| Statistics | |

| Population | 38m |

| Internet penetration | 68% |

The Polish media environment is characterised by strong TV channels, embattled newspaper groups, and a number of large and successful web portals. A lively political climate created by the parliamentary election spurred people’s interest in news.

Top Brands % Weekly Usage (TV, Radio and Print)

| Weekly use | Main source | |

|---|---|---|

| RMF FM news | 44% | 15% |

| TVN news (inc. TVN 24, TVN 23 Biznes i Świat) | 43% | 22% |

| TVP news (inc. TVP Info, TVP1 and TVP2) | 37% | 12% |

| Radio Zet news | 32% | 8% |

| Polsat news | 29% | 5% |

| Gazeta Wyborcza | 25% | 5% |

| Fakt | 18% | 2% |

| Regional or local newspaper | 17% | 3% |

| Polskie Radio news | 15% | 4% |

| Super Express | 12% | 1% |

| Rzeczpospolita | 11% | 1% |

| Newsweek Polska | 11% | 1% |

| Wprost | 10% | 1% |

| Dziennik Gazeta Prawna | 9% | 1% |

| Polityka | 8% | 1% |

| Tok FM news | 8% | 2% |

Top Brands % Weekly Usage (Online)

| Weekly use | Main source | |

|---|---|---|

| Onet news | 60% | 24% |

| WP news | 52% | 17% |

| TVN news online | 51% | 16% |

| Interia news | 34% | 7% |

| Gazeta.pl | 29% | 5% |

| Wyborcza.pl | 25% | 3% |

| Fakt online | 23% | 1% |

| Polsat news online | 21% | 2% |

| Newsweek Polska online | 16% | 1% |

| Gazeta Prawna online | 14% | 1% |

| Regional or local paper website | 13% | 1% |

| Rzeczpospolita online | 12% | 1% |

| Wprost online | 12% | 0% |

| Dziennik.pl | 12% | 1% |

| TVP News Online | 11% | 1% |

| Ipla.tv | 11% | 1% |

Overview of key developments

By Vadim Makarenko

Journalist at Gazeta Wyborcza, and former Reuters Institute Journalist Fellow

Recent years have been difficult for newspapers in Poland. Despite a rise in overall advertising expenditure, newspaper revenue shrank by 11.5% with circulation continuing to fall year on year. [68. http://bi.gazeta.pl/im/2/19853/m19853372.pdf

Both in print and digital, newspapers remain key destinations for news while popular portals battle for supremacy online by developing their editorial operations and investing in original video production. In the autumn of 2015, online web portal Wirtualna Polska (WP.pl) launched a current affairs programme ‘Dzieje się na żywo’ (Happening live) with two editions running five days a week using professional hosts with a strong background in print journalism. In the last week of February 2016, the programme was delivering 4.5m streams. Soon afterwards Onet.pl, the biggest portal in Poland and WP’s key competitor, raised the bar by launching six live programmes, some of them hosted by former TV anchors.

Meanwhile WP is moving into digital terrestrial television (DTT), winning a transmission slot for an interactive TV channel called WP1 due to be launched in the second half of 2016. Wirtualna Polska (WP) also used its vast cash reserves to buy Open.fm, a radio streaming platform – as well as a group of e-commerce and travel websites.

Television remains a key source of news in Poland, with three big players, PSB TVP, Polsat, and TVN. The latter is now owned by the US-based Scripps network and runs the most successful TV news channel in Poland and Central Europe. TVN is also a key source of online news.

PSB has been in turmoil since the election in October 2015. Parliament passed an amendment to the media law that gives the Treasury Minister the power to hire and fire the management of TVP and Polskie Radio – a move criticised by both the EU and EBU. The Law and Justice Party (PiS), which won a clear majority in October elections, had argued that journalists on public service channels were biased against them. Under pressure, the broadcaster is now taking a pro-government line on many issues. In March, TVP’s flagship evening news programme Wiadomości lost 644,000 viewers (a fall of 17%). Undaunted, the new government plans further changes – replacing a licence fee with a new tax; transforming TVP and Polskie Radio into ‘national cultural institutions’ run by directors, but in reality under control of the Culture Minister; and creating a single media-buying agency to consolidate the ad budgets of state enterprises.

Poland has the highest level of ad-blocking in our survey at 38%. This could be attributed to news websites overloaded with ads, but it may also be driven by heavy usage of illegal video streaming services, which also carry extremely intrusive advertising. [69. https://variety.com/2015/digital/news/house-of-cards-season-3-pirated-with-china-top-country-for-downloaders-1201444023/

Rising ad-blockers and falling online ad rates have pushed publishers to adopt paid content strategies and new forms of advertising, such as branded and sponsored content. Both strategies have been working up to a point. Natemat.pl, which has built its revenue almost exclusively on native ads reached break-even point in 2015. At the same time the number of paid digital subscriptions for the leading quality newspaper, Gazeta Wyborcza, has reached more than 77,000 (vs 22,000 at the end of 2014).

A Polish pay-as-you-go news system called Webnalist emerged in September. Its founders call it a ‘nanopayment platform’ where reading an individual story can cost as little as 0.01 PLN (virtually 0 GBP).

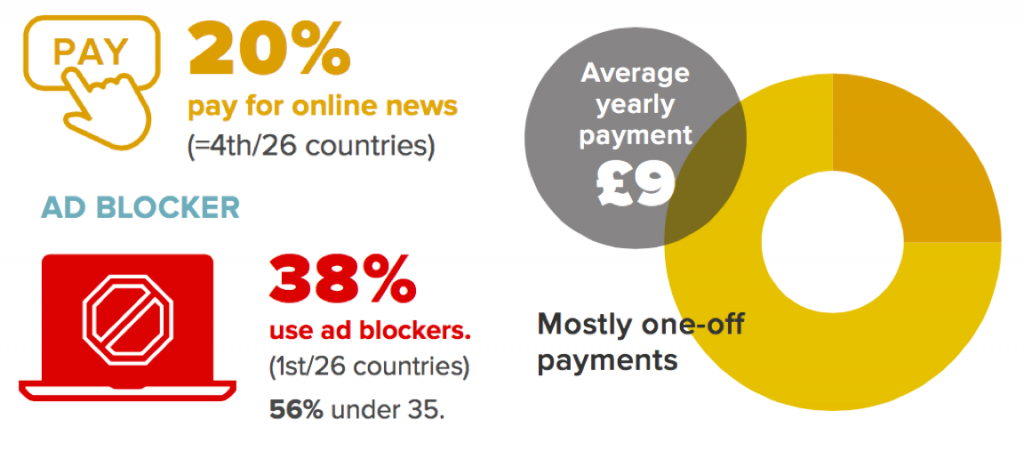

Poland scores highly in terms of paying for digital news. A growing number of streaming services in Poland – Deezer, Tidal, Spotify (music), Netflix (movies), Storytel (audiobooks), and Legimi (e-books) – may have partially normalised the idea of paying for digital content.

Paying for news

Poland has an impressive headline rate but most online payments are one-off rather than for ongoing subscriptions. The average yearly payment is amongst the lowest in our survey.

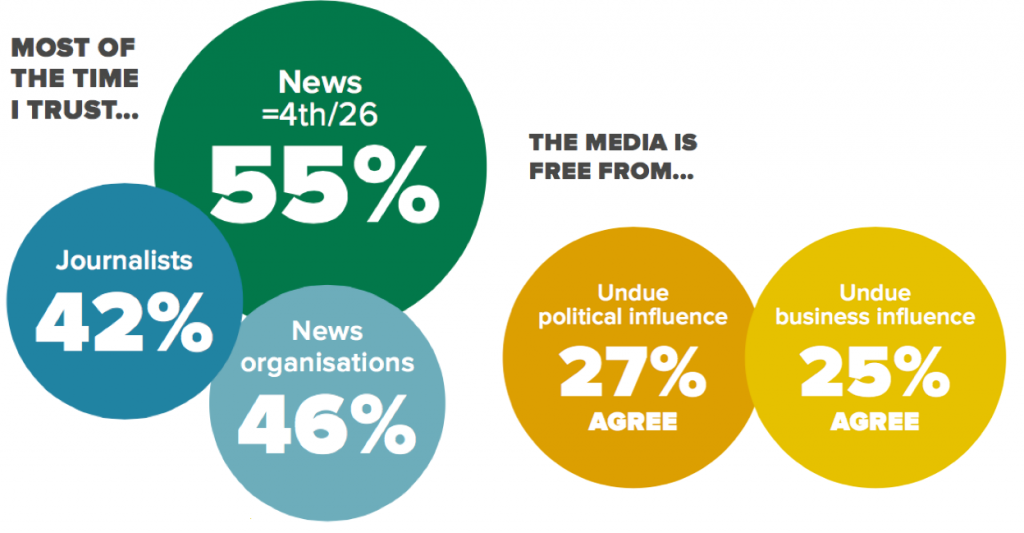

Trust

Historically, public trust in the media and journalists has been high in Poland, though it has fallen in recent years. 2015 was a year of parliamentary and presidential elections with highly politicised media coverage – and this has become even more partisan since.

Scroll data area to see more

TOP SOCIAL NETWORKS*

| RANK | NETWORK | ALL | U35s |

|---|---|---|---|

| 1 | 50% | 54% | |

| 2 | YouTube | 31% | 35% |

| 3 | Google+ | 9% | 4% |

| 4 | 9% | 6% | |

| 5 | Nk.pl | 3% | 1% |