In this report, we examine how private sector legacy news organisations across six European countries use social media for news distribution.

We analyse, in particular, how strategies vary across different news organisations and across different social media platforms, with a section focusing on how publishers have responded to the January 2018 changes to Facebook’s algorithm which deprioritised posts from pages (including news publishers) in favour of interactions with friends.

The analysis is based on 21 interviews conducted between April and May 2018 with senior editors and managers at a strategic sample of 12 newspapers and commercial broadcasters across Finland, France, Germany, Italy, Poland, and the UK and an examination of social media data on their performance across Facebook, Twitter, and Instagram.

Our key findings are:

- All the news organisations in our sample are making major investments in social media and report receiving significant amounts of traffic, off-site reach, and/or additional digital subscribers (especially through Facebook) that they see as underpinning their editorial ambitions and commercial objectives.

- We identify three main strategic aims shaping the different ways in which our case organisations approach social media: (1) driving on-site traffic through referrals, (2) driving off-site reach through native formats and distributed content, and (3) driving digital subscription sales (often in part through advertising content on Facebook). The main focus of each organisation is largely aligned with its business model, with advertising-oriented organisations pursuing traffic and subscription-based organisations pursuing sales.

- Even though all our case organisations are frustrated by what they see as very limited opportunities for effectively monetising their content directly on Facebook itself, and many have experienced a significant drop in the overall number of interactions since the January 2018 algorithm change, they still see the indirect benefits in terms of traffic, off-site reach, and/or subscription sales as an important part of their overall digital strategy.

- All our case organisations report that Facebook continues to account for the largest share of their social media traffic, delivers higher levels of audience engagement (the number of interactions relative to the number of followers is on average more than ten times higher on Facebook than on Twitter), and is considered more cost-effective at driving digital subscription sales. Many subscription-based organisations also sponsor a significant number of Facebook posts as part of their strategy to drive sales.

- Conscious of the ‘platform risk’ associated with relying on one main social media platform, all our case organisations are keen to diversify their social media distribution, working with platforms like Twitter and Instagram (as well as in some cases others that we do not cover here). But, with some variation, Facebook remains by far the most important part of their social media strategy and absorbs the clear majority of the resources allocated for social media distribution.

- Twitter, in contrast, is valued in particular as a way of generating off-site reach and visibility through breaking news, especially among elites including politicians, journalists, and news lovers. In most cases, its contribution to traffic, audience engagement, and digital revenues is seen as limited.

- Instagram (owned by Facebook) is seen as a fast-growing platform with significant potential to deliver high audience engagement and promote news brands, especially to younger audiences. Most organisations are in early and experimental stages of their use of Instagram and report limited direct and indirect returns on their investments at this stage.

- Across Facebook, Twitter, and Instagram, our case organisations have found very few effective ways of monetising content distributed directly through social media, and instead focus on indirect forms of monetisation by converting on-site traffic through advertising and by selling subscriptions. The absence of effective monetisation helps explain why most of them only engage with various native and off-site formats for articles, videos, and the like to a limited extent. While several case organisations are aiming at driving off-site reach to increase their visibility and promote their brand, none of them feel that the kind of distributed content strategy associated with digital-born organisations like AJ+, BuzzFeed, and NowThis News represents a sustainable business proposition for them.

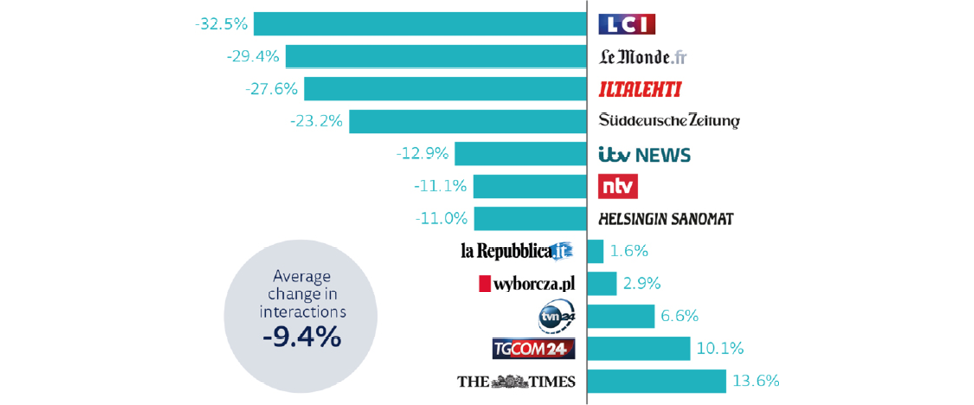

- The impact of Facebook’s January 2018 algorithm change varies from organisation to organisation, but is in most cases very far from the apocalyptic scenarios drawn up by some commentators. On average, the number of interactions dropped by 9% in the wake of the change. Le Monde and LCI saw interactions drop by almost a third, but, for example, and The Times saw interactions grow. There is no clear pattern or single approach that explains this variation (and many external factors we cannot control for), but broadly those organisations that increased their activity on Facebook have seen a smaller decline in interactions than others, and in some cases growth.

- Overall, our analysis demonstrates that, despite frequent frustrations, considerable uncertainty, and concerns over long-term platform risk, private sector legacy news organisations continue to invest in social media distribution, especially on Facebook, because they see the platform as generating a short-term return on their investment and as offering a way of pursuing their editorial ambitions and commercial objectives. After more than ten years of working with social media, publishers continue to balance the risks and rewards of working with often very large platform companies that offer real opportunities even as they also compete with news organisations for attention and advertising.

Introduction

The move towards a more digital, mobile, and social media environment presents news organisations with challenges and pressure to keep up with audiences’ changing media use. People increasingly use search engines, social media, and other platform products and services as their primary means of finding and accessing news online (Newman et al. 2018). This move to distributed discovery (where news is found via third-party platforms but accessed on publishers’ own sites) and distributed content (where news is both found and accessed on third-party platforms) presents news media with new opportunities and challenges as publishers increasingly compete with platforms for attention and advertising, even as they also rely on them for reaching audiences online (Bell et al. 2017; Nielsen and Ganter 2018).

In this report, we analyse how a strategic sample of 12 private sector legacy media organisations (newspapers and commercial broadcasters) in six European countries use social media for news distribution. We focus, first, on their social media strategies. We show how the aims pursued differ across different news organisations and across different platforms, and how monetising news directly on social media remains a challenge for media organisations (even as indirect benefits, including referral traffic, off-site reach, and digital subscription sales, are valued). We pay particular attention to how our case organisations work on Facebook, because all our interviews suggest that – despite frequent frustrations, considerable uncertainty, and concerns over long-term platform risk, especially in light of recent changes to the company’s algorithms and priorities – it is still seen as the most important social media platform for publishers and continues to account for a clear majority of the resources invested in social media. Second, we focus on the January 2018 changes to Facebook’s algorithm – changes that the company announced were intended to prioritise ‘meaningful social interactions’ with friends over content posted by pages, including news publishers1 – how different publishers responded, and how they fared in the wake of change that deprioritised news on Facebook. We show how most of our case organisations saw a significant drop in interactions (on average 9%) but also how some saw an increase.

We find that all the news organisations in our sample are making major investments in social media and report receiving significant amounts of traffic, off-site reach, and/or additional digital subscribers that they see as underpinning their editorial ambitions and commercial objectives. How they approach social media differs in significant ways, with different primary aims largely aligned with their primary business model. We identify three main strategic aims, namely (1) driving on-site traffic through referrals, (2) driving off-site reach through native formats and distributed content, and (3) driving digital subscription sales (often in part through advertising of content on Facebook). Advertising-based organisations are primarily oriented towards traffic and sometimes off-site reach, subscription-based organisations towards sales. While there are many commonalities across the organisations covered, attributable in part to the development and imitation of shared forms of what are seen as ‘best practices’ (as we also found when analysing public service media, see Sehl et al. 2018) and forms of ‘algorithmic isomorphism’, where certain practices are rewarded by automated ranking systems (Caplan and boyd 2018), it is also clear that private sector legacy news organisations’ approaches to social media are strongly shaped by path-dependent business models oriented towards advertising, subscriptions, or some mix.

Across the different strategic aims, business models, and practical approaches identified, all our case organisations focus primarily on Facebook, and continue to experience their relation with the platform as one characterised by asymmetry, inability to effectively monetise off-site reach, uncertainty (as sudden and sometimes inexplicable changes can transform performance overnight), and concerns over long-term platform risk. This means that even publishers with very clear strategic aims for their social media activities constantly have to adapt and experiment to achieve them, and most publishers try to hedge against platform risk and ongoing changes in how these platforms operate (see Nieborg and Poell 2018). Our case organisations do this by continuing to focus on their own websites and apps, by working with alternative means of distributed discovery including search optimisation, aggregators, email newsletters, and mobile notifications, as well as through investments in alternative social media platforms – even if the direct returns on the latter are often much less immediate and tangible than the traffic and subscription sales that most generate from Facebook. None of them see a sustainable business model from the kind of off-site strategy associated with digital-born news media like AJ+, BuzzFeed, and NowThis News.

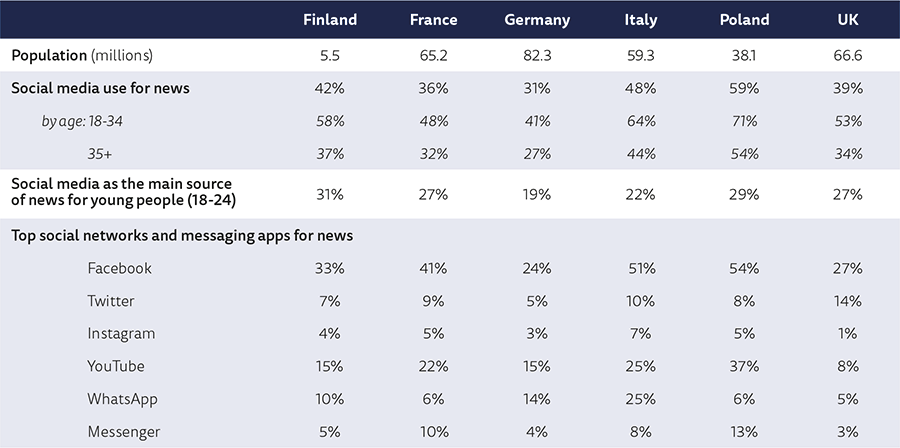

The countries we cover here are Finland, France, Germany, Italy, Poland, and the United Kingdom. They represent a range of European media systems that differ in many respects (Brüggemann et al. 2014; Hallin and Mancini 2004), including how social media platforms are used to distribute and consume news. Table 1 shows a number of key indicators in terms of social media use in each country to provide some context for the analysis.

Table 1: Social media use for news: six-country overview

Sources: Newman et al. (2018) and additional analysis on the basis of data from digitalnewsreport.org for news and social media use in 2018. Social media use for news: proportion that used social media in the last week. Social media as the main source of news for young people: proportion of those aged 18–24 who used social media as the main source of news in the last week. Top social networks and messaging apps: proportion that used each for news in the last week. Internet World Stats (2018) for population per country in Dec. 2017.

We focus on a sample of 12 news organisations across six countries. In each country, we selected one newspaper and one commercial TV broadcaster from those with the widest offline reach.2 (In Finland, where it was not possible to include a commercial broadcaster, we included two national newspapers.) Table 2 shows the list of the organisations covered.

Table 2: Media organisations covered in this study

This study is based on two methods. First, analysis of 21 interviews conducted between April and May 2018 with senior editors and managers at 12 different newspapers and commercial broadcasters in the six European countries covered; 13 interviews were conducted in person and eight via Skype or telephone. A complete list of interviewees is given at the end of this report. Second, we have analysed data on the publication strategies adopted by the same organisations and their performance on social media platforms3 collected using CrowdTangle, a monitoring tool that provides information on the number and type of posts published on Facebook, Twitter, and Instagram, as well as on the number of interactions generated by specific accounts on these platforms. (Many of the organisations covered here also use YouTube, Snapchat, and other platforms, but the three covered here are generally seen as the most important social media platforms for news at present.) Data were then checked with the senior editors and managers during the interviews. The report follows a previous study on how public service media in these six countries use social media platforms (Sehl et al. 2018).

1. Strategies for Social Media Distribution

In this chapter, we illustrate the strategies adopted by private sector legacy media organisations to distribute news on social media platforms.

1.1 Different Aims and Business Models

A general goal pursued by most social media strategies is to make contact with new audiences that news organisations have difficulty reaching through their own channels. Veera Siivonen, marketing director at Helsingin Sanomat, for example, explains that the Finnish newspaper uses social media platforms ‘to attract younger subscribers because, like many other traditional news brands, [we had] an ageing subscriber base.’4

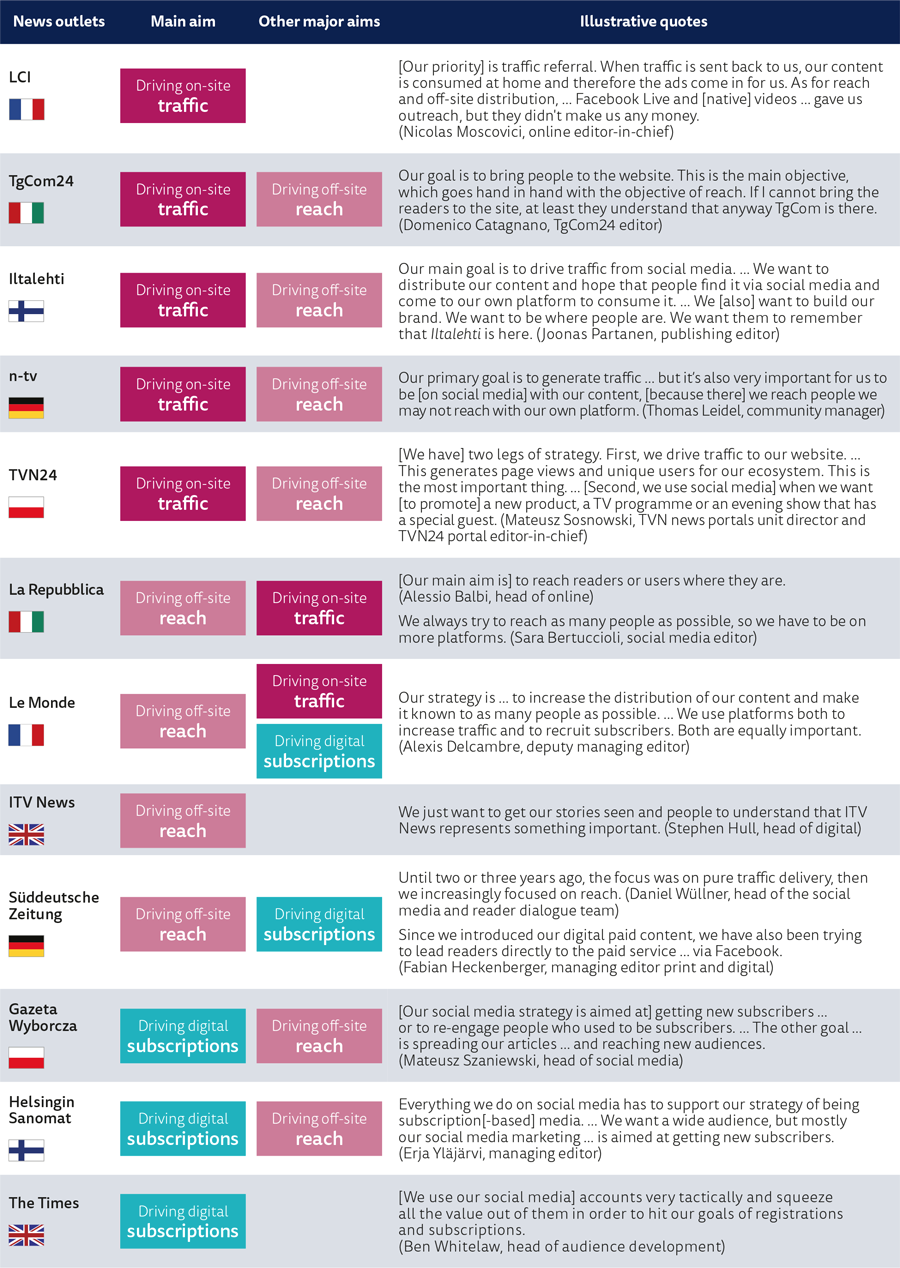

However, what news outlets hope to do with the new audiences they reach through platforms varies across different organisations and affects the way they approach social media distribution. Table 3 shows three specific aims pursued with social media strategies, as they result from our analysis of how editors and managers have emphasised them during the interviews.

First, many news organisations use social media primarily to drive on-site traffic. The presence of these organisations on social media is ‘instrumental’ in bringing users to their destination websites, as Stefano Ventura, director of news products RTI business digital at Mediaset, the group owning TgCom24, put it.5 The share of web traffic that comes from social media and other forms of distributed discovery varies significantly by site. At the Italian newspaper La Repubblica, for example, approximately 15% of the website’s traffic now arrives from social media platforms, 20–25% from search engines, and the remaining 60% or more is direct traffic or internal circulation.6 At the French newspaper Le Monde, Facebook accounts for just under 10% of total traffic, Twitter a fraction of that.7 These numbers are broadly in line with those reported by the analytics company Parse.ly, which in early August 2018 reported that, across its network of 2,500+ sites, 56% of traffic came from direct or internal referrals, 23% from search, and 13% from social.8 In the previous 12 months, Google accounted for 49% of external referrals and Facebook for 25%.9

Secondly, other organisations prioritise driving off-site reach, and consider the circulation and visibility of their news and brands among social media users as more important than bringing these users back to their destination websites. This approach is particularly evident in the case of ITV News. Stephen Hull, head of digital at the British broadcaster, explains:

Driving back [readers] to the website in many ways is seen as a mark of success, … but I think we’ve all kind of revised that view. … So, I would take a website view as much as a Facebook view. … [In this perspective,] you recognise that [with] native publishing you are going to lose impact on your website. As a business, we understand that.10

Table 3: Specific aims for news distribution on social media

Source: Our analysis of how the interviewees have emphasised the main aims their organisations pursue with social media distribution. Cases are grouped by their main aim.

Thirdly, other organisations adopt strategies principally focused on driving digital subscriptions. In these cases, social media are used to promote paid content, favour users’ registrations, and try to turn social media users into a loyal audience available to pay for the brand’s news.

In most cases, news organisations’ strategies are aimed at pursuing different combinations of these three aims.

The strategic aims for social media distribution primarily reflect news organisations’ different business models. Whereas researchers have mostly focused on how social media news distribution practices represent a mix of traditional journalistic news values, user preferences, and Facebook’s technical standards (e.g. Lischka 2018), we show that differences in business models are central in how news media approach social media and that most organisations continually try to adapt and experiment to identify social media practices that underpin their editorial and commercial strategy (Kalogeropoulos and Nielsen 2017).

Figure 1 shows this relation between aims, located at the angles of the triangle, and business models, represented by coloured labels. The news outlets which use social media primarily to drive on-site traffic are located on the left side of the triangle, those focusing more on driving digital subscriptions are on the right side, and those focusing more on off-site reach are towards the top. News organisations such as LCI, The Times, and ITV News, which have very clear strategies focused solely on one key aim, are located closer to the respective angles, whereas organisations that combine different aims are located in intermediate positions.

The relation between business models and strategies is evident. All free access, advertising-based media are located on the left side of the triangle, as they focus primarily on using social media to attract traffic to be monetised with digital advertising on their destination websites. The Times, on the right side of the triangle, has a subscription-based model with a paywall which allows only registered users and subscribers to read the vast majority of its digital news. Its social media strategy is almost exclusively focused on driving digital subscription, as is its business model. News outlets adopting mixed models prioritise either reach or subscriptions, and combine these with the aim of driving traffic in different ways, depending on the different forms of pay models they adopt and the relative importance of advertising and subscription revenues within their business models. La Repubblica, for example, adopts a mixed model like Helsingin Sanomat and Gazeta Wyborcza, but it clearly emphasises more traffic and digital advertising, whereas the Finnish and the Polish newspapers focus much more on using social media to boost digital subscriptions.

Figure 1: Business models and specific aims for news distribution on social media

Source: Our analysis of the interviews. The specific aims located on the angles are those illustrated in Table 3. The position of the case organisations reflects how these three aims are prioritised and combined (positions within the grouped cases do not reflect any particular order). The coloured labels used for brand names represent their business models adopted for digital news, based on our analysis of the interviews and additional analysis of the news websites of the selected organisations (accessed in July 2018). Free access, advertising-based media: free access to all or the vast majority of the digital news included in the homepage; business models mainly based on ad revenues. Paywalled, subscription-based media: the vast majority of the news on the news website’s homepage is available only for subscribers/registered users; business models mainly based on digital subscription revenue (though advertising continues to play a role). Mixed models (advertising- and subscription-based): mix of free access to online news and content available only for subscribers/registered users (this includes both freemium and metered models); business models based on different combinations of ad and subscription revenues. Special model (no direct monetisation for digital news): free access to all the digital news and no commercial ads in the homepage.

Finally, ITV News is a special case in our sample. It is the only news outlet focusing solely on reach and, as we will see in Chapter 1.3, its daily operations on social media are consistent with this approach. It is important to note that ITV News adopts a special business model for its digital news, as it does not host commercial ads on its news website (see also Cornia et al. 2016). As explained by Stephen Hull:

We are a very good part of the ITV business. We are about reputation and trust, which means we do not have to hit [a number] of page views to fulfil an ad campaign.11

1.2 Differences between Platforms and the Centrality of Facebook

In order to reach new audiences, news organisations are present on different social media platforms. Covering as many social media platforms as possible would be ideal, but news organisations have to focus their efforts to ensure a reasonable editorial and commercial return on their investments. In mid-2018, the social networks most commonly used by our sampled organisations are Facebook, Twitter, and Instagram. These three platforms are used by all the news organisations in our sample; other social media and messaging apps such as YouTube, LinkedIn, Snapchat, WhatsApp, Google+, and Facebook Messenger are also used by some news outlets, but their use is unevenly spread across the sampled organisations and, in some cases, news outlets’ accounts on these platforms are not regularly updated.

Table 4 shows how publishers pursue different aims on Facebook, Twitter, and Instagram and what they consider the distinctive features of each.

Although several interviewees point out how Facebook’s algorithmic changes sometimes challenge their strategies, this popular platform is still considered the most important social media site. It is valued for driving traffic to the news organisations’ websites, enabling access to large audiences, and favouring high levels of engagement around the content produced by news organisations.

Twitter is considered to be a platform for publishing breaking news and participating in elite discussions. For most organisations, it seems to be more about maintaining visibility among politicians, journalists, and news junkies, rather than having a clear commercial purpose. Indeed, although some organisations have large follower bases on Twitter, referral traffic is generally very limited.

Finally, Instagram is generally seen as a platform that is growing very fast, favours audience engagement, and enables news organisations to improve their image, promote their brands, and reach younger audiences. Like Twitter, it is not considered an effective traffic-driver. Unlike Twitter, it is seen to be more about soft news, entertainment, and celebrity journalism, rather than a platform for quick and frequent news updates.12

Table 4: Platforms’ specificities and different aims pursued on Facebook, Twitter, and Instagram

Source: Our analysis of the interviews. The table presents a selection of interviewees’ quotes exemplifying the specificities and the different aims pursued by our sample of news organisations on Facebook, Twitter, and Instagram.

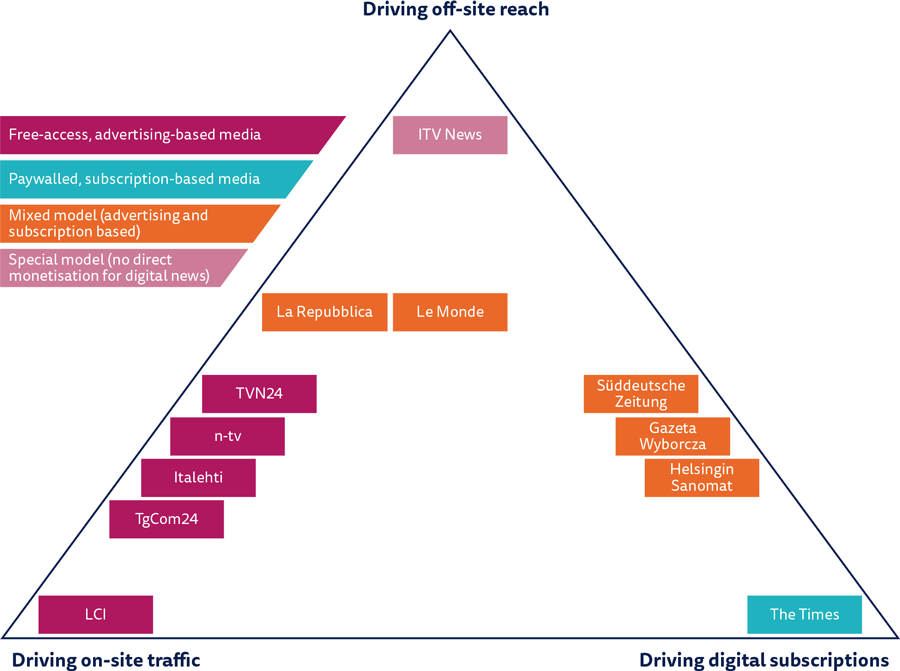

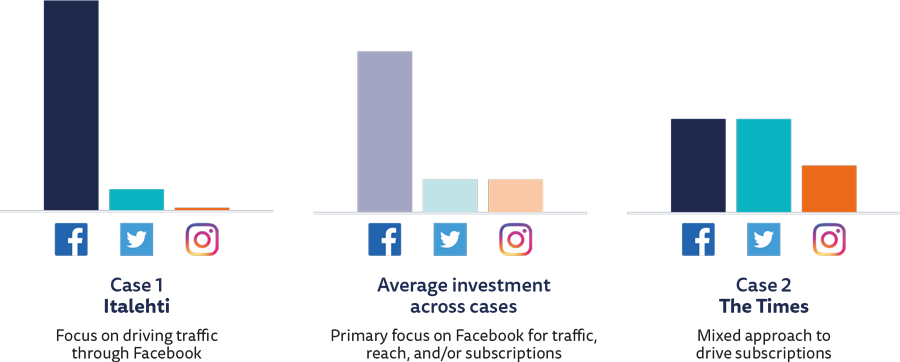

Facebook’s centrality for these organisations is confirmed by the proportion of resources (i.e. amount of money, number of people, and workload) invested in the different platforms, which is shown in Figure 2. Most social media editors’ workload is currently devoted to Facebook, which absorbs the vast majority of the resources allocated for social media distribution by our news organisations. A more limited share of these resources is split between Twitter and Instagram. Twitter’s resource demands are relatively light because most news organisations rely heavily on automatic posting for their accounts, as well as journalists posting on their personal accounts.

Figure 2: Different approaches to investing in social media distribution

Source: Our analysis of approximate figures on resources for social media distribution collected during the interviews. Interviewees at all the organisations except one have provided estimates of the proportion of resources (i.e. money, people, and shares of working time) invested in the different platforms in the last year. It is important to note that the average has been calculated on the basis of rough estimates in order to provide a general indicator of industry trends, rather than precise figures on investment breakdowns. For this reason, precise figures are not included here. It was not possible to include special operations like Le Monde’s Snapchat team in the analysis.

Figure 2 only offers a general picture of the resources allocated across the organisations studied but there are some clear outliers. Iltalehti currently invests roughly 90% of its social media resources on Facebook, with 9% on Instagram, and the remaining 1% divided between Twitter, YouTube, and Snapchat, according to Joonas Partanen, publishing editor at the Finnish tabloid.13 On the other hand, The Times invests roughly equal proportions on Facebook and Twitter (40% for each), and the remaining 20% on Instagram, says Ben Whitelaw, head of audience development at the British newspaper.14

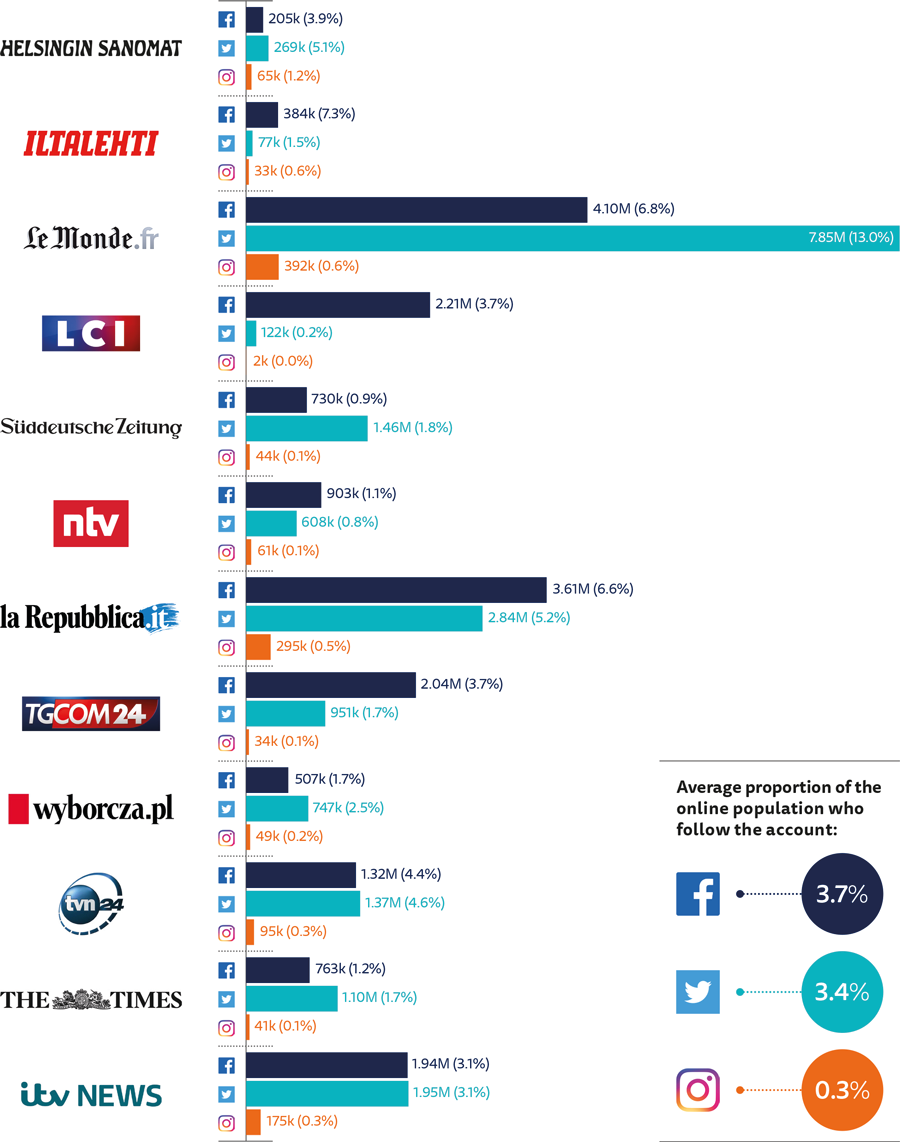

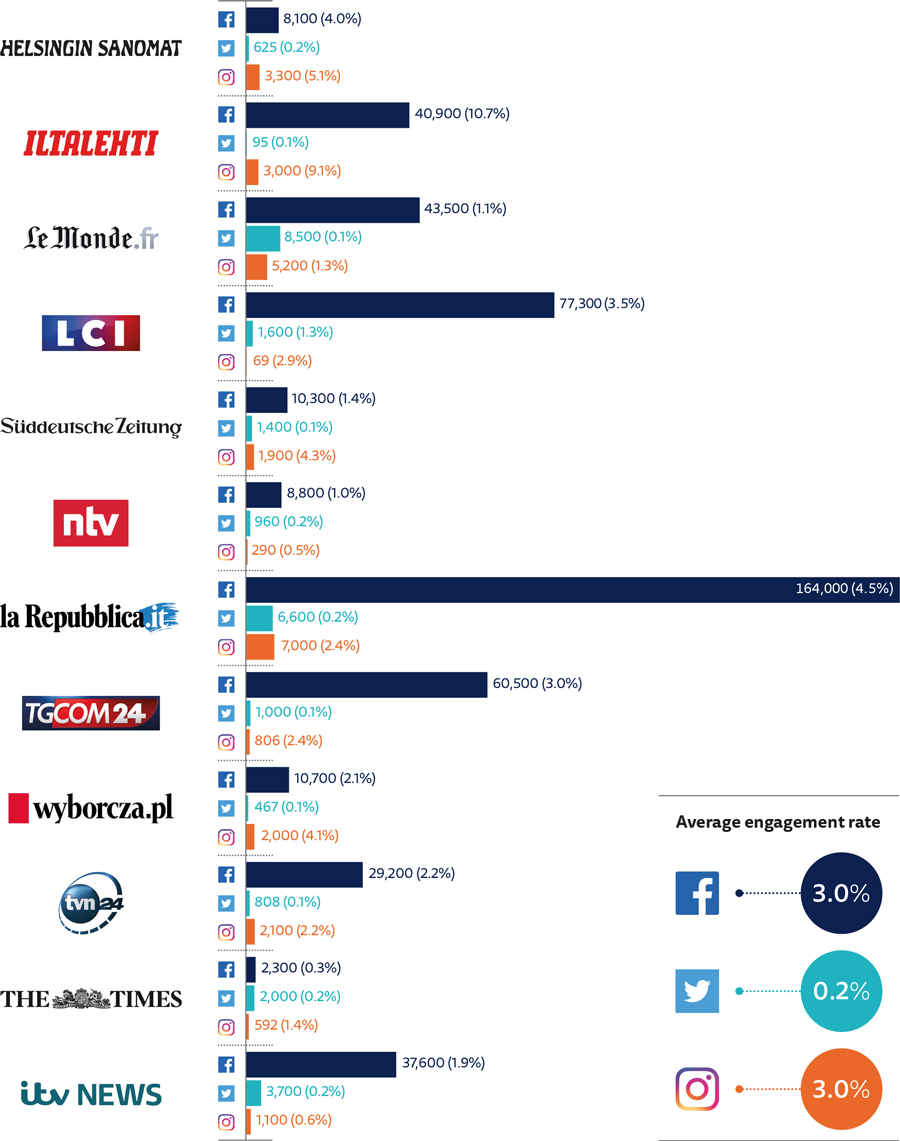

We now consider two quantitative indicators of news organisations’ social media operations: the number of followers they reach and the quantity of interactions generated by their news stories. The number of followers is an indicator of news outlets’ potential audience on the different platforms, while interactions – such as comments, shares, likes, and retweets – are generally considered a key metric to assess how these audiences engage with their content. The latter is seen as a key indicator, as on platforms like Facebook the algorithm favours the visibility of content that generates what the company defines as ‘meaningful interactions’ between users.

Figure 3 shows the number of followers that the media organisations’ main news accounts have on Facebook, Twitter, and Instagram. To facilitate direct comparison between very different countries, we also express the number of followers relative to the number of internet users in each country. On average, our case organisations have 3.7 Facebook followers for every 100 internet users in their country, and 3.4 Twitter followers.15 (Expressed as percentages as in Figure 3, this enables comparison, although two limitations should be noted. First, some followers will be international, meaning that the domestic reach will be lower than suggested by the percentage. Second, follower counts will also include at least some unauthentic accounts, further inflating the figures somewhat. Publishers are well aware of this limitation. Mateusz Szaniewski, head of social media at Gazeta Wyborcza, for example, explains that Twitter is less important in terms of traffic and audience engagement for the Polish newspaper ‘because it is really chaotic’ and there are many ‘fake accounts and … trolls.’16)

Figure 3 also shows differences between organisations in how their follower base is divided between Facebook and Twitter. News organisations which mainly use social media to drive traffic to their websites (see Table 3 in Chapter 1.1) tend to have a larger follower base on Facebook than on Twitter (see Figure 3). This is particularly evident in the cases of Iltalehti, LCI, and TgCom24. TVN24 is the only case of an organisation prioritising traffic referrals with a slightly larger follower base on Twitter. In contrast, all news organisations that use social media primarily to drive digital subscriptions have a more limited follower base on Facebook and more followers on Twitter (see Table 3 and Figure 3). Ben Whitelaw, head of audience development at The Times, explains how their business model, which is strongly focused on digital subscriptions, means they are more interested in loyalty than simple numbers:

[Media people at conferences often say:] ‘We have reached five million Facebook fans’, and I say: ‘Who cares? That is not going to sustain the business.’ … Because we have had a very clear business model since 2010, we’ve been able to say: ‘This is what social media is for.’ We don’t care how many people are following us or subscribing to us on these channels. It’s about having a core, loyal audience and building up people who want our journalism in their feeds.17

Finally, Figure 3 shows that, compared to Facebook and Twitter, news organisations’ follower base is still limited on Instagram, where they reach on average just 0.3% of the online population. However, it is important to note that many news organisations have only recently started to invest in Instagram, so there is rapid growth,18 albeit from a low base.

Figure 3: Followers on Facebook, Twitter, and Instagram

(number of followers relative to number of internet users in each country in parenthesis)

Sources: Followers: CrowdTangle for no. of Facebook page likes and Twitter and Instagram followers on 31 Mar. 2018, rounded up. Proportion of the online population who follow the account: no. of followers in proportion to the no. of internet users in the national context (CrowdTangle for followers on 31 Mar. 2018; it was not possible to isolate the domestic followers therefore, the figure might include people who follow the brands from other countries. Internet World Stats (2018) for number of internet users in the six countries in Dec. 2017). Average proportion of the online population who follow the account on each platform calculated from the 12 news organisations’ accounts.

Figure 4 shows the number of interactions generated by the content posted by the 12 news organisations on Facebook, Twitter, and Instagram. It shows how all our case organisations have far higher levels of interactions relative to their number of followers on Facebook than on Twitter. The average engagement rate on Facebook is 3.0% (meaning that a news organisation’s follower base of 100 users produces three actions a day such as commenting, sharing, or liking), whereas the average engagement rate on Twitter is only 0.2%. This is also evident from the absolute number of interactions. If we take Le Monde, for example, it has almost double the number of followers on Twitter compared to Facebook (see Figure 3), but they generate less than a fifth of the interactions on Facebook (see Figure 4). The higher level of engagement on Facebook suggests that these users are much more active, and might help explain why this platform is judged to be much more effective in driving traffic to the news organisations’ websites. As Alexis Delcambre, deputy managing editor of Le Monde, puts it:

In terms of number of followers, reach, and impact, [Twitter is particularly important for us]. … [However, in terms of traffic,] Facebook is superior. … Facebook brings just under 10% of [our] traffic; Twitter is much less.19

Mateusz Szaniewski, head of social media at Gazeta Wyborcza, says that approximately 95% of their social media traffic comes from Facebook, with only 2% from Twitter, and the rest from other platforms.20

Secondly, Figure 4 demonstrates the high level of engagement on Instagram (3.0%). In the cases of La Repubblica, Gazeta Wyborcza, and TVN24, for example, significantly fewer Instagram followers generate more interactions than their Twitter followers (see Figures 3 and 4).

Figure 4: Users’ interactions and engagement on Facebook, Twitter, and Instagram

(Average daily interactions; engagement rate in parenthesis)

Source: CrowdTangle for average daily interactions on each platform, six months from 1 Oct. 2017 to 31 Mar. 2018, rounded up. Engagement rate: daily interactions in proportion to the follower base (average daily interactions 1 Oct. 2017–31 Mar. 2018/total no. of followers on 31 Mar. 2018). Average engagement rate per platform calculated from the 12 news organisations’ accounts. Interactions are users’ actions such as comments, shares, likes, and retweets.

In summary, our quantitative and qualitative analyses both demonstrate the central role of Facebook in social media strategies, and these 12 companies devote most resources to it. Conversely, Twitter is mostly seen as being of secondary importance, especially from a commercial point of view. It is considered a good platform for breaking news and elite discussion, but its contribution to traffic referral and audience engagement is limited. One interviewee explained, off-the-record, that their organisation is present on Twitter just because they are ‘expected to be there, but [they] have almost no strategy around it.’21

Approaches to Instagram are rather experimental. Our interviewees reported increasing interest in Instagram, but many saw it as unsuitable for hard news, and not good for traffic referral, since normal posts there cannot include links.22 Moreover, news organisations have only recently started to focus on Instagram, and their strategies for this platform are generally not yet fully developed. As explained by Alexis Delcambre, deputy managing editor at Le Monde:

We do not have a clear strategy for Instagram yet. So far, we have created a community and tried to understand what appeals to that community. I think we will define a more precise strategy in the coming months.23

Since Facebook plays such a major strategic role, in the following pages we look in more depth at how news organisations approach this platform and the particular challenges it presents.

1.3 Strategies for Facebook

Facebook is the single most important source of social media referrals and off-site reach, and thus an important priority for all the news organisations we cover here. The platform offers significant opportunities. But it can also be difficult to work with, because its products and priorities change over time (sometimes suddenly and drastically), and because communication is not always easy and rarely transparent. One executive says, ‘no one in Facebook really tells you about the algorithm. I think they don’t tell about it because it might change all the time so they don’t even know.’24 To be able to assess their success and adapt their approach, most of our cases try to experiment systematically. ‘We try things, it’s very empirical’, says one editor, ‘we ask Facebook questions, but we don’t always get answers. So, we try to understand for ourselves by doing tests.’25

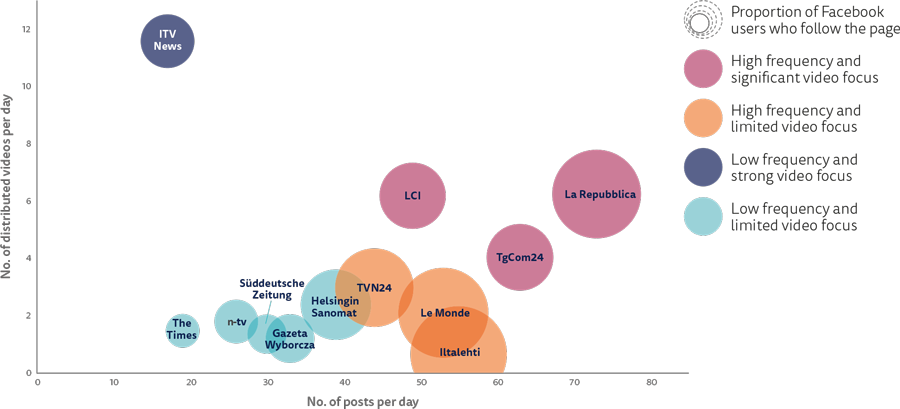

Figure 5 illustrates how news organisations adopt different strategies for news distribution on Facebook. It is based on three main dimensions: the news outlets’ frequency of publication, their reliance on distributed videos (i.e. Facebook native videos and Facebook Live,26 two off-site distribution tools that have been strongly promoted by Facebook in recent years through partnerships and algorithm ranking benefits), and the proportion of Facebook users who follow their pages.

Figure 5: News organisations’ publishing strategies for Facebook

Sources: X-axis: CrowdTangle for average no. of posts per day, six months from 1 Oct. 2017 to 31 Mar. 2018. Y-axis: CrowdTangle for average no. of distributed videos (i.e. Facebook Live and Facebook native videos) per day (same period of time). Size of the bubbles: no. of page likes in proportion to the no. of Facebook users in the national context – the larger the bubble, the higher the proportion of users who follow the pages (CrowdTangle for page likes on 31 Mar. 2018 and Internet World Stats (2018) for no. of Facebook users per country in Dec. 2017). Individual cases are marked as low frequency and limited video focus when they are below the average of all cases.

Figure 5 shows, first, that those news organisations who primarily aim to drive traffic to their websites generally publish more frequently and have a larger follower base on Facebook. These organisations differ in how much they rely on distributed videos. As shown in Figure 5, news organisations shown in pink publish a higher number of Facebook Live and native videos, whereas news organisations shown in orange rely less on these tools. Differences in how news organisations approach off-site distribution are illustrated in the following pages.

Secondly, Figure 5 shows that news organisations which focus more on using social media to drive digital subscriptions (see Table 3) publish fewer posts per day and fewer distributed videos, and tend to have a more limited follower base. These organisations are shown in blue in Figure 5. N-tv is the only case of an organisation focusing on traffic referral which adopts a strategy based on low frequency of publication and a limited use of distributed videos. Finally, ITV News adopts a distinctive strategy, which is based on a limited frequency of publication and a particularly strong focus on distributed videos. This is not simply because ITV News has more video available: the other broadcasters studied here rely much less on distributed videos. It is rather due to its different business approach. As already described in Chapter 1.1, ITV News does not monetise its digital news with advertising, and therefore prioritises reach over traffic referral.

The different sizes of the audiences that news organisations reach on social media largely reflect the specific aims they want to pursue with social media distribution and the specificities of their business models. News organisations focusing on audience scale and digital advertising try to drive large social media audiences to their destination websites, whereas organisations focusing more on digital subscriptions tend to target a more selected niche audience. As explained by Ben Whitelaw, head of audience development at The Times:

If you are about reach and scale, if you are a free website, then you will publish high volumes, a lot of articles that are kind of curiosity gap [and quite sensational] content in order to tempt people to come through. … [But] sensational content drives disloyal people … to a website. … If you’re a paywalled brand, … you’re not so much worried about the volume of content that you publish on these channels. You’ll probably use some curiosity gap content, but in a smarter way and it won’t be sensationalised.27

Alessio Balbi, head of online at La Repubblica, explains that the Italian newspaper focuses more on traffic and scale:

The attention that we devote to social media probably comes from the attention that we have always dedicated to traffic. Perhaps, … [other legacy newspapers] which rely heavily on subscriptions … do not have this orientation, … they do not aim at wide audiences.28

We now look in more depth at the frequency of publication and the type of posts used by the news organisations.

Figure 6 provides details on the number of posts published on Facebook, and shows how news organisations’ approaches vary significantly. Although interviewees recognise that ‘it is very difficult to find what the ideal number [of daily posts] is’,29 news organisations normally run tests to check the publication frequency that best fits their strategy and maximises the reach of their content. La Repubblica and TgCom24, for example, have found that the right pace for them is a post every 10–15 minutes during the daytime. Alessio Balbi, head of online at the Italian newspaper, gives a sense of how continuous trial and error is used to try to establish the appropriate number of posts while bearing in mind the uncertainty and frequent changes associated with social media distribution:

Over time we have tried and we have seen that this is a number [of daily posts] that allows us to keep a good visibility on all posts, which do not kill each other … and we can maintain a good level of engagement and traffic. Obviously, if we become aware of algorithm changes and it requires a reduction or increase in this number, we will act accordingly. There was a phase when Facebook said, ‘Post only once every half hour.’ Now it seems that the indication is different.30

Figure 6: Frequency of publication on Facebook

(Average no. of posts per day)

Source: CrowdTangle (average no. of posts per day from 1 Oct. 2017 to 31 Mar. 2018).

News organisations which publish less frequently also establish their rhythm through testing, but they focus on different strategic considerations. Mateusz Szaniewski, head of social media at Gazeta Wyborcza, explains that they tested doubling their frequency of publication (from every 40 minutes to every 20 minutes), but were ‘surprised’ because they did not see a proportionally relevant rise in traffic referrals. The benefit was not worth the cost in terms of the increase in the social media team’s workload.31

It is clear that differences in the frequency of publication are the result of how much a news organisation wants to rely on Facebook for distributing its content combined with some experimentation to see what works best for them. For example, Stephen Hull, head of digital at ITV News, explains that his organisation prefers to adopt a cautious approach towards Facebook and focus also on other platforms, especially after recent developments involving the US tech company:

[On] Facebook we are more selective. It is … very flattering … to get volume or draw attention from Facebook, but we recognise that the brand is changing, and its reputation too. … So, we are quite respectfully cautious about Facebook. We still post there pretty regularly, but … there is always a danger in placing all your bets in one place.32

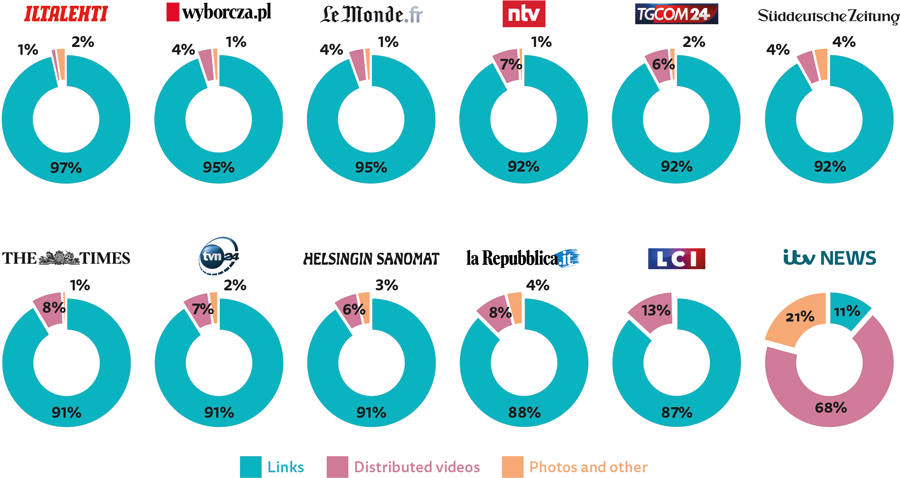

Figure 7 provides details of the types of posts that the news organisations publish on Facebook. It shows, first, how all private sector news organisations except ITV News are mainly focused on posting links that drive social media users to their website. As we have already seen, ITV News differs from its peers because it uses social media almost exclusively for reach and does not monetise its digital news with advertising or subscriptions.

Figure 7: Facebook post types

(% of all posts)

Source: CrowdTangle (% of all posts from 1 Oct. 2017 to 31 Mar. 2018). Distributed videos are Facebook Live and Facebook native videos, i.e. videos that are consumed on Facebook’s platform.

By looking at the proportion of distributed videos, rather than at the absolute number that we have considered in Figure 5, Figure 7 also shows that private sector legacy news organisations tend to make very limited use of them. ITV News is the outlier again, with most of its posts being distributed videos.

Off-site distribution tools such as Facebook Live and Facebook native videos enable users to consume content within the Facebook platform. The benefits include a better user experience, higher engagement and reach for the content posted and, in some cases, advertising revenue share or partnerships with Facebook that fund video production. Alessio Balbi, head of online at La Repubblica, explains that although distributed videos do not directly generate traffic referral, the Facebook algorithm rewards their use by prioritising them in people’s news feeds, which can increase the reach of other types of posts, including links aimed at generating traffic referrals:

As Facebook has manipulated the algorithm, … the videos were rewarded at the engagement level, and then to publish videos raises the engagement of the page, so it also favours the non-video content that we subsequently publish.33

However, several news organisations approach off-site distribution with caution, and are wary of having their relationship with the audience mediated by a third party. The talk in 2015–16 of the home page being ‘dead’ and the future of publishing being primarily focused on off-site reach and monetisation was clearly premature. The potential benefits of off-site reach via social media are counterbalanced by the risk for news outlets of undermining the channels they have traditionally relied on in order to distribute news, over which they have more control, and which are central to monetisation. In the words of Daniel Wüllner, head of the social media at Süddeutsche Zeitung:

One should consider: […] ‘Do I have to put in energy to build a community on Facebook? Or do I have to put more energy into building a community on my own site?’34

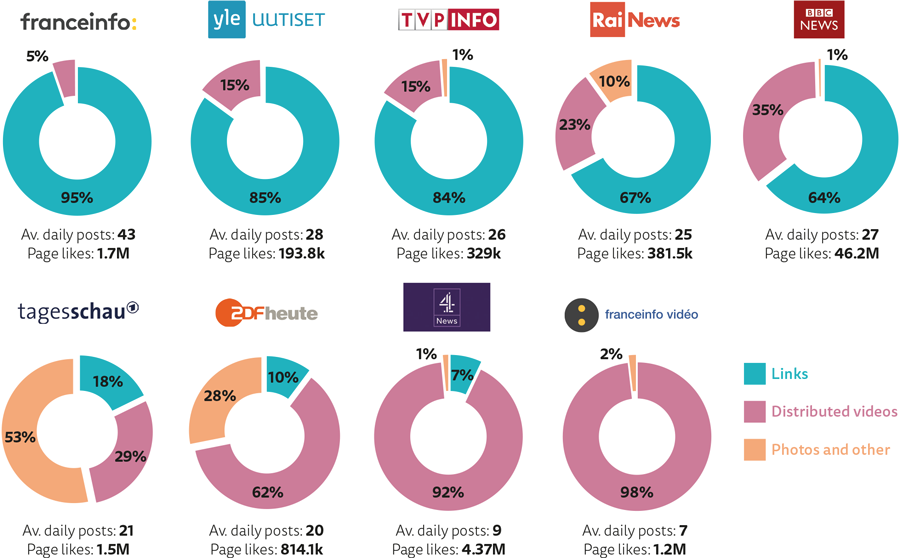

Therefore, the commercial imperatives of private sector news organisations lead them to approach distributed videos cautiously. When they use this form of off-site distribution, they do it in a pragmatic way. As Domenico Catagnano, editor of TgCom24, sharply put it: using distributed videos ‘is a gift [they] give to Facebook, hoping to be rewarded.’35 Other types of media organisations rely significantly more on these tools. Figure 8 allows a comparison with non-commercial media in the same six countries. It shows that most public service media relied more on distributed videos in the same period. Franceinfo might appear to be strongly focused on links, but this is because most of its video production is distributed by a dedicated account, Franceinfo Vidéo, which publishes almost only distributed videos (see Figure 8; see also Sehl et al. 2018). Several public service broadcasters have a similar pattern to ITV News. This is not because they are all broadcasters, but because they are much less reliant on monetising traffic with digital advertising.

Figure 8: Facebook post types: comparison with some public service media

(% of all posts, average no. of posts per day, and no. of page likes)

Source: CrowdTangle (% of all posts and average no. of posts per day from 1 Oct. 2017 to 31 Mar. 2018; no. of page likes on 31 Mar. 2018).

1.4 Monetisation and Social Media Platforms

Monetising news distributed through social media remains a challenge. Publishers’ social media activities primarily deliver a return on investment indirectly, when traffic driven by social media is monetised through digital ads on-site or social media activities help drive digital subscriptions, rather than directly through revenues generated on the platforms themselves. As Nicolas Moscovici, online editor-in-chief of LCI, explains:

We don’t make money with social networks. … [There is] indirect monetisation, through traffic they [refer to our website,] … but otherwise … there is little or no monetisation of content posted on Facebook.36

Joonas Partanen, publishing editor at Iltalehti, confirms that direct monetisation is ‘small and minimal’ but, in terms of referred traffic, social media is ‘one key element.’ He adds that, if social media stopped driving traffic to publishers, this would be a big problem for the industry:

If we stopped … getting social media traffic, it would certainly not be good for our business because we want to have at least as much traffic, users, and page views as we have at the moment.37

Most interviewees are dissatisfied with existing forms of direct monetisation, such as advertising revenue share with social media platforms. However, some news organisations which experimented with this tend see it as an ‘added bonus’,38 and are open to new opportunities that might arise. They tend to adopt a trial-and-error approach.

Massimo Russo, managing director digital division of GEDI, the group owning La Repubblica, explains this approach:

We always try to test [new opportunities]. … First, we try to see how they work from a journalistic point of view. … Then, we explore if we can deploy [these new tools] at scale. … In this phase, you also evaluate their monetisability, which becomes one of the key elements in the final decision. … If monetisation does not follow, [the organisation’s interest declines].39

Facebook’s Instant Articles (originally launched in 2015 as a format for native, on-site publishing that would load quickly on mobile phones) is an example of an initiative that enables direct monetisation of off-site content, either by the publisher selling their own ads within certain guidelines set by Facebook (and keeping the revenue), through branded content, or by advertising sold through Facebook’s Audience Network (with revenue shared between the publisher and the platform, normally split 70–30).40 Only a few of our sample organisations currently use Instant Articles, though some have embraced it. La Repubblica, for example, publish a large proportion of their posts on Facebook as Instant Articles.41 They sell ads through Facebook’s Audience Network, in addition to their own sales agency Manzoni. Massimo Russo stresses how this was a pragmatic decision:

We will use Instant Articles and Audience Network as long as this is convenient from an economic point of view. If we see that the return on that traffic is lower than what we could expect from using our inventories, then we will stop or do less. Up to now, … this is an efficient way for us to monetise some parts of the mobile inventories that would otherwise be difficult to monetise.42

Facebook distributed videos have had some attraction because of their role in encouraging engagement and the ranking of other posts with links. However, in the past, they were only financially viable for some because Facebook paid some publishers to produce and distribute them. But, as interviewees in Italy and France point out, Facebook stopped these partnerships at the end of 2017. Facebook offers various formats for monetisation of video, including pre-roll advertising, preview trailers, and ad breaks. However, for the moment, these opportunities are not available in some of the countries covered in this study, and none of our case organisations report generating meaningful revenues through these formats.43

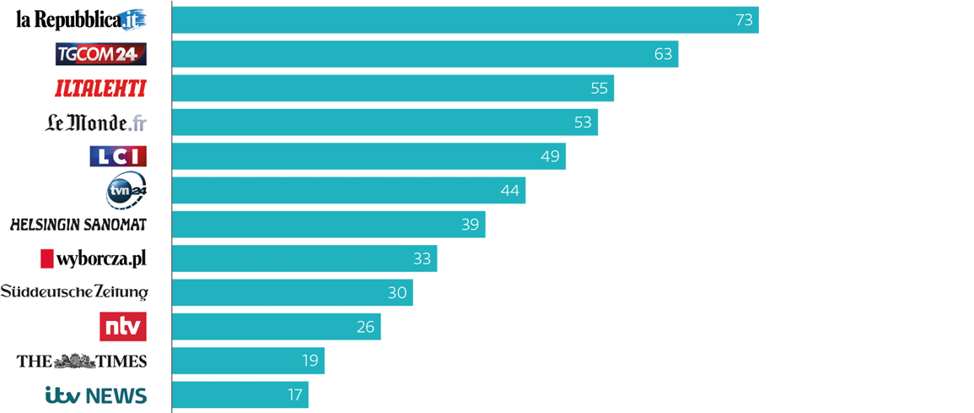

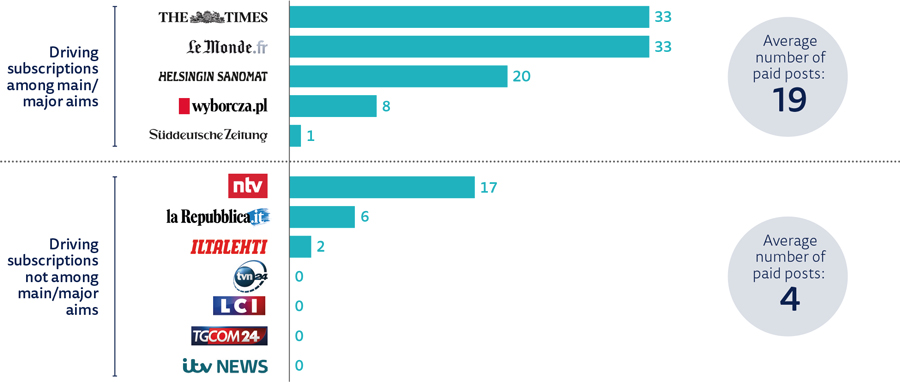

Beyond using social media to drive on-site traffic or build off-site reach monetised through advertising or branded content, several newspapers use social media to drive digital subscription sales. Mateusz Szaniewski, head of social media at Gazeta Wyborcza, says that the Polish newspaper has recently changed its strategy for their paid news stories, which were previously free to access for users arriving from Facebook. He explains that ‘Facebook is now the biggest [driver] of new subscribers’, with up to 20% of their total digital sales and 40% of all new subscribers coming from Facebook. However, he also points out that most of these new subscriptions are boosted by running Facebook paid campaigns, and adds that ‘the most important rule’ is that these campaigns have to pay their way by delivering more in subscription sales than the costs of advertising.44 Süddeutsche Zeitung and Le Monde also say they have redirected their Facebook advertising campaigns, which are now focused on promoting paid content instead of freely accessible news.45

Gazeta Wyborcza is far from alone in advertising their content on Facebook. Figure 9 shows the number of sponsored posts on Facebook our 12 case organisations were paying to promote their content on 1 August 2018. This is a proxy for the scale and scope of their investment in advertising

on the platform. There is significant variation from case to case, but also a clear overall pattern. The five organisations focused primarily on driving digital subscriptions through their social media activities on average sponsored 19 different posts. The seven organisations focused primarily on driving on-site traffic or off-site reach sponsored on average four daily posts, and in many cases no posts at all.

Figure 9: Number of Facebook sponsored posts by news organisations on 1 August 2018

Source: Our count of the no. of posts news organisations paid for that were present on Facebook at noon on 1 Aug. 2018. Data collected through the tool ‘Info & Adds’, which Facebook recently made available for all pages. The no. of posts refers to the country where news organisations are based. Duplicated posts or posts that are very similar to each other are included in the total figures.

Beyond publishers using Facebook as a platform for advertising their news, the company has been testing a new subscription model as part of Instant Articles, working with a small number of publishers from across the US and Europe, including La Repubblica.46 Massimo Russo explains that this tool brings in many users. However, he also points out that, for the moment, it seems that the conversion rate for users arriving from Facebook is lower than the conversion rate for users who hit the paywall when navigating on the La Repubblica website.47 More generally, our interviewees report that users referred by social media tend to be less inclined to subscribe than the more loyal audiences who come directly to their website.

Even as all our case organisations make significant investments in social media distribution, because they see important short-term benefits and believe social media can enable their long-term strategy (whether advertising based, subscription based, or a mix), it is clear that direct monetisation on social media is still a challenge for private sector news organisations. This is in line with what previous studies by various industry groups have found. The trade group Digital Content Next (2017, 2018), for example, analysed data from a selection of their members, and found that social media distribution generated less revenue than publishers had expected. In their sample, distributed content revenues accounted, on average, for approximately 5% of publishers’ total digital revenue.48 Similarly, a WAN-INFRA (2017) study has found that news monetisation on Facebook is marked by uncertainty, and news publishers cannot rely solely on monetisation programmes offered by digital platforms, as their contribution to digital revenue is limited and not sufficient for all publishers in all markets. All of our case organisations are aware of these limitations, and express their frustrations with the currently limited success of off-site monetisation directly on social media platforms, but continue to invest because social media, especially Facebook, still drive traffic, reach, and subscription sales.

2. Change in Facebook’s Algorithm and News Organisations’ Responses

In this chapter, we analyse how our case organisations responded to Facebook’s major algorithm changes in January 2018, a move that led some to suggest that the platform was breaking up with news and publishers would walk away from it as a consequence.

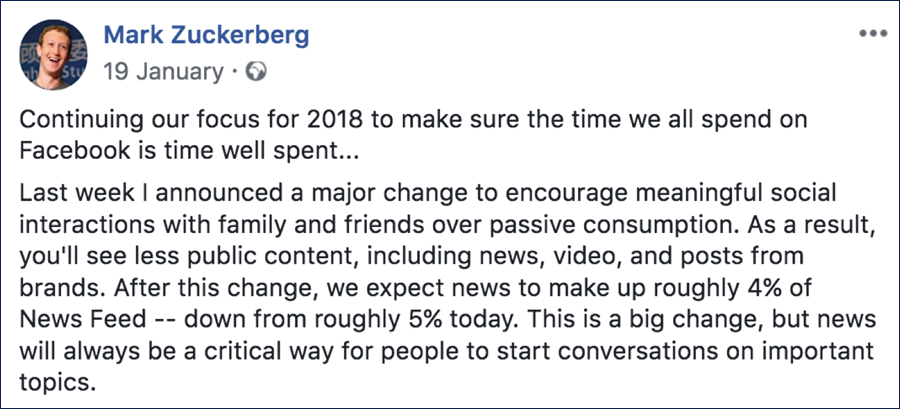

2.1 Deprioritising News to Favour Friends’ Posts

On 11 January 2018, Facebook announced a change in the algorithm which governs the selection and ranking of the posts that users see on their news feed. Facebook explained that ‘meaningful interactions’ from friends would be prioritised over posts from brands’ pages, including those of publishers. Facebook also specified that pages might see their reach and referral traffic decrease, but the impact would vary from publisher to publisher, depending on several factors including ‘the type of content they produce and how people interact with it.’49 In another post, Facebook’s leader Mark Zuckerberg added that, after this change, he expected news to constitute approximately 4% of the posts users see, down from 5% before the algorithm change (see Figure 10).

Figure 10: Mark Zuckerberg’s post on the possible implications of algorithm change for news

Source: Screenshot from Mark Zuckerberg’s Facebook page (19 January 2018).

Given Facebook’s centrality in social media strategies (see Chapter 1.2), news organisations worried about the implication of this change. Joonas Partanen, publishing editor at Iltalehti, recalls:

Of course, we didn’t feel this was good news. … The algorithm changed from like 5% to 4%. Of course, we felt that probably people [would see] 20% less of Iltalehti postings. What can we do about that? We can’t predict what Facebook is going to do, we just have to get on with it.50

Reaction from some news industry leaders and observers was more negative. Some trade press and general news outlets framed the Facebook change as an ‘apocalypse’ or a ‘guillotine’, which would have cut news organisations’ traffic ‘in half’ and seriously undermined the survival of digital publishers or even ‘decimated’ them (see Figure 11).

Figure 11: Some examples of negative reactions to Facebook change

Sources: Screenshots from a Facebook post published by BuzzFeed News on 12 Jan. 2018 (https://www.facebook.com/BuzzFeedNews/photos/p.1763375040350173/1763375040350173/?type=3&theater) and from Joseph (2018), Katz (2018), Moses (2018), Lazauskas (2018), Kovach (2018), Duke (2018), BBC News (2018), Tomasetti (2018).

Figure 12 shows the change in the news organisations’ page performance in terms of average daily interactions generated before and after Facebook’s announcement.51 It is important to note that change in interactions and, more generally, social media performance might have been determined by several factors beyond algorithm changes. These include news organisations’ change in strategies, which we illustrate in Chapter 2.2, but also contextual factors that are not taken into consideration in this study. (In early 2018, for example, a general election campaign was under way in Italy, while negotiation for the coalition government was taking place in Germany.)

Figure 12: Change in news outlets’ page interactions

Source: CrowdTangle (% of change in average daily interactions in the 12 weeks before and after Facebook’s announcement of the change of algorithm; before: from 19 Oct. 2017 to 10 Jan. 2018; after: from 12 Jan. 2018 to 5 April 2018). Average change calculated from the 12 new organisations’ accounts. Interactions include reactions (such as likes), shares, and comments.

Figure 12 shows that changes in interactions vary significantly from organisation to organisation and it is hard to see a clear pattern across the organisations studied. Some news organisations, such as LCI, have seen significant decreases in engagement. Nicolas Moscovici, online editor-in-chief at the French broadcaster, says that they have registered a similar decrease in traffic referral:

What we have seen is a decrease in our traffic flow. … Without being too precise, we have lost 30% of our traffic from social networks, from Facebook. It’s a big deal.52

Other news outlets have observed less significant decreases, have held steady, or even observed increases in interactions. Stefano Ventura, director of news products RTI business digital, Mediaset, says that the ‘immediate effect’ of the algorithm change was a ‘limited’ decrease in TgCom24’s organic reach. However, they did not observe any negative effect on engagement and referral, and today they are performing better than before because of an effective reorganisation in how they distribute news on social media.53 The Times also observed a decrease in reach but increases in referrals and in the proportion of the audience who interacts more frequently with their page.54 On average, the total number of interactions of our 12 case organisations decreased by 9.4% after the January 2018 algorithm change. (This is a slightly bigger drop than the overall drop in social referrals in the Parse.ly network between the first week of January 2018 (14.1%) and the first week of August (13.1%).)55

Decreases in news organisations’ performance are not solely attributed to the January 2018 algorithm change. Several interviewees pointed out that these decreases had started earlier. Daniel Wüllner, head of the social media at Süddeutsche Zeitung, for example, says that the reach of the German newspaper ‘continuously decreased’ in 2017.56 Alexis Delcambre, deputy managing editor of Le Monde, explains that many people in the industry and at the French newspaper think that this ‘is part of a broader change [affecting news organisations’ reach] on Facebook that had already started’ before January.57

2.2 Algorithm Change and Variation in the News Organisations’ Strategies

As pointed out by one of our interviewees, ‘with Facebook, the problem is that when the algorithm changed, you don’t know … what depends on the algorithm and what depends on what you did.’58 In this chapter, we look at the three different ways in which the news organisations we have studied responded to the algorithm change.

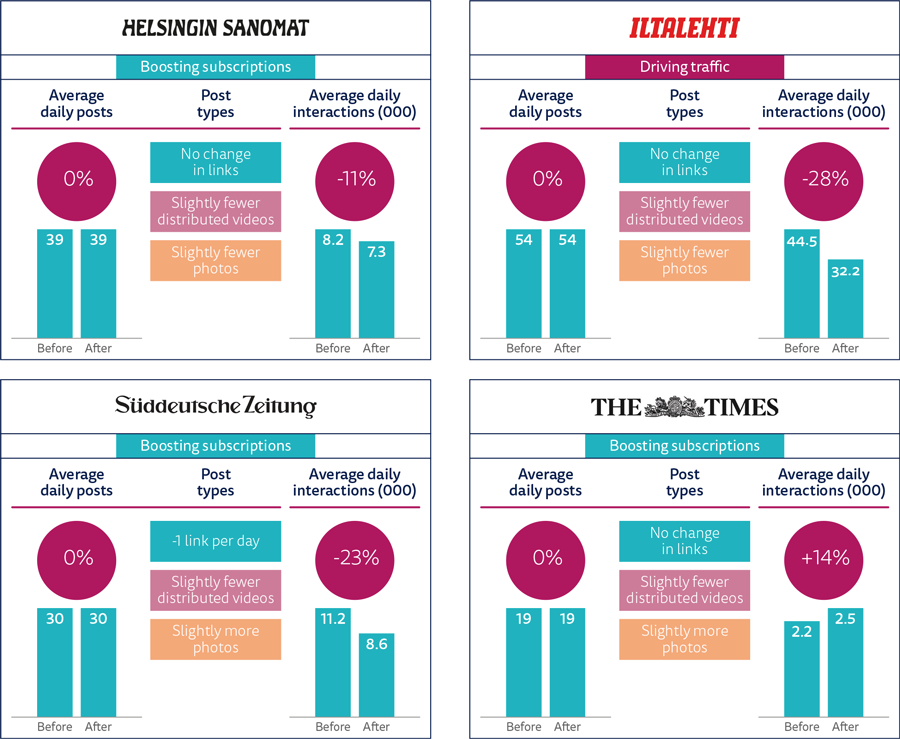

Some news organisations have not made significant changes in the number of daily posts or types of post published. These cases are shown in Figure 13, which also shows the variation in the average daily interactions generated by their Facebook pages. Data refer to the 12 weeks that precede and follow Facebook’s announcement.

Figure 13: News organisations’ responses to the algorithm change

Group 1: no significant changes in strategies

Source: CrowdTangle. Before: the 12 weeks before Facebook’s announcement of the change of algorithm (19 Oct. 2017–10 Jan. 2018). After: the 12 weeks after the announcement (12 Jan.–5 April 2018). Labels in the top of each box reproduce whether traffic and subscriptions are the ‘main aim’ or the ‘major aims’ (see Table 3).

News organisations such as The Times, Helsingin Sanomat, and Süddeutsche Zeitung made no significant changes to their overall strategies following the algorithm change. These three news organisations focus strongly on paid content (see Chapter 1.1), post less frequently (see Figure 6 in Chapter 1.3), and have a more limited Facebook follower base than other outlets that focus more on traffic referral and advertising (see Figure 3 in Chapter 1.2).

Journalists and managers from these three news outlets confirm the picture of no significant changes in strategy following Facebook’s announcement. They also stress that, with business models focused on subscriptions, they consider themselves less exposed to algorithm changes than other news outlets. As Ben Whitelaw, head of audience development at The Times explains:

One of the unspoken benefits of having a subscription model is the resilience against these platform changes: … it is so refreshing … to be able … not to have to have an emergency meeting [every time] you hear about a Facebook [or Google] algorithm change.59

The sense of being less reliant on social media platforms is also clear from interviewees at Helsingin Sanomat. Veera Siivonen, marketing director, says that the algorithm change has reminded them that ‘the destination [website] is the important’ platform and they ‘don’t [have to] rely on anyone else.’60

Iltalehti is a different case. The Finnish tabloid focuses strongly on traffic referral (see Table 3) and publishes more frequently on Facebook (see Figure 6), two factors that might suggest greater sensitivity to the algorithm change. However, Joonas Partanen, publishing editor, explains that Iltalehti did not change its strategy because they wanted to isolate the algorithm effect, to see ‘how it changes if [they publish in] exactly the same way.’ He also adds that the algorithm change meant that they have ‘to be even better on Facebook than before to get even the same kind of numbers.’61

Change in users’ interactions and how this is possibly related to the algorithm change and the news organisations’ responses is discussed at the end of this chapter.

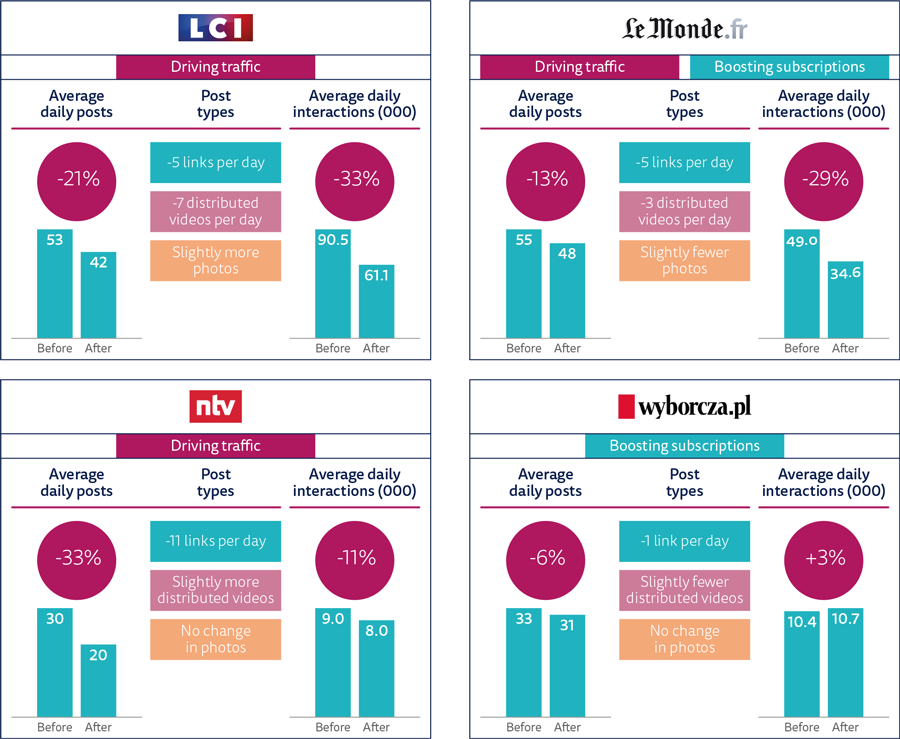

A second group of news organisations have responded to the algorithm change by reducing their frequency of publication. These cases are illustrated in Figure 14. N-tv, LCI, and Le Monde have significantly reduced their rhythm. They also are organisations that consider traffic referral one of the major aims of their social media strategies (see Table 3 in Chapter 1.1). Nicolas Moscovici, online editor-in-chief of LCI, explains that, because of the Facebook algorithm change, the French broadcaster is in the process of radically reconsidering their approach to this platform:

[Our] strategy is currently being rethought, because there have been a lot of changes, especially with the Facebook algorithm. …. For a long time, … we gave our content to Facebook, which sent us traffic, obviously. However, … there is a problem with the monetisation of our content on Facebook. So now that they have changed the rules of the algorithm a bit, we are thinking about what we give to Facebook and what we do not give to it anymore.62

Figure 14: News organisations’ responses to the algorithm change

Group 2: decrease in frequency of publication

Source: see Figure 13. Differences between changes in the no. of average daily posts and of post types are due to rounding.

Gazeta Wyborcza has implemented only a minor reduction in its frequency of publication. This is in line with the response of other news outlets that focus strongly on digital subscriptions. Mateusz Szaniewski, head of social media, confirms that they have not implemented significant changes in their strategy, and explains that they prefer to focus on their subscribers and destination website:

Well, I would not say that [our strategy has] really changed. … We want to be as independent as possible. That is why we don’t really cry over the Facebook algorithm and how the reach has dropped. … There is nothing we can do [about it]. What we can do is to fight for our direct traffic … and take care of our subscribers.63

Figure 15: News organisations’ responses to the algorithm change

Group 3: increase in frequency of publication

Source: see Figure 13. Differences between changes in the no. of average daily posts and of post types are due to rounding.

Figure 15 shows the cases of the news organisations that have increased their frequency of publication since January 2018. Although interviewees at TVN24 and ITV News say that the increase in their number of posts is not part of a proper change of strategy,64 interviewees at TgCom24 and La Repubblica say that their strategies have explicitly altered to address the algorithm change.65 This seems to confirm that news organisations that are strongly focused on advertising revenues (see Chapter 1.1) and publish more frequently on Facebook (see Figure 6) are more sensitive to the algorithm change. Unlike the previous group of organisations, their response has implied increases in their activities on Facebook. Stefano Ventura, director of news products RTI business digital, Mediaset, explains that TgCom24 has recently established a new social media unit, and this has allowed the Italian broadcaster to better address the algorithm change. He also explains that TgCom24 try to favour users’ engagement on Facebook by increasingly using ‘interactive posting’ and ‘cross-posting’:

[Interactive posting means focusing on topics that,] because of either the type of story or how content is written, encourage an intense debate between users. … [These posts] greatly favour

interactions, which seem to be the predominant element in the algorithm. … [Moreover,] we have learned that increasing cross-posting, [i.e. creating synergy between Mediaset websites, which link to each other on Facebook] creates a positive effect and counterbalances the algorithm impact.66

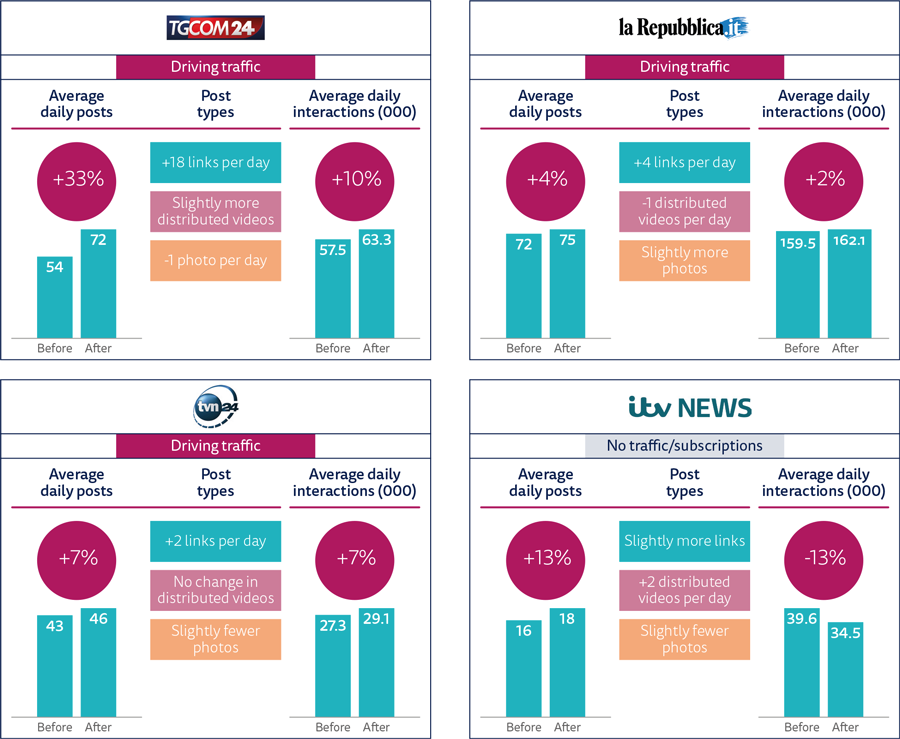

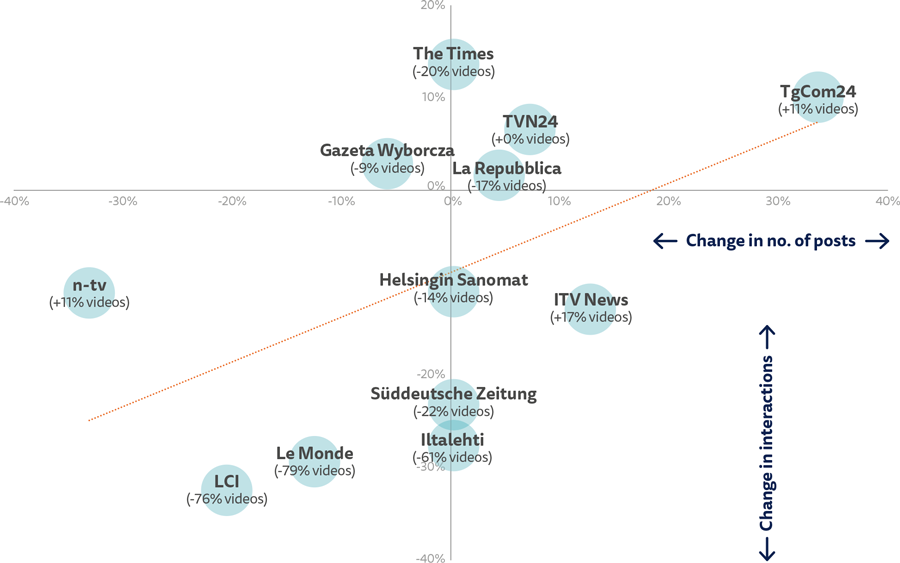

Figure 16 provides an overall view of the changes in news organisations’ strategies (measured in terms of frequency of publication and use of distributed videos – two factors among the many that influence performance in the news feed) and the change in their performance (measured in terms of daily interactions). These measures are indicators normally used when news organisations run tests to adjust their publication strategies. However, it is important to note that they do not account for all aspects of social media strategies. Moreover, external factors not considered in our analysis (e.g. elections or other important news stories) might affect performance.

Figure 16: Overview of news organisations’ responses and changes in users’ interactions

(% change in frequency of publication, daily interactions, and use of distributed videos on Facebook)

Source: CrowdTangle. X-axis: % change in no. of daily posts in the 12 weeks before and after Facebook’s announcement of the change of algorithm (before: 19 Oct. 2017–10 Jan. 2018; after: 12 Jan.–5 Apr. 2018). Y-axis: % change in no. of daily interactions generated by news outlets’ pages before and after Facebook’s announcement of the change of algorithm (same periods of time). % change in distributed videos in parenthesis (same periods of time).

Several of our cases seem to indicate a possible relation between news organisations’ changes in strategy in response to Facebook’s algorithm change, and variation in their performance. Helsingin Sanomat, Süddeutsche Zeitung, and Iltalehti have not changed their frequency of publication, and the daily interactions generated by their Facebook pages have decreased. This seems to indicate a possible impact of the algorithm change, although more cases should be considered. Le Monde, LCI, and n-tv have decreased the number of posts published per day, and their performance has also decreased. Conversely, TgCom24, TVN24, and La Repubblica have increased their frequency of publication, and observed an increase in their interactions. Some outlets have increased the number of distributed videos, a format Facebook is prioritising, but of those who have, only TgCom24 has seen interactions increase. Our sample is small, there are some outliers, and many possible intervening factors are unaccounted for, so it is hard to reach any definite conclusions, but there seems to be a relationship between changes in strategy and variation in performance (as suggested by the trendline in Figure 16). What is clear is that the uncertainty that characterises algorithmic selection on social media platforms does not allow organisations to have a clear picture of what is happening, or to know how to respond to it successfully.

Conclusion

In this report, we have analysed how major private sector legacy news organisations across six European countries use social media for news distribution.

Based on 21 interviews with senior editors and managers at 12 newspapers and commercial broadcasters in Finland, France, Germany, Italy, Poland, and the UK, we have shown that all of them invest but that they approach social media in different ways, largely aligned with their business model. All make significant investments in social media, often with a primary emphasis on Facebook, but with different ends in sight. We have identified three main strategic aims pursued through social media distribution: driving traffic to news organisations’ websites, driving off-site reach on third-party platforms, and driving digital subscriptions.

Although Facebook’s decision in January 2018 to change its ranking algorithms to reduce the amount of news in the news feed in favour of more content from friends has been a blow for many publishers, and though most of our case organisations have seen interactions on the platform decline, they still concentrate the majority of their resources on Facebook. This is because – as the largest and most widely used social media platform – Facebook continues to be seen as a powerful driver of traffic, reach, and subscription sales. Twitter, in contrast, is valued in particular as a way of generating off-site reach and visibility through breaking news, especially among elites including politicians, journalists, and news lovers. In most cases, its contribution to traffic, audience engagement, and digital revenues is seen as limited. Instagram (owned by Facebook) is seen as a fast-growing platform with significant potential to deliver high audience engagement and promote news brands, especially to younger audiences. Most organisations are in early and experimental stages of their use of Instagram and report limited direct and indirect returns on their investments at this stage.

Private sector legacy news organisations’ approaches to social media generally and Facebook specifically present some commonalities based on the development and imitation of shared forms of what are seen as ‘best practices’ (Sehl et al. 2018) and various forms of ‘algorithmic isomorphism’, whereby certain practices are rewarded by automated ranking systems (Caplan and boyd 2018). However, it is also clear that their approaches are fundamentally shaped by their business models. Newspapers and broadcasters focusing strongly on advertising tend to adopt more aggressive strategies and invest to reach larger audiences on Facebook, often with the aim of generating referral traffic to their own websites, whereas subscription-based newspapers tend to adopt more cautious approaches and focus on building and reaching a smaller, more targeted audience of readers with the aim of converting them into paying subscribers. Off-site reach is an important but ultimately secondary consideration for most of the organisations covered here, and none of them see a sustainable business based on the kind of distributed content approach associated with digital-born news media like AJ+, BuzzFeed, and NowThis News. While native formats for articles and various forms of video are promoted and rewarded by social media platforms, most of our case organisations have found it very hard to monetise off-site reach and thus do not prioritise it. Our case organisations thus invest in social media primarily for the indirect benefits in the form of referral traffic and digital subscription sales, and generally feel that there currently are no clear, sustainable business models for news on social media.

The impact of the January 2018 Facebook algorithm change varies from organisation to organisation, but the apocalyptic scenarios anticipated by some observers have not materialised for any of our case organisations. Many have seen significant declines in interactions, but even after the drop Facebook remains the most important social media platform for most. While organisations pursuing traffic and reach have in several cases been hard hit, some have managed to improve their performance and attribute this in part to increased activity and an embrace of native formats, while those focused on driving subscription sales consider themselves less exposed overall to the changes.

Overall, our analysis shows how news media’s dealings with social media continue to be characterised by frequent frustrations, considerable uncertainty (especially as algorithms and priorities change, sometimes dramatically and with no notice), and concern over long-term platform risk. But it also shows that publishers continue to invest, adapt, and experiment on platforms that they compete with for attention and advertising because they also provide with important opportunities for pursuing their editorial ambitions and commercial objectives. Private sector legacy news organisations engage with and invest in social media conscious of the real risks they represent, but also with a clear eye for the rewards.

References

BBC News. 2018. ‘Facebook news feed changes “decimated” publisher’, 28 Feb., https://www.bbc.com/news/technology-43225987

Bell, E. J., Owen, T., Brown, P. D., Hauka, C., and Rashidian, N. 2017. The Platform Press: How Silicon Valley Reengineered Journalism. New York: Tow Center for Digital Journalism, Columbia University.

Brüggemann, M., Engesser, S., Büchel, F., Humprechtanaly, E., and Castro, L. 2014. ‘Hallin and Mancini revisited: Four empirical types of Western media systems’, Journal of Communication, 64: 1037–65.

Caplan, R., and boyd, d. 2018. ‘Isomorphism through algorithms: Institutional dependencies in the case of Facebook’, Big Data and Society, 1–12.

Cornia, A., Sehl, A., and Nielsen, R. K. 2016. Private Sector Media and Digital News. Oxford: Reuters Institute for the Study of Journalism.

Digital Content Next. 2017. Distributed Content Revenue Benchmark Report. New York: Digital Content Next.

Digital Content Next. 2018. Distributed Content Revenue Benchmark Report. New York: Digital Content Next.

Duke, J. 2018. ‘Facebook’s algorithm changes cut publishers’ traffic in half’, Sydney Morning Herald, 3 May, https://www.smh.com.au/business/companies/facebook-s-algorithm-changes-cut-publishers-traffic-in-half-20180503-p4zd3e.html

Hallin, D. C., and Mancini, P. 2004. Comparing Media Systems: Three Models of Media and Politics. Cambridge: Cambridge University Press.

Internet World Stats. 2018. http://www.internetworldstats.com/europa.htm#fi (online database).

Joseph, S. 2018 ‘“Organic reach on Facebook is dead”: Advertisers expect price hikes after Facebook’s feed purge’, Digiday, 15 Jan., https://digiday.com/marketing/organic-reach-facebook-dead-advertisers-will-spend-reach-facebooks-feed-purge/

Kalogeropoulos, A., and Nielsen, R. K. 2017. ‘Investing in online video news: A cross-national analysis of news organizations’ enterprising approach to digital media’, Journalism Studies, 1–18.

Katz, A. J. 2018. ‘Here’s how Facebook’s algorithm shift is hurting digital publishers, and the steps they can take to survive’, Adweek, 1 Mar., https://www.adweek.com/digital/heres-how-facebooks-algorithm-shift-is-hurting-digital-publishers-and-the-steps-they-can-take-to-survive/

Kovach, S. 2018. ‘Facebook is trying to prove it’s not a media company by dropping the guillotine on a bunch of media companies’, Business Insider UK, 13 Jan., http://uk.businessinsider.com/facebooks-updated-news-feed-algorithm-nightmare-for-publishers-2018–1?r=US&IR=T

Lazauskas, J. 2018. ‘Facebook’s algorithm is apocalyptic for brands, publishers, users, and Facebook itself’, Contently, 12 Jan., https://contently.com/strategist/2018/01/12/facebook-algorithm-apocalypse/

Lischka, J. A. 2018. ‘Logics in social media news making: How social media editors marry the Facebook logic with journalistic standards’, Journalism, 1–18.

Moses, L. 2018. ‘“We’re losing hope”: Facebook tells publishers big change is coming to news feed’, Digiday, 11 Jan., https://digiday.com/media/losing-hope-facebook-tells-publishers-big-change-coming-news-feed/

Newman, N., Fletcher, R., Kalogeropoulos, A., Levy, D. A. L., and Nielsen, R. K. 2018. Reuters Institute Digital News Report 2018. Oxford: Reuters Institute for the Study of Journalism.