| Statistics | |

| Population | 324m |

| Internet penetration | 90% |

Benjamin Toff

Research Fellow, Reuters Institute for the Study of Journalism

The fragmented US media landscape is dominated by private, for-profit enterprises, but new commercial challenges are causing both legacy and digital-born organisations to experiment with new strategies for growth.

The news media in the US remain fiercely competitive, with many vying for a shrinking pool of advertising dollars offline and a seemingly precarious share online – a market increasingly dominated by the Silicon Valley giants Google and Facebook. While business models continue to face upheaval from mobile devices and social media, some glimmers of hope appeared last year with a sudden burst of paid subscriptions following November’s presidential election.

Two trends accelerated over the past year against the backdrop of the election. First, more than half of Americans (51%) now say they used social media for news in the previous week. Twitter in particular, Donald Trump’s social media platform of choice, appears to have benefited from the campaign. Although only a small percentage say they use Twitter for news (15%), that figure was up from 10% a year ago. Second, when Americans get news online, they increasingly reach for a smartphone (55%), with computer use falling significantly.

These dual trends have led a growing number of organisations to embrace third-party delivery systems such as Facebook Instant Articles and Google’s AMP, which speed up the time it takes for content to load on mobile devices. But this growth has also met resistance from some publishers sceptical of trading traffic for control. Technology platforms are now estimated to command nearly two-thirds of all digital advertising revenue, according to a Pew study last year.

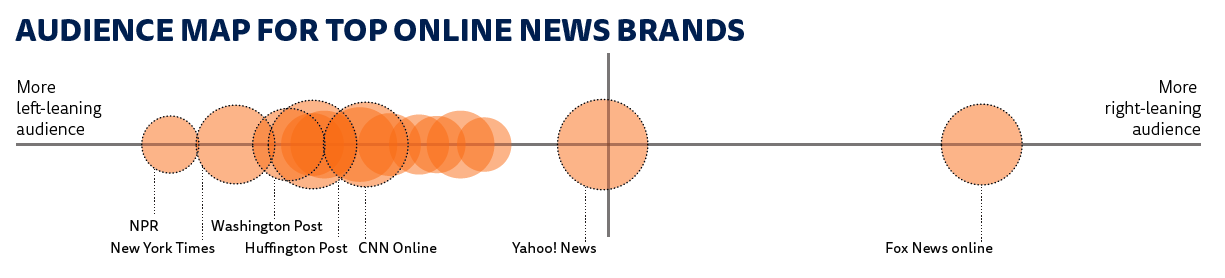

Adding to these digital disruptions, the election may have exacerbated polarisation in news audiences in the US. Trust in news remains strikingly divided along ideological lines, with those on the right twice as likely to say they mistrust the news as those on the left. While non-ideological outlets such as local television remain the most used sources offline, niche partisan outlets like Breitbart and Occupy Democrats grew their audiences considerably online. The election also proved valuable to some legacy organisations, particularly those with established reputations. Many more Americans reported paying for online news than ever before (16%), a seven percentage point increase, and institutions such as the New York Times, the Washington Post, and the Wall Street Journal all reported significant post-election boosts in subscriptions.

This subscription boom overshadowed otherwise worse-than-expected declines in the print advertising market in the US. At the Times, a 16% fall in print advertising more than offset digital revenue growth for the year, with overall revenue down 2%. At McClatchy, which owns 30 regional newspapers, strong digital growth (+14.8%) still could not compensate for double-digit declines offline, with overall revenue down 10.8% for the year. At the Journal, the advertising market prompted staff reductions in a newsroom that had once seemed relatively insulated from the forces battering the industry.

Uncertainty may have contributed to the failed merger of two of the largest US newspaper chains last year. Gannett, which owns more than 110 properties, proposed acquiring ‘tronc’, the publisher of the Los Angeles Times and the Chicago Tribune, but later withdrew its offer in response to shareholder scepticism about the $815m deal.

In October, the New York Times added to its array of lifestyle recommendation products by purchasing the Wirecutter and the Sweethome, product review sites which generate income through affiliate marketing links. Others have sought to weather the storm by becoming more indispensable to advertisers. BuzzFeed and Vox have pursued partnerships with third-party distribution platforms and developed in-house studios for sponsored content.

American media companies remain global leaders in pioneering new digital revenue streams, but questions remain over whether commercial efforts alone will be enough to support levels of watchdog and investigative journalism needed to sustain a healthy democracy. While a select number of national newspapers and a handful of nonprofits (ProPublica plans to open their first regional operation in Illinois this year) still fund rigorous newsgathering operations, state and local public affairs coverage generally remains a shadow of its former self. The future of news in the US may ultimately depend on whether the post-election surge in willingness to pay proves fleeting or a harbinger of a broad-based cultural change in public support for quality journalism.

Changing Media

Cable TV news has benefited from a Trump bump, reversing earlier declines but online and social media has benefited even more. In terms of devices, the smartphone now matches the computer in weekly use.

Trust

Following the presidential election, many publicly voiced concern about the spread of false information online, highlighting the value of professional journalism. Perhaps as a consequence, trust in news increased in the US (to 38%). While still low compared to other countries, Americans reported markedly higher trust in the news sources they themselves use (53%).