| Statistics | |

| Population | 23m |

| Internet penetration | 92% |

Caroline Fisher, Jerry Watkins, and Michelle Dunne Breen

News & Media Research Centre, University of Canberra

The Australian market is one of the most concentrated in the world with two powerful newspaper groups and strong commercial and state-funded broadcasters struggling with the transition to digital.

The Australian broadcast market is graced by not one but two state-funded players: national broadcaster the ABC and the more specialised SBS. Perceived by critics as somewhat left-leaning, the ABC brand remains one of the most trusted sources for news for those that use it and the organisation’s leadership takes the digital space seriously, evidenced by last year’s appointment of former Google executive Michelle Guthrie to the role of ABC Managing Director. Guthrie announced in March cuts of around 200 jobs by June as part of a major restructure, which will enable a new AU$50m Content Fund.1 The cuts are also meant to fund 80 new editorial jobs in regional Australia to boost rural and regional coverage.

By contrast, News Corp Australia, which publishes The Australian, The Daily Telegraph, and The Herald Sun has announced significant cuts to staff – including journalists and photographers – as part of an AU$40m cost-cutting exercise.2

Fairfax Media, which owns The Sydney Morning Herald and The Age has also shed around 100 jobs as part of a restructuring package announced last year; at time of writing (early April 2017) a number of commentators are suggesting that a private capital firm is interested in acquiring Fairfax, particularly its Domain.com real estate advertising business. Meanwhile News Corp has further expanded its print and broadcast portfolio via the purchase of APN regional newspapers and the Australian News Channel, producer of Sky News in Australia and New Zealand.

To further underline the importance of the regional market, terrestrial TV stalwart the Nine Network has severed its programming agreement with regional broadcaster WIN after 27 years. WIN continues to provide local news bulletins and Nine has announced the roll-out of 15 rival regional news bulletins.

All these changes are taking place against the backdrop of a proposed relaxation of cross-media ownership rules announced by the centre-right Turnbull government in March 2016.3 Alongside the public broadcasters ABC and SBS, Australia’s traditional media environment includes three commercial terrestrial TV networks, the Foxtel cable/satellite/IPTV network plus multiple commercial radio networks. Current regulation blocks any single entity controlling more than two of out of three traditional platforms (commercial radio, commercial television, and associated newspapers) within one commercial radio licence area – the so-called two out of three rule.

Relaxation of this rule could open the door to mergers between national and regional TV stations as well as rationalisation of the commercial radio market.

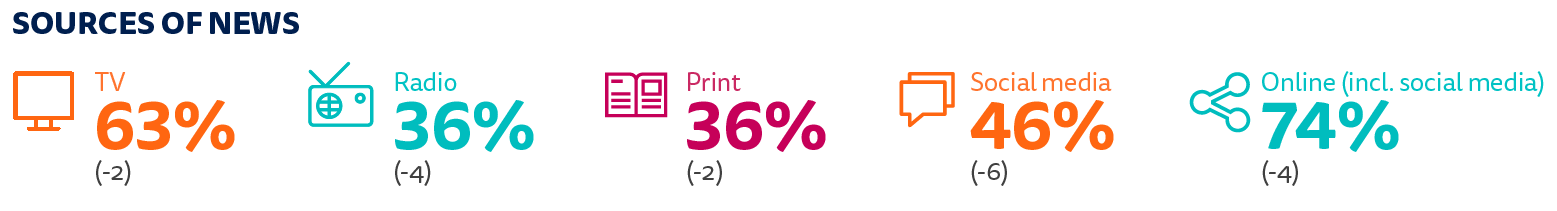

The likely impacts on plurality and diversity of voice are harder to discern. On one hand Australia already features one of the highest concentrations of print ownership of any Western democracy, with only two main players – News Corp Australia and Fairfax. Others argue that Australia’s high level of smartphone penetration and near-universal internet access in urban areas mean that plurality and diversity are already delivered via online, mobile, and social platforms to the majority of the population. Our data confirm that online news is reported as the main source of news by 43% of respondents, ahead of TV (36%) and well ahead of print and radio.

Traditional print brands are still read online by half (49%) of our Australian sample each week, but only around one in ten (13%) are prepared to pay for online news. Although internet advertising continues to move online – one PwC forecast sees it rising to 51% of the total ad market spend by 2020 – these revenues are not enough to compensate for accelerating loss of revenues from print.

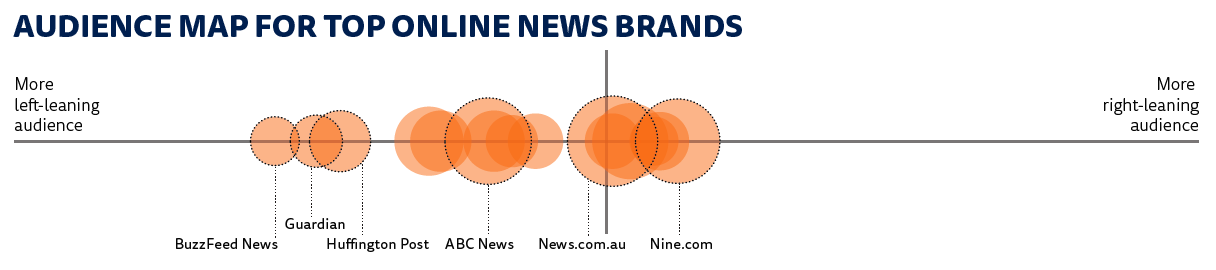

Local news brands also face increased competition from overseas brands, which have developed a significant Australian presence including local versions of UK mastheads the Guardian (2013) and the Mail Online (2014) as well as American sites BuzzFeed (2014) and the Huffington Post (2015). In 2017 the New York Times will also open a new bureau in Sydney which will house a small local editorial team tasked with increasing the brand’s reach and revenue.4

Changing Media

Trust

The level of general trust in news media has remained relatively stable at 42%. Over half (56%) of Australian respondents try to avoid the news either sometimes, often or occasionally. Women avoid news more often than men. A key reason provided for this avoidance by our respondents is that news can have a negative impact on mood.

- http://www.abc.net.au/news/2017-03-07/michelle-guthrie-unveils-abc-restructure-plan/8330878 ↩

- https://www.theguardian.com/media/2016/dec/07/news-corp-australia-announces-redundancies-and-fresh-cost-cutting ↩

- http://www.minister.communications.gov.au/mitch_fifield/news/modernising_australian_media_laws ↩

- http://www.niemanlab.org/2017/01/the-new-york-times-is-opening-a-full-bureau-in-sydney-australia ↩