| Statistics | |

| Population | 81m |

| Internet penetration | 88% |

German media use remains amongst the most traditional in Europe with television still preferred – but there has been a significant increase in social media and access via mobile devices.

Top Brands % Weekly Usage (TV, Radio and Print)

| Weekly use | Main source | |

|---|---|---|

| ARD (inc. Tagesschau, Tagesthemen, etc.) | 54% | 23% |

| ZDF (inc. heute, heute-journal, etc.) | 46% | 10% |

| RTL aktuell | 35% | 13% |

| A regional or local newspaper | 32% | 9% |

| n-tv | 24% | 4% |

| N24 | 24% | 4% |

| Public radio news | 20% | 5% |

| Regional TV news | 19% | 2% |

| Sat.1 Nachrichten | 17% | 2% |

| Commercial radio news | 14% | 3% |

| Bild (inc. Sunday edition) | 10% | 2% |

| ProSieben Newstime | 10% | 2% |

| Der Spiegel | 10% | 1% |

| Focus | 8% | 1% |

| Stern | 7% | 0% |

| Süddeutsche Zeitung | 5% | 1% |

Top Brands % Weekly Usage (ONLINE)

| Weekly use | Main source | |

|---|---|---|

| Spiegel online | 19% | 6% |

| N24 online | 17% | 4% |

| n-tv online | 17% | 4% |

| ZDF News online | 16% | 3% |

| ARD News online | 16% | 4% |

| Focus online | 16% | 3% |

| Regional/local paper website | 15% | 3% |

| Bild online | 15% | 5% |

| Web.de | 15% | 6% |

| t-online news | 14% | 7% |

| Gmx.de | 13% | 4% |

| rtl.de | 11% | 4% |

| Sueddeutsche.de | 10% | 2% |

| Stern.de | 9% | 1% |

| Die Welt online | 9% | 1% |

| ZEIT online | 9% | 1% |

Overview of key developments

By Uwe Hasebrink and Sascha Hölig

Hans Bredow Institute for Media Research, Hamburg

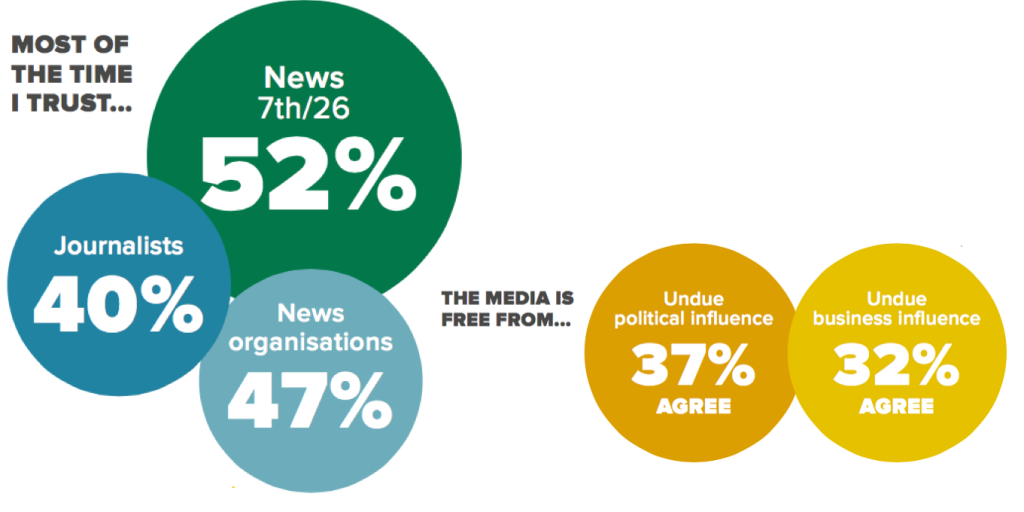

The last year has seen a robust public debate in Germany over issues of journalistic trust. Criticism relates to coverage of the sexual assaults during New Year’s Eve in Cologne and the conflict in Ukraine where journalists were accused of making errors, concealing facts, and biased reporting that supported the government line. Critics argue that Germany’s media are controlled by a politically correct elite, with some right-wing groups using the slogan Lügenpresse (lying press), a slur popular during the Nazi era. A majority of Germans still trust the media, but in a recent poll more than 40% described reporting on refugees as one-sided.[21. https://www.politico.eu/article/cologne-puts-germany-lying-media-press-on-defensive-migration-refugees-attacks-sex-assault-nye/

Television, particularly the widely watched evening bulletins from PSBs ARD and ZDF, remains the most important news source in Germany, although the internet is the main source for under-35s. Traditional brands dominate usage both offline and online and there has been little disruption from digital-born websites – although both BuzzFeed (2%) and the Huffington Post (8%) have German editions. Social media are less popular than in many other countries.

Having said that, German publishers have been creating and distributing more news in social networks over the last year – as well as more news designed for sharing. A number of new youth-orientated sites launched in 2015 include Bento, Ze.tt, and BYou; all spin-offs from the traditional news brands Spiegel, Zeit, and Bild respectively. These sites focus on soft news with a lighter tone, while using attention-grabbing and emotional headlines.

German PSBs have also been stepping up digital developments. At the start of 2015, ZDF launched a new cross-media news format heute+, which presents current topics in a more conversational and reflective way incorporating social channels.

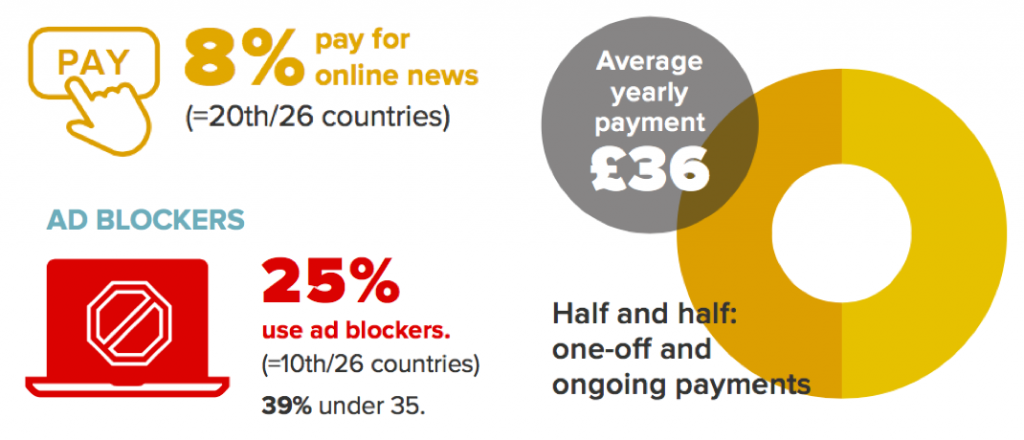

The number of people who pay for online news remains low in Germany at just 8% in our survey, though publishers are increasingly focusing on charging online. In the last year Süddeutsche Zeitung has restricted users to ten free articles, with a paywall once this limit is reached and according to the Federation of German Newspaper Publishers (BDZV) [22. https://www.bdzv.de/ this metered model is now used by about one-third of daily newspapers online.

A bigger proportion (60%) use a freemium model where selected content is subject to charges. Just 5% rely on a hard paywall that restricts all content to paying users.

Meanwhile Germany’s best-known publisher, Axel Springer, announced increased digital revenues amounting to 70% of the group’s total. [23. https://www.axelspringer.com/en/press-releases/axel-springer-strengthens-position-as-leading-digital-publisher-in-the-2015-financial-year Much of this has resulted from a deliberate strategy of diversification and investment in digital businesses across Europe and the United States. Springer took a 97% stake in Business Insider during 2015 and has shares in native video site NowThis, millennial publisher Mic as well as Politico Europe.

German publishers have also been leading the charge against ad-blockers. Axel Springer was amongst the first to restrict all access to bild.de unless the user turns off their ad-blocker or signs up for a monthly subscription. Other publishers have been informing readers that online advertising helps support quality journalism to try to convince them to switch off the software. They have also been investing in sponsored and branded content (so-called native advertising).

Blendle, which launched in Germany at the end of 2015, charges a small fee (micropayment) for each article sold and contains content from many of Germany’s leading publishers. Its most-read lists contain mainly serious news articles and fewer of the soft news articles and sensational headlines that are often found elsewhere. However, just 1% of our survey respondents said they had used Blendle in the last week.

Changes in media usage 2013–2016

Germany has a much higher usage of TV news than most other countries and has adopted more slowly to new online behaviours. Smartphone and social media use for news is also growing at a slower rate.

WEEKLY REACH PER DEVICE

| Computer | Smartphone | Tablet | |

|---|---|---|---|

| 2013 | 73% | 22% | 11% |

| 2014 | 54% | 32% | 15% |

| 2015 | 57% | 34% | 16% |

| 2016 | 57% | 40% | 18% |

SOURCE OF NEWS 2013–16

| TV | Online (inc. social) | Social | ||

|---|---|---|---|---|

| 2013 | 82% | 63% | 66% | 18% |

| 2014 | 82% | 54% | 63% | 22% |

| 2015 | 82% | 45% | 60% | 25% |

| 2016 | 78% | 38% | 59% | 31% |

Paying for news

The relatively healthy position of German newspapers and magazines meant they were late to charge users for online news. This is changing with a mix of models including paywalls and micropayment.

Trust

Despite the recent debates about biased reporting, most Germans still broadly trust the news. This is due to a strong track record of reliable reporting from both public service and commercial news brands. Our focus groups show that Germans are aware that truth is a complex issue but they also expect transparency and diverse views in news coverage.

Scroll data area to see more

TOP SOCIAL NETWORKS*

| RANK | NETWORK | ALL | U35s |

|---|---|---|---|

| 1 | 27% | 37% | |

| 2 | YouTube | 12% | 15% |

| 3 | 10% | 13% | |

| 4 | 4% | 5% | |

| 5 | 3% | 2% |