsroom. The Economist’s Jason Palmer was a science correspondent with the paper, a US national, and had previous broadcast experience with the BBC: ‘He is the perfect avatar for this mostly American audience who are saying, “help me to understand what’s going on”,’ says deputy editor Tom Standage.

Consumption Levels for Daily News Podcasts are on the Rise

Understanding consumption is hard because listening is fragmented across platforms and it is difficult to measure usage of podcasts that are downloaded and listened to later offline. The latest IAB (Internet Advertising Bureau) standard 2.0 counts a listen as ‘a download or a podcast that has been streamed for at least 60 seconds’, but some publishers and platforms do not yet adhere to this standard. Our research shows wide variation in numbers.

The New York Times says that The Daily reaches 2m listeners per day up from 1.1m in June 2018.11 The Economist told us that The Intelligence, which is less than a year old, reaches 1.5m people each month, with around 6–7m individual downloads monthly. It says that the average listener downloads or listens to three to four episodes each week. These are substantial audiences, even if they are not yet on a par with the most popular radio news shows in the US.

In the UK, numbers are generally smaller but still substantial. In less than a year the Guardian has built a bigger audience for its Today in Focus podcast than buys the newspaper. ‘It’s hundreds of thousands every day,’ says the Guardian’s Head of Audio, Christian Bennett, who points out that the podcast attracts younger people who are listening to the vast majority of each 25–30 minute episode, with a 80% completion rate: ‘It’s younger than people that buy the paper and it’s younger than people that come to our website as well. It’s opening up a new audience as opposed to cannibalising.’

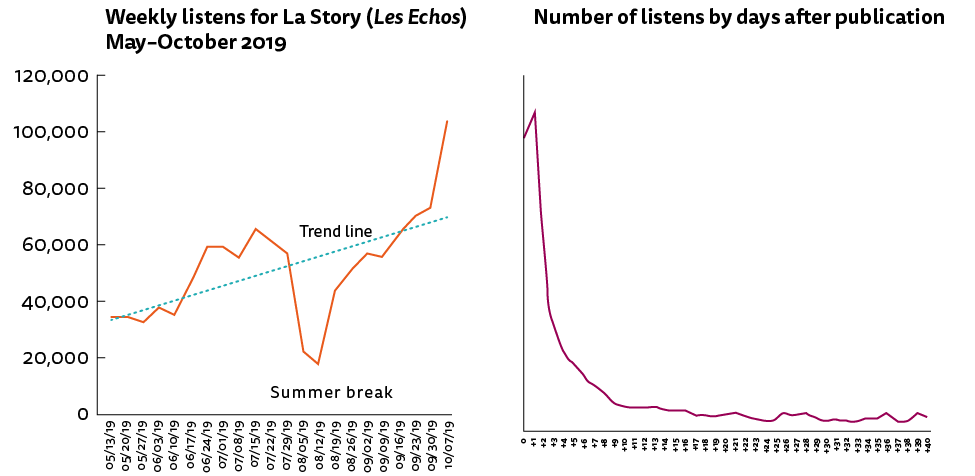

In France, daily news podcasts are a relatively recent development, but La Story from Les Echos has still managed to attract 100,000 weekly listens in October 2019 – more than double the figure at launch in May. Despite this, the shelf life for news podcasts in general tends to be much shorter than for other types of content such as lifestyle. Additional data provided by Les Echos shows that the vast majority of listening happens within two days of initial publication (see right-hand chart) and these patterns are consistent with other publishers we spoke to.

Source: Les Echos

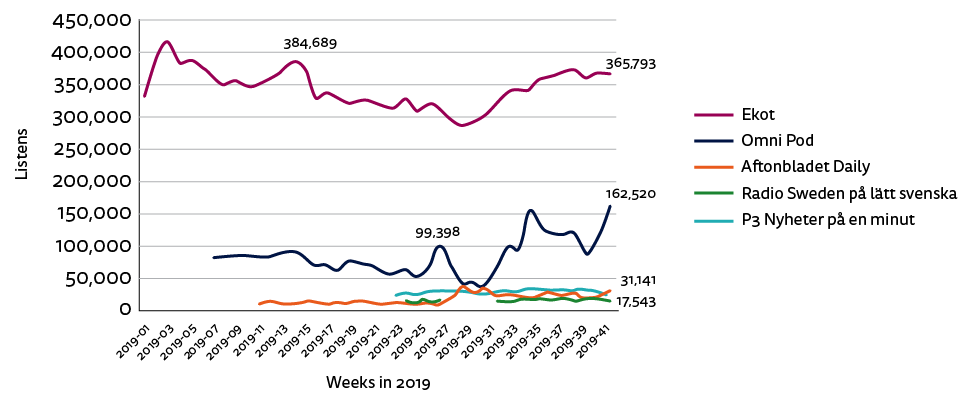

Daily Round-Ups Do Best in Sweden

In Sweden the main publishers have got together to create a publicly available Poddindex, using common measurement standards. Analysis of these data show that weekly listens to some of the top podcasts have doubled (Omni Pod) since the beginning of this year. Swedish Radio’s Ekot increased from 200,000 weekly listens two years ago but growth has been largely flat this year.

Both Ekot and Omni Pod have a news bulletin format and multiple editions each day, which may partly explain why their figures are higher than Aftonbladet Daily, which is a deep-dive podcast. The Omni Pod bulletin, which started as an experiment, aims to provide a concise briefing with a wide range of stories: ‘It’s highly educated people, mainly in big cities in Sweden and this is for them the perfect format for their morning behaviour,’ says Editor in Chief Markus Gustafsson.

Weekly listening figures for five popular Swedish daily news podcasts

Source: Poddindex Sweden (some missing or incomplete data)

Advertising is the Dominant Business Model

For most daily news podcasts that we studied, the main revenue driver is advertising or sponsorship – even for publishers like the New York Times that elsewhere deploy a subscription model. Digital advertising is broadly sold on a CPM model (cost per thousand listens in this case) and podcast CPMs are generally higher than websites and for many forms of video.12 This is partly because professional podcast content is mostly deemed to be ‘brand safe’, it is hard to skip ads, and ad density is still relatively low: ‘The user experience for audio is a good deal for everyone. You get a nice amount of audio to listen to,’ says the Guardian’s Christian Bennett. ‘The way ads work at the moment are very similar to what people are used to in traditional forms of media,’ he adds. Today in Focus is already making a positive contribution to the bottom line.

The engaged podcast audience appeals to advertisers as does the younger demographic, which they increasingly find hard to reach elsewhere online. Partly as a result, even an intensively staffed news podcast like The Intelligence from The Economist was also making money within six months.13 ‘There has been so much demand for sponsorship that it more than pays for itself,’ says Tom Standage who helped make the case for their daily news podcast, The Intelligence. ‘The big change is commercially, which is that we had advertisers who started to come to us last year and said we are only going to buy two kinds of ad next year. Print and podcast, what have you got?’

Even so there have been some challenges around news, with the most popular format, ‘host reads’, not considered to be appropriate because of concerns about trust. Sponsorship is a popular alternative, where a brand takes all advertising in the podcast for a defined period. Generic spot advertisements are becoming more widespread, however, with some publishers worried that this could undermine the premium, intimate, and carefully constructed nature of news podcasting. One approach used by many is to use neutral voices to read the ads. ‘We have two voices, male and female, we record the ads here and there is no music behind them,’ says Schwartz CEO Rebecca Costello.

New Paid Models Emerging

Some publishers are experimenting with keeping their news podcast behind the paywall as a way of delivering extra value to subscribers.

Politiken, which was one of the first major news organisations in Denmark to try a daily podcast, has been experimenting with a hybrid model where the podcast is free for two days each week, with mid-week versions kept back just for subscribers. Politiken’s approach has partly been driven by necessity given the lack of advertiser interest: ‘We are doing probably the best Danish podcast out there,’ says Digital Director Troels Behrendt Jørgensen, ‘but none of the traditional advertisers have really been interested.’

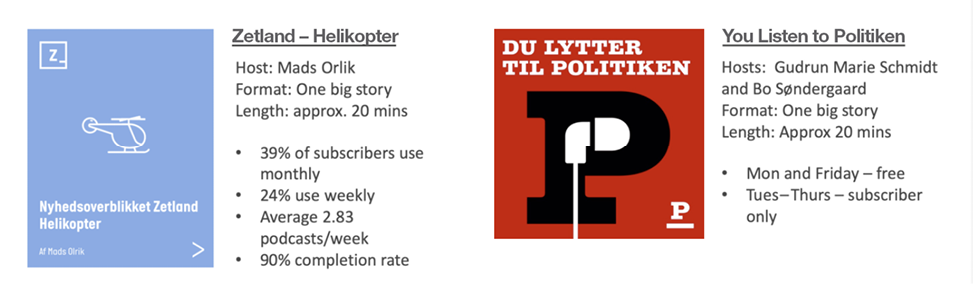

Others doubt that podcast advertising will ever work in small markets like Denmark and are also focusing on subscriber-based audio. Zetland is a small slow news operation with around 13,000 members that has refocused much of its operation around audio: ‘We are turning ourselves into a media company where people pay to listen to journalists,’ says CEO and co-founder Jacob Moll. ‘We made it very easy to find in our audio app,’ he adds. All news stories are also available in audio form and there is a daily news podcast, Helicopter, released at 4pm each day. For many subscribers it has become an invaluable part of the wider package, with four in ten (39%) accessing the podcast each month and a quarter (24%) listening every week. The average listener is extremely engaged, listening to 2.83 episodes each week. Zetland has invested in a number of other podcasts as well as live shows linked to the journalism. All articles are now read by journalists and these options are prominently displayed in the app. Zetland’s research shows that audio stories and podcasts are easier to consume for people with busy lives. This has helped reduce churn amongst members – especially time-poor young professional parents.

It may be that smaller markets or smaller publishers will follow a different trajectory when it comes to the business models for podcasting.

Daily Podcasts as a Marketing and Promotional Vehicle

For many publishers the main driver is not making short-term money but rather finding new audiences for their core subscription businesses. ‘It’s more about opening the top of our funnel and bringing Times journalism to a new audience who we think will eventually become our next generation of subscribers,’ says Erik Borenstein at the New York Times. The Times sees The Daily as a showcase for the depth of its journalism but has recently made that more explicit by including interviews with producers about the value of subscribing. At The Economist, Tom Standage agrees: ‘It’s a form of editorial that happens to be very effective marketing and also pays for itself.’

As audiences build, some publications are starting to look at these shows almost like Hollywood franchises, with merchandise and live recordings for which tickets are sold. The feed itself is also becoming extremely valuable as a way of promoting other podcasts. The New York Times recently pushed its narrative series 1619 to its 2m-strong subscribers as an effective way to build an audience quickly: ‘We’ve put every episode of that series into the daily feed on the weekend and get positive response from listeners,’ says Erik Borenstein. ‘We do it very respectfully, only occasionally, but we think it really works.’ NPR is using similar tactics with the Up First feed to supercharge some of its other podcasts.

Daily news podcasts have clearly struck a chord with listeners looking to get away from screens and get a deeper and more immersive take on the news. They are amongst the most popular of all podcasts, with listeners often accessing several episodes a week. The five-days-a-week schedule has created much more advertising inventory and a strong new revenue line for publishers, with blue chip companies now showing considerable interest in the US, the UK and Australia. Outside the English-speaking world, there seems currently to be much less competition, with just a handful of publishers in each country getting involved, but there is also much less revenue as many advertisers have yet to be convinced.

5. Wider Publisher Strategies: Case Studies

Daily news podcasts are just part of the wider opportunities that publishers see in the on-demand audio space. Different starting points and business models mean a range of approaches are in play. In this chapter we explore a number of case studies based on our interviews in the UK, the US, Australia, France, and Sweden. We have chosen a mix of broadcasters, digital-born, and former print publishers.

Publishers from a Newspaper Background

The New York Times

The New York Times has pursued a ‘fewer, bigger, better’ strategy, with a portfolio of just five podcasts – The Daily, Still Processing, The Argument, The Book Review podcast, and Popcast – along with the Modern Love podcast, which is a partnership with public radio station WBUR in Boston. ‘We don’t want to rush things. We feel very happy with how they’re going,’ says Director of Audio Erik Borenstein. He still feels there is plenty of room for growth: ‘We want to be very deliberate about what we’re creating and where we’re distributing it.’

A key focus for the Times now is to recruit more talented audio producers who can make a variety of programming types – interviews shows, weekly round-ups, and narrative series. As the Times expands audio output, keeping the quality high will be critical.

The Times is watching new developments carefully, particularly as a range of audio on-demand becomes easier to access at home and through in-car devices. ‘I do think you’ll start to see a lot of great innovation on the form – from short form to long form, audio books, spoken word articles, and live audio,’ says Borenstein. ‘All of the fun innovation that media going over the top unlocks will start to happen in audio and I think that’s very exciting.’

The Washington Post

The Washington Post has been podcasting for more than a decade, but audio has stepped up a notch with its own department and new strategies around audience building and monetisation. ‘We have some of the best reporters in the world here and we want to make sure that their reporting and their storytelling is in front of as many people as possible,’ says Head of Audio Jessica Stahl. Much of the team’s effort goes into supporting the flagship Post Reports, but the Daily 202 offers a shorter daily fix around news. Politics is covered by Can He Do That? which deploys a more conventional interview format to explore different aspects of the Trump presidency. Retropod is a popular highly designed daily history show, while the Post is also experimenting with narrative podcasts like Moonrise, and Letters from War, a documentary tracing the story of one family in the Second World War. ‘Some of our biggest, most interesting work can be in the documentary format where you can make a really big splash with one thing,’ says Stahl. But she also acknowledges that it can be hard to find and build an audience for one-off shows compared with the ongoing formats. ‘It’s an existential effort to find new listeners.’

The Times and Sunday Times

The Times has not yet launched a daily news podcast but has established a reputation for innovative hits. Walking the Dog was an interview show based on the playful idea that celebrities might open up in a different way when they were with their favourite pet. Giles Coren Has No Idea, which at one stage was the top-ranked ‘news’ podcast in the UK, explores the writer’s struggles with working out the subject matter for his print column each week. The irreverent Red Box podcast with Matt Chorley brings a lighter approach to politics: ‘That’s interesting for us because one of the things that gives us is tone,’ says Times Managing Director Chris Duncan: ‘It may not immediately occur to you that we do have quite a lot of humour. It isn’t an entirely serious and dry view of the world.’ Chorley has used the podcast as a springboard to take politics on the road in a series of live shows. Sport has also been a successful genre, with both football and rugby podcasts attracting loyal audiences. It is also an area where sponsorship and monetisation tends to be easier than hard news.

The Times has benefited from the group’s recent purchase of Wireless Group (owners of talkSPORT and Virgin Radio). This has provided access to professional studios but also new skills and insights: ‘Publishers are really good at working out how you format newspapers,’ says Duncan. ‘But in terms of thinking about a series of podcasts, about programming, and what’s the optimum length of a podcast – all of those things the audio guys really brought a lot of expertise in.’

Monetisation efforts are focused on advertising, sponsorship, and some early moves into branded content (e.g. with a show for KPMG). With significant numbers for the most popular Times podcasts and growing advertiser interest, Chris Duncan is positive about the future: ‘It feels like it will be a significant revenue line because it’s going to become a significant habit.’

Financial Times (FT)

The FT podcast strategy is focused on reaching new audiences in the United States, where the publication is less well known. The idea is to make younger and more female audiences more aware of the FT’s breadth and range, in the hope that they will eventually subscribe. The FT has culled some shows, revamped others, and is looking to professionalise the whole portfolio to stand out in the hugely competitive US market. ‘We are hiring, we’re bringing in talent, we’re bringing in producers. But the bigger picture objective is not about doing more. It’s about doing less of the right stuff better,’ says Renée Kaplan, Head of Audience and New Content Strategies.

More resources are going to the FT Daily News briefing, while News in Focus becomes biweekly, with a dedicated non-British female host. They are also working up ideas around working life and careers, areas where the FT already has considerable authority and expertise. Another possible idea is to branch out into investigations and narrative series. ‘What is the FT version of true crime?’ asks Kaplan. Beyond this the FT is also experimenting this autumn with its first podcast exclusively for existing FT subscribers: a global affairs podcast called the Rachman Review. New technology from podcast distributer Acast allows paid subscribers to be authenticated so that podcasts can be listened to on any third-party platform. Existing solutions remain clunky for users but hold out the promise that exclusive audio could become an important part of the overall bundle – a useful weapon in building loyalty and reducing churn.

Dagens Nyheter (DN)

This quality newspaper in Sweden has been experimenting with different types of audio including podcasting, but the economics remain somewhat challenging. The main interest has been to create more loyalty and more habit with existing users, to prevent churn within the subscription model: ‘Podcasts or audio book content is a great asset because you can send out push notifications when there is new content available, to remind people that they get something for their subscriptions’, says Martin Jönsson, Head of Editorial Development. DN operates four podcasts including The Weekly (a news magazine), one for popular culture, one for children, and one documentary feature. Johnson has not ruled out starting a daily news podcast – or turning The Weekly into a daily version – but recognises that the investment is significant and the rewards uncertain. ‘Sweden is a smaller market. So you need bigger numbers to make the advertising or sponsorship work.’

Digital-Born Publishers

Slate

Slate has been making podcasts for almost 15 years. It was a format that grew naturally within a web magazine culture that differentiated itself by being conversational, opinionated, and argumentative. Talk podcasts, like the Political GabFest, were pretty much invented at Slate and are now just part of a portfolio of 25 different shows. With the talk space relatively crowded, Slate has been pushing into narrative series. Slow Burn is a critically acclaimed true crime series which covered Watergate and then the impeachment of Bill Clinton. Slate also recently teamed up with The Economist for the Secret History of the Future, though as Editorial Director Gabriel Roth points out these series can be more risky: ‘The classic Slate podcast is a model where you’re taking like a few hours out of three reporters’ days once a week. A project like Secret History involves taking months and months of a reporter’s time, over much of a year to make – and so it’s just a different prospect.’

Podcasting will make around half of Slate’s entire revenue by the end of this year, up from 28% in 2018.14 The bulk of this revenue is advertising, but podcasting also contributes heavily to its Slate Plus membership programme, which boasts 60,000 members. ‘The strongest connections that we have to our audience are very often through the podcast and the strongest set of benefits through Slate Plus are associated with the podcast,’ says Gabriel Roth. Members get ad-free products and bonus episodes too, using home-grown technology, Supporting Cast, which is now being sold to other publishers.

Vox Media

Vox Media, which incorporates SB Nation, Recode, Polygon SB Nation, The Verge, and Eater, as well as Vox itself, has one of the largest, fastest-growing, and most diverse collections of quality podcasts. Podcasting was a ‘natural fit from a content perspective,’ explained Vox’s Marty Moe in a recent interview.15 ‘The question was, from a business perspective, is this something we can justify putting a lot more into?’ Having grown up as a side project for many columnists and editorial leaders, podcasts are now seen as a strategic driver of growth. The Vox Media Podcast Network has doubled the number of shows over the last year to more than 200 active shows, contributing to an eight-figure audio business overall. Popular shows include The Ezra Klein Show (Vox), Recode Media with Peter Kafka, Recode Decode, and the recently launched Pivot with Kara Swisher and Scott Galloway in the tech and business space. Today Explained, the daily news show, is a joint production with Stitcher, a relationship that also helps with distribution as it can be promoted via a second network with millions of listeners.

The number of Vox podcasts gives the company critical mass with advertisers but also allows it to use its network to create and promote new shows for companies and brands – another growth opportunity. Vox has recently brought together all of its online video, television, and audio into a single studios business, partly to reduce its exposure to a softening market for traditional internet advertising. A studios business also makes sense because Vox sees podcasts as a way of uncovering stories or formats that could then be licensed for television. The idea of digging deeper into a single topic has been adapted for a Netflix series, Explained, which has been commissioned for a second series.

Broadcasters

National Public Radio (NPR)

NPR was one of the pioneers in podcasting and a number of its best-known shows continue to dominate the Podtrac and Apple charts (Up First, Planet Money, Hidden Brain, How I Built This, etc.). As well as creating native news podcasts, NPR is working on making more of its broadcast schedule available on demand. Chris Turpin, Vice President for Editorial Innovation and Special Projects, believes that ‘many of the distinctions that initially people saw between podcasting and broadcast audio are essentially vanishing’.

NPR’s podcast-first strategy involves four pillars: (1) short news podcasts that build habit, often aimed at new devices; (2) weekly podcasts that are relatively cheap to make and tend to make money; (3) ‘news that you can use’ podcasts that lend themselves to the increasing searchable nature of audio; and (4) blue ribbon podcasts that fit the public service remit and often have multiple funding streams, such as a recent civil rights era podcast which showcased NPR’s journalism and role in American life. One recent trend has been to create more frequency in its podcasting. The Indicator is a successful NPR daily economics daily podcast, while NPR Politics will become daily during the upcoming election. NPR is also looking to reuse more of its podcast-first content back on linear radio.

NPR is projecting that podcast sponsorship revenues will surpass revenues from broadcast underwriting next year at around $55m. ‘Something like 25% of our underwriters are now blue-chip companies,’ says Turpin. ‘That’s a big sea change. And it gives you a sense of the way that podcasting is here to stay as a commercial entity.’

BBC

The BBC started its podcast service 15 years ago, but today mixes original on-demand broadcast shows with a new focus on native podcasts. It has developed its own platform, BBC Sounds, a name that symbolises the move away from radio towards a range of audio formats. The Apple podcasts directory shows 85 podcasts in the news category alone, including some in a number of different languages.

The BBC sees podcasts as a way of attracting younger and more diverse audiences that it is finding increasingly hard to reach. ‘I am thinking about how to get to audiences that aren’t serviced by linear output,’ says the BBC’s Editorial Director Kamal Ahmed, who has commissioned The Next Episode, a weekly show that is aimed at under 35s and addresses issues such as identity politics and online safety. Podcasting allows the BBC to reach niche audiences without alienating the mainstream but also to take more risks in terms of format and length. Current affairs commissions include pod-first thrillers like Rat Line and Tunnel 29, a serialised story of a man who dug a tunnel under the Berlin Wall. Both shows started life as podcasts but also became radio hits. The BBC also seeks to find new ways of delivering its public remit, with the Grenfell Tower Inquiry podcast covering every day of the harrowing testimony – a process that ran to more than 100 episodes.

One breakout hit has been Brexitcast/Electioncast, where the BBC’s top correspondents discuss events in a much more informal and light-hearted way than would normally be the case within the constraints of traditional radio. The show is rebroadcast on radio and is now shown on television, but it still manages to retain its podcast sensibility.

Because of the difficulty of building audiences for one-off podcast series, the BBC has been using its flagship Beyond Today podcast to showcase its best original reporting around big issues. TV reporter Jane Corbin recently used it is as vehicle to talk about her investigation into the murder of Saudi journalist Jamal Khashoggi. For Head of Current Affairs Jo Carr, this was a really interesting example of how podcasts can be used to ‘get really interesting blue-chip journalism out to different audiences’.

Swedish Radio (SR)

SR dominates the spoken-word landscape in Sweden and has more than 150 news podcasts alone in the Apple directory. Many of these are popular radio shows distributed in a podcast format, but there is also a pod-first commissioning strategy. Existing shows are being remade with a sharper beginning and more of a narrative structure, ‘It’s a mix between remaking the traditional titles and also making them more podcast first,’ says Head of News Olle Zachrison. The idea is increasingly to take successful podcasts about US politics and Brexit and bring that different tone and approach to radio audiences too: ‘We’re broadcasting them in the linear channel because it’s great content and they’re very contemporary.’

One of Swedish radio’s biggest podcast successes has been its P3 documentary strand, which routinely gets around 500,000 unique listeners for the on-demand version: ‘Immediately when the first minute comes on the audience in the linear channel drops because people don’t want to spoil their podcast experience,’ says Zachrison, who recognises that podcasts may cannibalise radio, but that the wider strategy is to reach listeners with quality audio content on any platform in the right format for listeners.

In terms of news content, SR has been focusing on extending its main news brand Ekot into the on-demand space with updating bulletins that can be accessed via podcast as well as voice devices such as Google Home. SR has also been testing a new native news podcast of around eight minutes that combines a brief news update with a deep-dive into one item of current affairs. Over time, SR expects to commission more episodic series such as one about the changing nature of China.

Australian Broadcasting Corporation (ABC)

ABC has around 300 podcasts in the Apple directory and 31 in the news category. While the majority are catch-up radio programmes, ABC has set up its own studios team to create and commission shows that are digital-first. ‘With those podcasts the intro is often different,’ says Head of Audio Studios Kellie Riordan. ‘We remove all that radio-speak (“welcome to the show today”, etc.) – and instead put you at the plot point. You start the show where the person has a gun to someone’s head and then you rewind back to what happened to get to this point.’ Unlike the BBC and SR, much of the ABC’s podcast content does not make it back onto the radio. ‘I would argue that I’ve probably failed in my job to create distinctive immersive earbud podcast experiences, if those shows fit neatly on the radio,’ adds Riordan. She says that a scripting and production style that is designed for younger audiences may not always work for traditional radio listeners.

Overall, ABC makes around 40 digital-first shows, including a number for younger children, families, women, and younger men. Research shows that the latter were interested in both sport and comedy so this led to a mash-up with a comedian presenting a show about football. A show aimed at women called Ladies We Need to Talk deals with health, sexuality, and relationships but is steeped in health journalism and feminist theory. There is also a life-hacking show called The Pineapple Project, which tackles issues like careers, money, and networking at work: ‘It’s about fitting in to a woman’s busy life with content that she can actually use,’ says Riordan. The studios also specialise in serialised documentaries told in an episodic way across six to eight episodes, including a popular true crime series.

Radio France (France Inter, France Culture, etc.)

Like other broadcasters, Radio France sees podcasting as a way to reach younger and more diverse audiences, but also to refresh and reinvigorate radio formats: ‘The podcast is something that allows you to take editorial risks, to experiment with different types of production,’ says Ari de Sousa, head of digital products and marketing at Radio France. But the simplicity and speed of podcast creation has raised sensitive questions in an organisation that is heavily unionised and where roles have been clearly delineated for decades. Despite this, new production agreements are being discussed, with some experiments underway. Deputy Editor Lucas Menget at the news division France Info would prefer to tread cautiously: ‘I’m in favour of doing a few shows well, rather than go in all directions. This year, if we launch four podcasts it will be the maximum.’ A regular podcast on the US elections is in the pipeline, along with a stand-back look at the mayoral battle for Paris, which has already started and will continue until March next year.

France Info has also started a partnership with Bayard Presse to help develop podcasts for younger audiences. ‘It is the joining of their know-how on youth and our know-how on audio,’ says Menget.

France Inter has also recently launched several native podcasts, including 13 Novembre l’enquête, about the terror attacks in Paris (Bataclan); Oli, stories for kids told by celebrities; and Intérieur Queer, a programme about gay culture.

Divergent Strategies and Motivations

Podcasts clearly risk cannibalising existing radio audiences and raise difficult internal questions for broadcasters. Investment in podcasting is often accompanied by cuts in radio budgets, which has caused tension at both the BBC and Radio France.16 Public broadcasters tend to take an extremely wide view of podcasting since they have a much broader brief than just news. In this respect they have more of a vested interest in defining the on-demand audio space and much more to lose.

By contrast, newspaper and digital-born players have less content and less heritage in audio, and are proving more willing to innovate in exploring both commercial and editorial possibilities.

6. Future Developments and Potential Impact for Publishers

In this final chapter we look at changing business models, the role of platforms and other intermediaries, and the implications for news publishers.

How Business Models Could Develop

Advertising

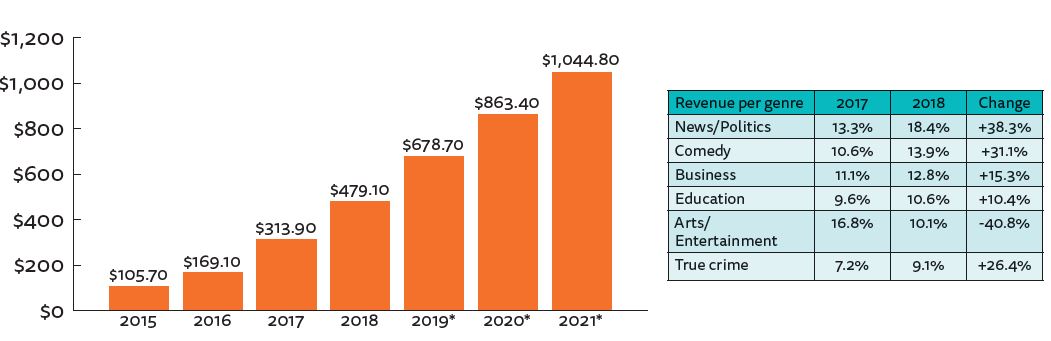

As we have already discovered, some publishers are already making good money from podcasting. In the US alone, advertisers will have spent almost $700m by the end of 2019 and the podcast market is expected to be worth more than $1bn by 2021.17 This is still some way behind radio, which is expected to earn $18bn.

Podcast advertising revenue 2015–2021 (in millions)

Total market estimate

IAB 2018 Podcast US Ad Revenue Study conducted by PwC. Estimates based on self-reported data to around 65% of total. * estimates

IAB 2018 Podcast US Ad Revenue Study conducted by PwC. Estimates based on self-reported data to around 65% of total. * estimates

News is the biggest and fastest-growing area of spend, with growth of 38% during 2018. In the UK, agencies that sell podcast advertising say there has been a real turnaround in the last 18 months due to rising consumption, the growing amount of quality content, and data which show how podcasts resonate with hard-to-reach younger demographics. Michael Williamson is Audio Video Investment Director at Manning Gottlieb, OMG, which represents more than 30 brands. He says the majority of these clients are now buying podcasts: ‘They are all seeing positive results and are talking about “can we do it again?”. It’s really nice to see a media that is definitely in growth.’

As interest grows, the big US players have been setting up operations in Europe to sell local advertising and promote their content: ‘This is the first time the Americans are looking outside of America to grow their audiences,’ says Ruth Fitzsimons, MD of Podfront, which is a London-based collaboration between Stitcher and Wondery set up to represent their big productions. For these shows, she says, around 20% of listening is now happening outside the US: ‘We’re starting to see more spend coming out of the agencies just on podcasts [in Europe] and this is where it now becomes viable.’

In Australia, too, the three biggest advertisers – the Australian Post, the Commonwealth Bank, and Telstra (telco) – have started to look at podcasts: ‘They’re all jumping in,’ says Robert Loewenthal, CEO of Whooshkaa, which hosts thousands of podcasts and helps with monetisation. ‘When they allocate their budget and strategy sessions, they are saying “how much will we allocate to podcasts this year?” A couple of years ago it was zero.’

Host reads remain the most popular – and highly priced – ad format for podcasts, but these are hard to scale and are problematic for news, a genre where the lines between editorial and advertising need to be clear and transparent. On the other hand, publishers do not want to undermine their carefully constructed intimate podcasts by accepting too many low-quality spot advertisements. New technology now allows any ad to be inserted dynamically at the point of play/download and more of this advertising is being sold programmatically.

While advertising rates are currently high and US publishers are doing well, some are concerned about these changing dynamics: ‘You know we’ve seen what digital advertising has done in every other form of media and where the value accrues to large platforms,’ says Erik Borenstein at the New York Times. Spotify and Google in particular are looking to offer advertisers an easier and more scalable way of buying podcast ads. As more content is consumed on their platforms, they can use the data they collect to deliver better ad targeting. It is a familiar story that worries publishers: ‘If they are building big advertising businesses on the back of publisher audio, I would hope that they are sharing some of that value back with the publisher,’ says Borenstein.