| Statistics | |

| Population | 5.5m |

| Internet penetration | 94% |

The media environment in Finland is characterised by a strong regional press, a strong public broadcaster (YLE), one important national daily Helsingin Sanomat, and two popular evening tabloids, both reaching half of the population online.

Top Brands % Weekly Usage (TV, Radio and Print)

| Weekly use | Main source | |

|---|---|---|

| Yle News | 70% | 38% |

| MTV3 News | 58% | 17% |

| Regional or local paper | 35% | 11% |

| Free city paper | 32% | 3% |

| Helsingin Sanomat | 23% | 8% |

| Ilta-Sanomat | 22% | 2% |

| Iltalehti | 19% | 1% |

| Commercial radio news | 18% | 3% |

| HSTV news on Channel 4 | 9% | 0% |

| Kauppalehti | 7% | 0% |

| Foreign TV news channels | 4% | 1% |

| BBC News | 4% | 0% |

| CNN | 3% | 0% |

| Maaseudun Tulevaisuus | 3% | 0% |

| Hufvudstadsbladet | 2% | 0% |

| Other foreign newspapers | 1% | 0% |

Top Brands % Weekly Usage (Online)

| Weekly use | Main source | |

|---|---|---|

| Ilta-Sanomat online | 60% | 21% |

| Iltalehti online | 58% | 18% |

| Yle News online | 44% | 15% |

| Helsingin Sanomat online | 36% | 9% |

| MTV news online | 32% | 5% |

| Regional or local paper website | 26% | 6% |

| Taloussanomat online | 21% | 1% |

| Kauppalehti online | 18% | 1% |

| Uusi Suomi online | 10% | 1% |

| Website of a free city paper | 8% | 0% |

| Website of a fireign newspaper | 8% | 1% |

| Website of foreign TV news | 6% | 0% |

| BBC News online | 5% | 0% |

| MSN News | 5% | 1% |

| Commercial radio online news | 5% | 0% |

| Channel 4 news online | 4% | 0% |

Overview of key developments

By Esa Reunanen

University of Tampere, Finland

Print circulations have continued their decline in 2015. This is a serious problem for newspaper companies, because most of their revenue still comes from print. The biggest daily newspaper, Helsingin Sanomat lost 6% of its circulation, and the second biggest daily, Aamulehti, also lost 6%. 1

Traditional Finnish media companies have sustained their strong audience position in online with limited competition from home-grown pure player Uusisuomi.fi (10% weekly reach) and popular news aggregator Ampparit.com (11%). 2 The Finnish language and small market seem to shield national news brands somewhat from international competition. Other reasons for the popularity of traditional Finnish media companies online are the amount of free content still available (especially the evening tabloids and YLE) combined with soft paywalls, bundled subscriptions, and the strong Finnish reading tradition.

YLE’s position was actively debated in 2015 with the government’s decision to freeze the index-linked increase in YLE’s funding criticised by the opposition. Meanwhile a parliamentary working group is reviewing YLE’s mission and funding against the backdrop of criticism from private publishers over its strength in digital.

Newspapers in Finland have differing strategies regarding paid online news. The evening tabloids have mostly free offerings while two thirds of daily newspapers use paywalls. They are easing their print readers’ way into digital by offering bundled subscriptions at a similar price to – or just a little higher – than print-only subscriptions. They are also looking for the right digital-only price point, which can vary from 35% (Etelä-Saimaa) to 73% (Iisalmen Sanomat) of the cost of a bundled subscription. 3 With reasonably priced digital services, Finnish media companies are continuing to reach out to those who are no longer willing to pay for print.

In 2015, Alma Media underwent some major corporate restructuring. It sold some of its less profitable regional newspapers and merged with Talentum, the publisher of some leading magazines specialising in financial news and technology. Alma Media already owned a leading business newspaper, Kauppalehti, and the merger now strengthens Alma Media’s position as a provider of economic and business journalism. Sanoma, for its part, is selling its regional newspapers in Eastern Finland to a local publisher and it has recently also sold many of its magazines.

At the beginning of 2016, Finland’s biggest commercial broadcaster MTV, together with a number of partner companies (mainly with a background in newspapers), established a new video network that offers MTV’s videos for the partner companies’ use. It also sells advertising into the videos produced by the partner companies. This new network competes with Sanoma’s Ruutu video network and with international competitors like Google and Facebook.

Changes in media usage 2014–2016

Finnish people have embraced online media, but not at the expense of broadcast news. The printed newspaper sector is declining more slowly than elsewhere due to a strong reading culture.

WEEKLY REACH PER DEVICE

| Computer | Smartphone | Tablet | |

|---|---|---|---|

| 2014 | 80% | 41% | 23% |

| 2015 | 75% | 50% | 26% |

| 2016 | 74% | 59% | 30% |

SOURCE OF NEWS 2014–16

| TV | Online (inc. social) | Social | ||

|---|---|---|---|---|

| 2014 | 79% | 58% | 82% | 36% |

| 2015 | 75% | 53% | 90% | 40% |

| 2016 | 75% | 53% | 89% | 45% |

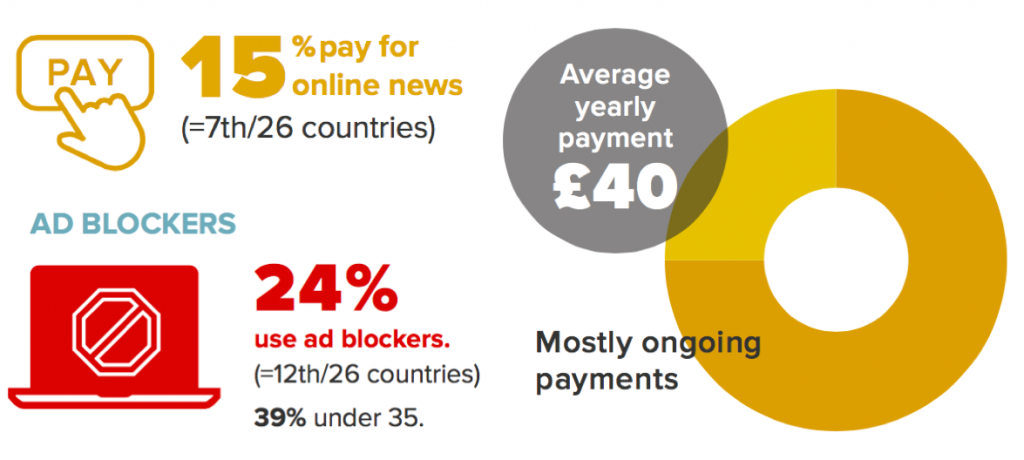

Paying for news

A strong tradition of subscription has made it easier to transition to paid content online. But growth is slow and of those not already paying, three quarters (74%) say they would not do so in the future.

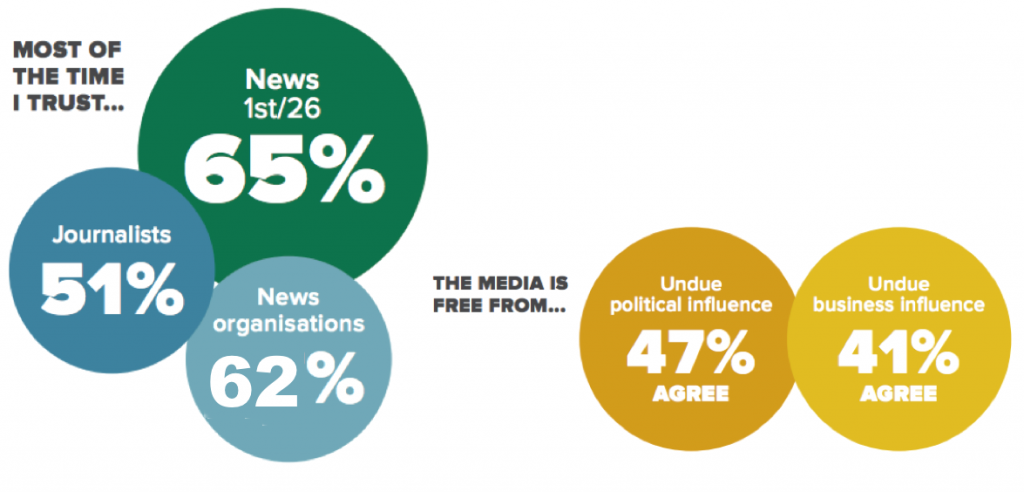

Trust

Mainstream news organisations in Finland are not politically partisan and journalists have a strong professional culture that values objectivity and independence. The heated debate around immigration policy, however, has somewhat challenged the trust in the media’s neutrality. On the other hand, this same debate has also highlighted the news media’s role as a trustworthy alternative to disinformation online.

Scroll data area to see more

TOP SOCIAL NETWORKS*

| RANK | NETWORK | ALL | U35s |

|---|---|---|---|

| 1 | 34% | 42% | |

| 2 | YouTube | 9% | 8% |

| 3 | 6% | 9% | |

| 4 | 6% | 10% | |

| 5 | Suomi 24 | 5% | 2% |

- https://mediaauditfinland.fi/ Advertising expenditure in printed newspapers decreased 8% while total media advertising spend was down 2%, and online advertising up 7%. [41. https://www.kantar.fi/sites/default/files/press_release_media_advertising_expenditure_year_2015_finland_.pdf The turnover of listed Finnish media companies is also falling, with Sanoma Media Finland reporting a reduction of 10% and Alma Media down 1%. The listed media companies, however, continue to be profitable, the operating profit income ranging from 2% (Sanoma Media Finland) to 11% (Ilkka). [42. Without non-recurring items and without Ilkka’s share of Alma Media. Source: Suomen Lehdistö 2/2016. ↩

- Although Uusisuomi.fi has adopted its name from a former newspaper it is a new enterprise and is classified here as a pure player. ↩

- According to a recent survey that included newspapers that offer subscriptions and appear six or seven times a week. Source: Suomen Lehdistö 1/2016. ↩