| Statistics | |

| Population | 65m |

| Internet penetration | 92% |

Nic Newman

Research Associate, Reuters Institute for the Study of Journalism

The UK’s relationship with Europe has been the central political issue following the Brexit vote and a surprise election. This has also influenced a media environment characterised by a strong public broadcaster (the BBC) and a highly competitive national press struggling with digital transition.

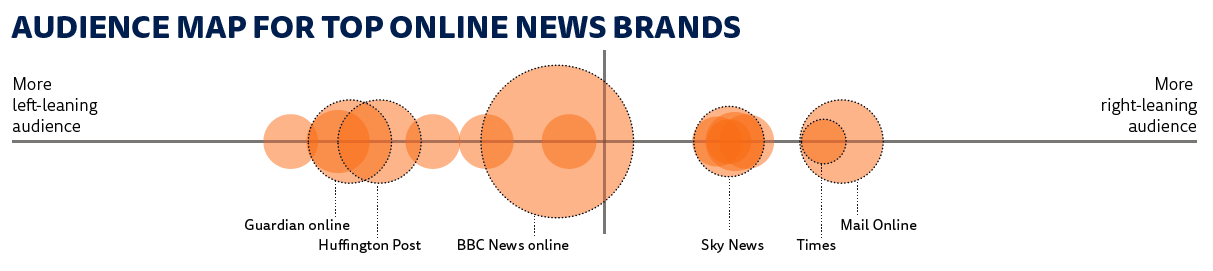

Trust in the UK media took a significant knock (-7 percentage points) in the wake of a bruising and polarising Brexit campaign. The role of the BBC came under particular scrutiny, with the referendum taking place when the corporation was seeking a new charter. Remainers accused the BBC of pursuing ‘unthinking balance’ and failing to expose the exaggerations and distortions of the Leave side. The right-wing press and websites played a key role as cheerleaders of the Leave campaign as well as attacking the BBC for a perceived pro-EU bias. None of this has enhanced the reputation of mainstream journalism, at the same time as the growth of social media (+6) exposed people to alternative perspectives and a more emotive form of news. Polarised news sites such as left-leaning the Canary (2%) and alt-right Breitbart (2%) have started to pick up (some) traction in the UK on the back of increased social media use. Politicians are becoming increasingly concerned about the implications of this rapidly changing media ecosystem. Parliamentary hearings were getting underway into fake news before the election and the Conservative manifesto promised to crack down on social media and search engines that fail to tackle extremism and illegal adult material.

Meanwhile UK news publishers are pursuing a combination of radical cost-saving and increased collaboration in the face of steep declines in print advertising revenues. Overall, print ad spending fell by 13% in 2016, according to Enders Analysis, with Facebook and Google being the main beneficiaries of the move to online. Partly as a result of these trends the Guardian newspaper, which has lost over £100m in the last two years, shed 250 jobs in the UK and has cut its US staff. At the same time, it is considering moving to a tabloid format to save printing costs and announced a content sharing deal with Vice which will see the work of Guardian journalists air on nightly news programmes in the US and UK. Other potential collaborations include the Telegraph Media Group, Trinity Mirror, and News UK forming a single advertising sales operation to make it easier for agencies to buy audiences.

A number of publishers are pursuing diversified revenue streams including membership, paid content, e-commerce, and events. The Financial Times has around 750,000 paid subscribers, of whom 550,000 subscribe to a digital platform, while The Times has around 200,000 digital subscribers paying £6 a week. Perhaps the most unlikely success of the year came with the launch of a pop-up printed newspaper, the New European, which made modest profits for its publisher Archant.

There is particular concern about the future of local news as newspapers scale back coverage of local democratic institutions such as councils and courts. Trinity Mirror is looking to deliver cost savings of around £20m while Johnston Press, which owns 200 titles across the UK, including the i, the Yorkshire Post, and The Scotsman, is selling off some of its smaller weekly papers. To address concerns of a democratic deficit, the BBC has been encouraged by the government to fund 150 local reporters, which other local newspaper groups can use.

The new BBC charter gives funding certainty for around a decade but part of the price has been a commitment to further efficiencies. Despite this, the BBC remains Europe’s most successful public broadcaster with impressive weekly reach for news online (47%) and via TV and radio (67%). The BBC has invested in new formats including new ‘ten to watch’ vertical videos within its mobile app. It has also experimented with Instant Articles and Facebook Live and is a global launch partner of Facebook audio.

Traditional media brands are facing new competition from a number of digital-born media brands. BuzzFeed News (8%) has consolidated its position, with strong political coverage aimed at millennials. Its investigative team broke a major story around match fixing in tennis, in a historic partnership with the BBC. The Lad Bible (6%) has gained audience in the past year with a light-hearted content mix aimed at young men. The Huffington Post (14%) continues to build audiences in the UK, with the range of its coverage and strong solutions-based journalism.

Changing Media

More than four in ten (41%) use social media for news while smartphone usage is sharply up again, matching the computer as the most important device for accessing news.

Trust

There has been a significant fall in those who agree that the news can be trusted (from 50% to 43% in the past 12 months) with under 35s particularly distrustful. Much of this may be related to the use of social media where only 18% say that social media can be trusted to separate fact from fiction, compared with 41% for news brands.